Copyright dailymail

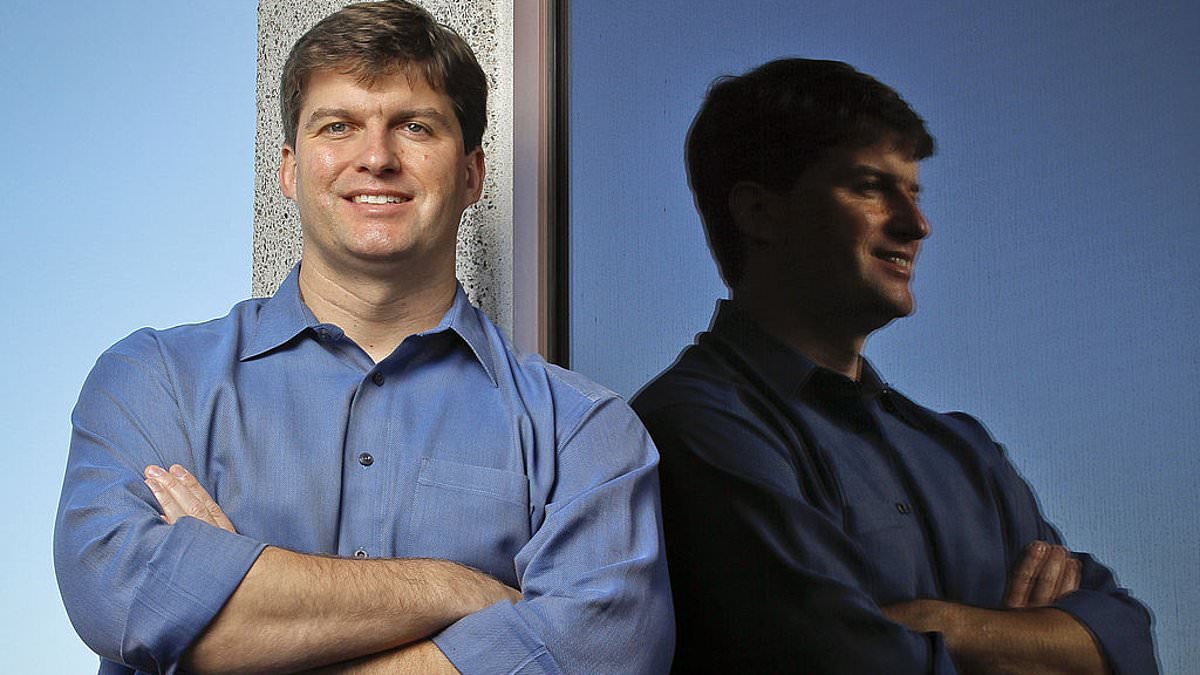

Another week, another wobble for the tech bubble. The latest slide in the share prices of some of the world’s biggest companies highlights how stretched valuations have become – and just how sensitive they are to any bad news. It has also revived fears that frothy stock markets – pumped up by hype around artificial intelligence (AI) - are on the cusp of a wider crash, which would puncture the savings and retirement plans of millions in this country and around the world. So, is this sharp sell-off a portent of things to come? And what should you do to protect yourself, your investments and your pension from the next nosedive? The trigger for this week’s pearl-clutching, which saw $500billion (£380billion) wiped off the technology stocks overnight on Tuesday and into Wednesday, was a big bet against two of AI’s biggest high-flyers by one of the world’s most notorious investors. Michael Burry shot to fame after making a fortune from ‘shorting’ - or betting against – the sub-prime US mortgage market ahead of the 2008 financial crash. He was later portrayed by Christian Bale in the hit film The Big Short, which also starred Margot Robbie, Brad Pitt and Ryan Gosling. Now Burry has taken aim at microchip designer Nvidia, the biggest public company on the planet with a $5trillion (£3.8trillion) price tag, and Palantir, the controversial AI software firm with close links to the White House. The ‘Big Short’ on the AI bubble Burry is worried that their share prices – and those of the broader AI sector – are defying gravity after a stellar rise fuelled by hopes the revolutionary technology will transform the way we live and work. To make money from the crash he thinks is around the corner, Burry’s hedge fund, Scion Asset Management, has bought more than $1billion (£760million) in put options on the two companies. Put options are popular with hedge funds and other speculators who want to profit from share price declines. They give the buyer the right to sell an underlying asset at a pre-determined price on or before a set expiry date. A put option becomes more valuable as the price of the underlying asset falls – and vice-versa. It means the more a share price falls, the more ‘put’ holders profit. But, conversely, their losses are exaggerated if the share price continues to rise in value. Details of how much Burry stands to make if his bets against AI pay off are not known, but they are based on regulatory filings for the three months to the end of September when AI share prices were riding high. They have risen further since, though this week’s brief stock market reversal will be good news for Burry. In a recent cryptic post on social media platform X he wrote: ‘Sometimes we see bubbles. Sometimes there is something to do about it. Sometimes the only winning move is not to play.’ Tech bosses hit back As their share prices slumped the targeted tech bosses hit back. Palantir chief executive Alex Karp told CNBC it was ‘super-weird’ and ‘bats**it crazy’ that Burry was tilting against ‘the two companies…making all the money’. And Nvidia boss Jensen Huang, in London this week to open a new datacentre that helps power AI, told Sky News the AI sector was ‘a long, long way’ from a Big Short-style collapse. This time it’s different? So who is right? And why does it matter if a few tech stocks crash and burn? Institutions ranging from the Bank of England to the International Monetary Fund have sounded the alarm about the lofty valuations attached to AI and the risk of the boom turning into a bust similar to the dotcom bubble at the end of the last century. Even James Anderson, the former Baillie Gifford stockpicker seen by many as Britain’s best tech investor, has voiced concerns. But Stephen Yiu, chief investment officer of Blue Whale Growth Fund, notes that ‘not all bubbles are the same’. The dotcom bubble saw the mass adoption of the internet and mobile phones ‘but the technology was still in its infancy, hampered by slow data speeds and basic handsets’, he recalls. ‘In short there was a lot of friction holding back the potential uses for the technology, slowing the rate of adoption,’ he says. ‘Businesses and many homes already connect to the web via fast fibre broadband’, reducing that friction, says