Copyright scmp

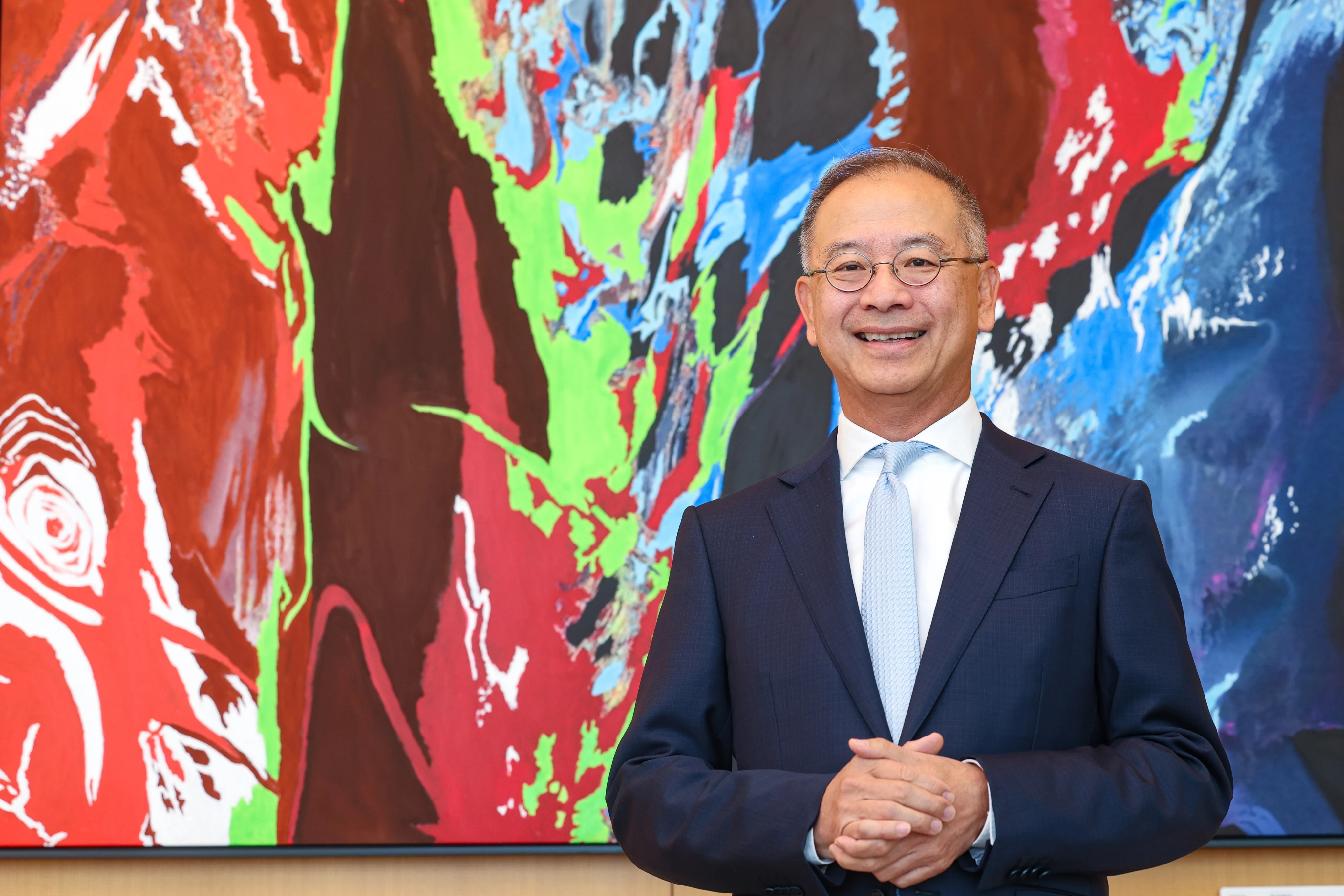

Challenges from commercial property credit quality will persist for Hong Kong banks next year, though these may be balanced by prospects in capital markets and yuan business, according to the head of the city’s de facto central bank. “The Hong Kong Monetary Authority will continue to monitor the credit quality of the property sector, which will continue to be a challenge for the banking sector next year,” said chief executive Eddie Yue Wai-man in an exclusive interview. However, there was no need to be too worried, he added. Hong Kong’s lived-in home prices recorded a modest gain for the fifth straight month, rising 0.14 per cent in August and narrowing this year’s price decline to 0.24 per cent, according to the Rating and Valuation Department. Yue said the data showed the residential market was stabilising, so the focus was on commercial property. “Although the banking sector faces pressure from commercial real estate credit quality, this sector represents only a small portion of its lending, and banks have made sufficient provisions,” he said. “The risks are manageable.” HSBC and its subsidiary, Hang Seng Bank, made combined provisions of US$500 million for office and retail properties in Hong Kong in the first half, a fivefold increase from a year earlier, according to their interim results. “We are seeing continued challenges in some of the office commercial real estate in Hong Kong,” HSBC CEO Georges Elhedery said in July. “That is mainly due to an oversupply, resulting in downward pressure on rents and capital values.” Some prominent developers have lately undertaken debt restructurings. New World Development successfully -refinanced HK$88.2 billion (US$11.35 billion) worth of debt before a June 30 deadline after months of negotiations that pulled the developer back from the brink of default.- Yue played down these concerns, saying “Hong Kong’s banking sector has a strong capital ratio and is very profitable”. Data from the HKMA showed that the aggregate pre-tax profit of the city’s 30 retail banks rose more than 13.4 per cent year on year in the first half. The capital ratio of local lenders stood at 24.4 per cent at the end of June, well above the international standard of 8 per cent. The bad-loan ratio in the banking sector decreased slightly to 1.97 per cent at the end of June, from 1.98 per cent at the end of March. Yue said the HKMA was also working with the Hong Kong Association of Banks to introduce measures to help support small and medium-sized enterprises affected by tariffs and geopolitics. “Overall, the banking sector in 2026 has more opportunities than challenges,” he said. He also said that the strong stock and fixed-income markets had led to dozens of companies raising funds in the city, with several other international firms issuing green bonds or dim sum bonds – bonds issued offshore and denominated in yuan. Issuers from Kazakhstan, Qatar, Singapore and the United Arab Emirates have raised bonds in the city this year. Many of them issued dim sum bonds as the yuan interest rate is much lower than the US dollar. “Besides the lower cost of funding, bond issuers are attracted to Hong Kong because of the big pool of investors,” Yue said. The city was also an ideal location for mainland banks and companies to set up regional headquarters for their global expansion, which would bring new business opportunities for banks in the city, he said. Earlier this month, the HKMA and mainland regulators announced a range of measures to promote Hong Kong as an international yuan trading centre, including a new Renminbi Business Facility, which Yue said would support banks in offering yuan loan products. “The development of artificial intelligence and other technologies would bring challenges and opportunities for banks next year,” he said. “While banks can use AI to enhance their productivity, they could also face cybersecurity risks.”