Copyright cityam

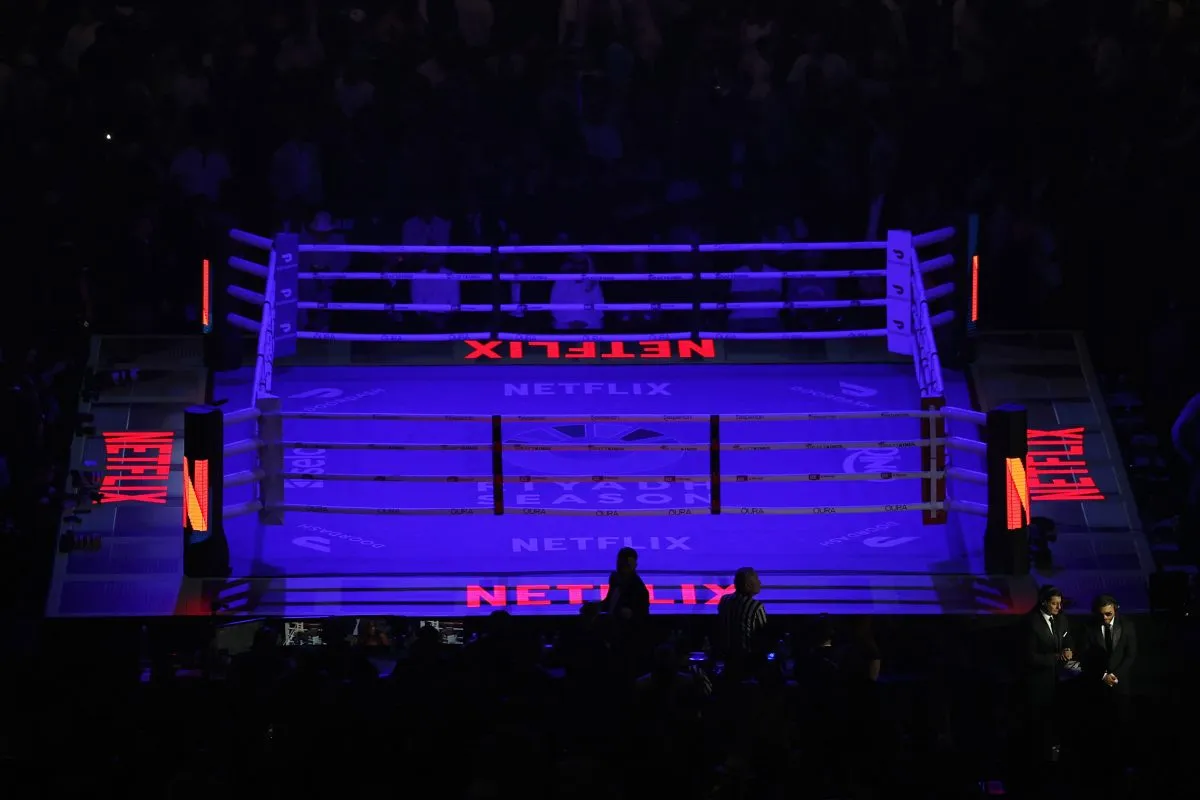

Streaming has overtaken traditional broadcast and cable TV viewing as its biggest players have increased investment in sports rights, according to a new report. Platforms such as Dazn have pumped significant funds into showing live sport, with the sector as a whole spending $12.5bn in 2025, up 25 per cent on last year. Streaming’s share of TV usage eclipsed linear and pay channels in the US for the first time this year. The quarterly Sports Market Update from investment bank Houlihan Lokey cites Dazn, co-owned by Sir Leonard Blavatnik and Surj Sports Investments, alongside Prime Video, YouTube and Netflix as key players in the sports streaming space. YouTube dabbled this year in NFL, broadcasting the Sao Paulo international match for free across its platforms alongside multi-viewing options, while Netflix has also shown live American football, boxing and golf in the past 12 months. Apple TV+ is a key player in Major League Soccer, entering into a deal with Lionel Messi due to a subscription surge after his move to the States, while Prime Video is broadcasting NBA and MLB. Streaming takes over And the use of streaming giants for global events has surged too, with Dazn broadcasting the Club World Cup and Netflix taking ownership of the Riyadh Season Six Kings Slam tennis tournament. “Technology – from streaming and fan data to player-led content and digital merchandising, even technology driving turf management and venue automation – is unlocking new ways to monetise engagement and acting as a key value creation lever,” Houlihan Lokey’s John Lambros said. It comes amid a hike in global sports media rights, surpassing $60bn in 2024 and expected to pass $67bn next year – in part due to the Fifa World Cup – while franchise valuations across North America are climbing and there’s a more lucrative market associated with women’s sport than ever before. Added Lambros: “Funds are increasingly seeing sport as a distinct investment category, much like music and other creative industries, where underlying alpha in marketing, fan connectivity, and digital expansion remains largely untapped. The market is pricing in that potential, which is, in turn, part of the reason why valuations have moved so sharply.” Houlihan Lokey cites the NFL’s stake purchase in ESPN, Paramount’s $7.7bn UFC deal and the return of certain baseball leagues to NBC as key deals for 2025. “Live sports continue to be a cornerstone of our broader strategy,” Paramount chief David Ellison added, “driving engagement, subscriber growth, and long-term loyalty, and the addition of the UFC’s year-round mustwatch events to our platforms is a major win.”