Yiu, ‘Look at the speed of adoption of ChatGPT, which reached 800 million users in only three years. The internet took 13. AI is already delivering’ he adds. Yiu claims AI applications like OpenAI’s chatbot are already having a tangible impact on our work and personal lives and are worth more than the hundreds of billions of pounds being pumped into the technology by tech giants such as Amazon, Microsoft and Facebook-owner Meta. ‘But If that tilts the other way, and investment outweighs the value added by AI, that’s when a bubble could form,’ Yiu admits. The fund manager’s warning is significant. He is an AI evangelist who has made a fortune for his clients by backing Nvidia, whose high-end microchips power the revolutionary technology and which has grown rapidly to become the world’s largest quoted company with price tag of almost $5trillion (£3.8trillion). Another big difference between now and a quarter of a century ago is the sheer scale of the tech giants themselves. When the dotcom bubble burst in 2000, some investors lost money, some tech firms went bust and jobs were lost, mainly in Silicon Valley and on Wall Street. But unlike the global financial crisis eight years later, the dotcom bust was localised and contained. It did not seep into the wider economy and cause deep recession and taxpayer-funded bail-outs. In fact, the party continued for a few more years. But the value of just a few tech companies today is now so elevated that if they sneeze we will all catch a cold - especially as more of our retirement savings are directly exposed to the vagaries of the stock market than in 2000. The so-called Magnificent 7 – Nvidia, Apple, Amazon, Microsoft, Meta, Google-owner Alphabet and Tesla – account for more than a third of the benchmark S&P 500 index total value. Meanwhile, the US stock market accounts for about 70 per cent of the global MSCI index. Nvidia alone is worth more than the entire annual output of Germany’s economy – the third largest in the world. And some valuations are looking vertiginous in the extreme. Both Tesla and Palantir trade on multiples of more than 200 times next year’s forecast earnings. Compare that with fallen tech giant Cisco. At the height of the dotcom boom it was briefly the world’s most valuable company but even then its shares were more lowly-rated than Tesla and Palantir are today. ‘There are just a lot of things about this market that haven’t been adding up for a while,’ said Rich Privorotsky, partner at investment bank Goldman Sachs. ‘We have been overdue a correction and the question is the magnitude.’ What should you do to insulate yourself against a stockmarket rout? For those worried about high-flying AI stocks falling to earth and denting their investment portfolio of pension, experts say the trick is to diversify. In other words, don’t put all your eggs in one big tech basket. That may mean lower returns if the AI boom continues, which it could do for several years. But having a broad range of investments in your portfolio also limits losses if the AI bubble bursts and drags other sectors down with it. Some global fund managers are doing this. For example, Brunner investment trust’s ‘all-weather’ approach invests not only in tech leaders like Microsoft and chipmaker Taiwan Semiconductors (TSMC) but also in highly cash generative companies such as retailer Tesco, hotels group InterContinental, oil giant Shell and drugs behemoth GSK. ‘We seek solace in the physical world,’ says Julian Bishop, Brunner’s fund manager. You could also back a broad range of UK companies through funds and trusts such as City of London, Temple Bar, Law Debenture, Fidelity Special Values, Ninety One UK Special Situations and Liontrust UK Growth. One thing to watch out for is inadvertent exposures to tech stocks. Thousands of Isa and pension investors who have money in popular global funds may be unwittingly backing the US names in the AI revolution. Many investors who have joined the rush to low-cost index tracker funds and ETFs may not realise how dependent on US tech giants their globally diversified fund is. The same is true of some global active funds and investment trusts. To check the shares that your fund or trust owns, consult the online factsheet and decide whether you are happy with this concentration of holdings.