Copyright Reuters

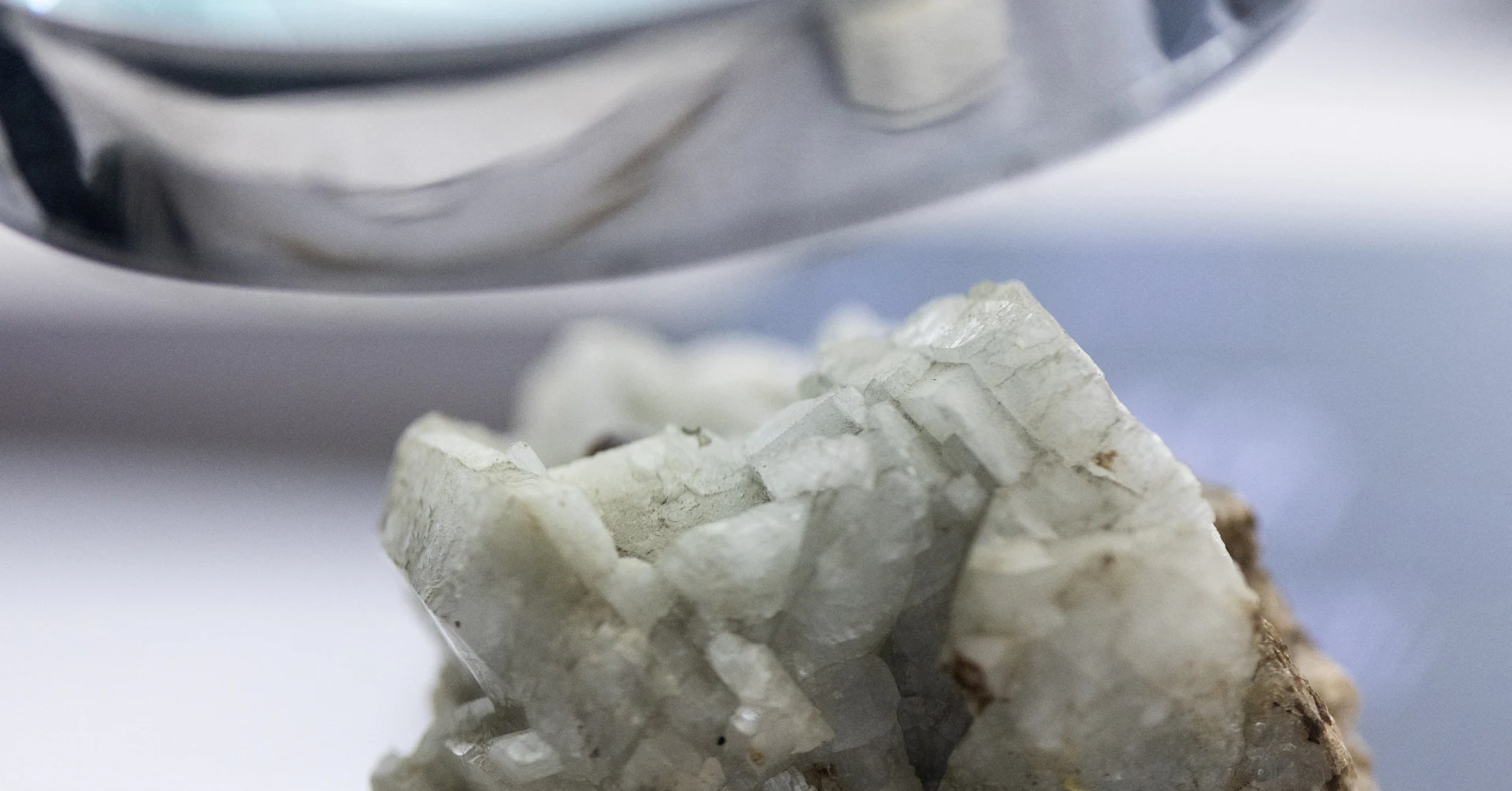

SYDNEY, Oct 23 (Reuters) - Critical minerals, and especially rare earths, as well as the ongoing need to decarbonise and a bigger role for governments are the three top areas of concern for the global mining industry. Those are the key takeaways from this week's IMARC event in Sydney, which brings together more than 10,000 industry participants in what is one of the world's biggest mining conferences. Sign up here. Events such as IMARC are useful for companies to network and generate business deals, but they also provide platforms for participants, ranging from miners to buyers to governments and suppliers, to express their concerns and where they see the industry heading. Three broad themes emerged from this year's event. 1. Critical minerals and rare earths are the main buzz. Part of IMARC's huge convention floor is given over to what resembles a farmer's market, but instead of selling organic vegetables and artisan cheese, the stalls are touting mining projects. The companies represented at the booths tend to be junior explorers seeking to raise capital from investors in order to advance their projects. This year's event was dominated by companies developing critical mineral mines, with several rare earths projects, as well as some speciality minerals and more conventional energy transition metals such as lithium. The investor marketplace is a good indicator of where the hot money is going chasing the next big thing in mining. Some five years ago, gold was the flavour of IMARC, while about 10 years ago it was battery metals such as cobalt, nickel and lithium. While not all of the projects on display will progress to actual mines, some will and this means that supply outside of China of these critical minerals is likely to increase in coming years. 2. Decarbonisation still matters, but must make economic sense. A major theme of the extensive agenda of presentations and panels at IMARC was the imperative to decarbonise mining operations. In some ways this may be seen as a bit of a surprise given the return to power of climate change denier Donald Trump in the United States, and the rising influence of far-right parties in some European countries. Indeed, one panelist who is a director of a junior mining company said many companies that he was aware of had scaled back their decarbonisation efforts to just the bare minimum required by law. But that wasn't the common position, with most mining companies keen to promote green credentials and what they are doing to transition operations to net-zero carbon emissions. However, there was also a shift in emphasis, with mining service companies working in the decarbonisation space emphasising the main benefit of switching is lower operational costs, with the reduction in emissions a welcome side benefit. This focus on cost-savings may actually work in favour of accelerating decarbonisation, as there isn't a miner out there that doesn't want to save money. 3. Governments have a major role to play in mining. IMARC started this week just hours after Trump and Australian Prime Minister Anthony Albanese signed an agreement to provide investment in critical mineral mining and processing. The deal will see up to $8.5 billion invested in a variety of projects to boost the supply of critical minerals, with a common theme of reducing reliance on China's dominance of the sector. In effect, what the two governments are doing is de-risking investment in the mining supply chain, and while the agreement was widely welcomed at IMARC, the view was very much that this is a first step and much more needs to be done. Building a supply chain outside China will be expensive and the refined metals produced are likely to be more costly than what can be sourced from China. The basic question that Western governments and companies that use these metals have to answer is how much are they prepared to pay for a supply chain outside of Beijing's influence? How that question is answered is likely to shape the future of investment in mining and processing in coming years. A final thought from IMARC is sometimes what is not in evidence is as important as what is visible. Notable for their absence this year were anti-mining environmental protests. In past years IMARC has attracted noisy but peaceful demonstrations by activists opposed to the industry. Their absence this year is being taken as a sign that environmentalists have recognised that the energy transition depends on mining, and that bogeyman status has now been transferred to the oil and gas industry. The views expressed here are those of the author, a columnist for Reuters. Editing by Lincoln Feast. Our Standards: The Thomson Reuters Trust Principles., opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.