Copyright The Philadelphia Inquirer

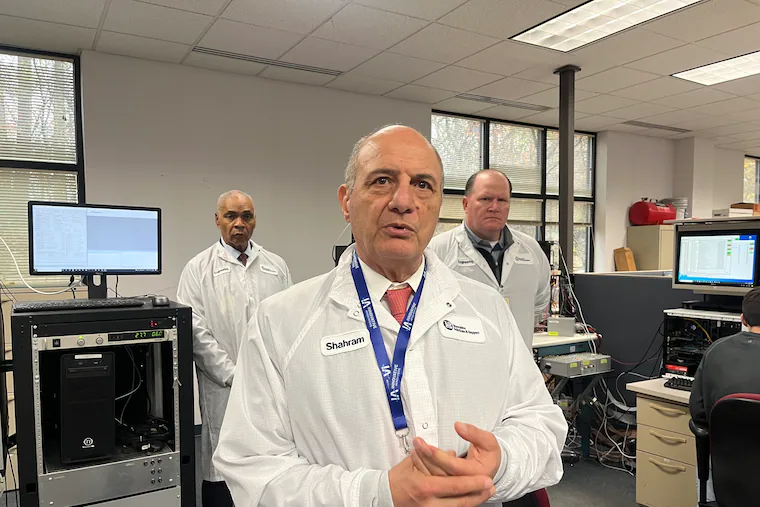

Innovative Aerosystems Inc.’s newly enlarged brick factory sprawls among spruce and oaks on a ridge above Chester County’s Great Valley. It’s crammed with work stations where 200 engineers, technicians, and staff design, make, and sell cockpit computers, flight controls, navigation instruments, and software for Air Force One, Boeing, Lockheed, Amazon, FedEx, U.S. and allied militaries, and other jet makers and operators. The company, founded in 1987, has doubled employment to 200 in the last three years and plans to hire 100 more engineers and technicians, chief executive Shahram Askarpour said, to design and make self-flying aircraft systems that will update and replace today’s air fleets. “The company that is leading autonomous flight is here in Pennsylvania. Not in Silicon Valley,” Glen R. Bressner, a Bethlehem-based venture capitalist who chairs the company’s board, said on a tour of the facility after its official opening Wednesday. Innovative Aerosystems is one of the U.S. employers betting on recent big-dollar manufacturing trends. The company is “reshoring” foreign industrial production to the U.S. as the Exton plant makes all the company’s parts, except mass-produced aluminum pieces farmed out to Chester County machine shops. It’s also relying on higher Defense Department spending on autonomous weapons and record levels of civilian flight worldwide. These trends are expected to extend past the second Trump administration and justify the recent investments, including the plant expansion, new hires, and the company’s recent $60 million purchases of product lines from rival Honeywell. Askarpour, a 20-year Innovative Aerospace employee who was head of engineering when he succeeded late founder Geoffrey S.M. Hedrick as CEO in 2022, bought a string of product lines from Honeywell for a total of $56 million in 2023-24, and has moved production to Exton. Innovative Aerosystems now makes products formerly manufactured in China, Korea, and Canada, as well as in Arizona, Florida, and Kansas. “We brought everything into Pennsylvania,” he said. “We manufacture 100% of everything we sell. When they talk about American manufacturing, we should be the poster child.” The company “tripled the revenues these last three years and quadrupled the profits,” while doubling employment, Askarpour said. Safety record The company’s control over parts and testing keeps fliers safe, he said. Innovative Aerospace has never had an FAA citation against its work traced to faulty parts, he said. The FAA typically issues around one warning every day to a large-aircraft manufacturer or supplier to correct an unsafe condition. Askarpour also persuaded the board to move beyond the founder’s conservative credit policy so Innovative Aerosystems could borrow more money. It traded its decades-old PNC credit line, which carried a $20 million ceiling, for a JPMorgan Chase & Co.-led $125 million credit line that can fund more sweeping expansion and acquisitions. In October he also changed the company name, which used to be Innovative Systems & Services. The company spends a lot of time scouting new talent. “A lot of it has to do with the right attitude,” Askarpour said. “The younger generation are not what they used to be. We prefer to hire veterans. Having served in the military. They understand the importance of what they do.” The U.S. military is the company’s fast-growing market. “Trump’s Air Force One [jets] all have our cockpits,” Askarpour said. “Our growth is supplying critical avionics to the Department of Defense, including the F-16, A-10, C-130, KC-135, and the T-7 trainer — while also expanding into commercial and emerging drone markets.” 100% of work in-house Wall Street is holding Askarpour’s company to the high expectations his strong financial reports have fed. The share price briefly topped $15 earlier this year for the first time since the Great Recession after the company said it expected little cost increase from supplying former Honeywell customers. But shares slipped and now trade around $9, after Askarpour later said that the company would have to bear the cost of making more parts for inventory than expected. At work stations in the factory, staff feed materials and instructions to print miniature metal and plastic parts, assemble them into boards and modules, clad them in fitted containers made on premises, bake and freeze materials to test them at extreme temperatures and pressures, apply finishes, and perform other industrial tasks. The company is unusual in that it makes its own circuit boards instead of outsourcing them to inexpensive suppliers in Southeast Asia, Askarpour said. “Most companies did, for many years. Then COVID hit, and everyone’s deliveries got hit because of supply-chain issues,” he said. “We were one of the few companies that made every aspect in house. We paint; we do our own electrical harness; we make our own instrument panels. We need a lot of technical disciplines. 100%. No one else does this.” In-house production also protects Askarpour from tariff variations, though some of its customers have been affected, as have U.S. government approvals during the current shutdown over the congressional budget fight. Pa.’s abundant military suppliers Innovative Aerospace isn’t alone as a Philadelphia-area aerospace supplier. Radnor-based Triumph Group has plants across the U.S. and in Mexico, Germany, and England. Berwyn-based Ametek, which owns factories making a range of industrial products, is a direct competitor. Military business can be fickle. At the 1,000-worker Leonardo plant in Northeast Philadelphia, steady growth prospects have been tempered by the Air Force’s review of an order for MH-129 Grey Wolf helicopters to ferry VIPs around the Washington, D.C., area — to be built by Leonardo and armed by Boeing — and a rival proposal to refurbish larger helicopters for that job instead.