Copyright ptcnews

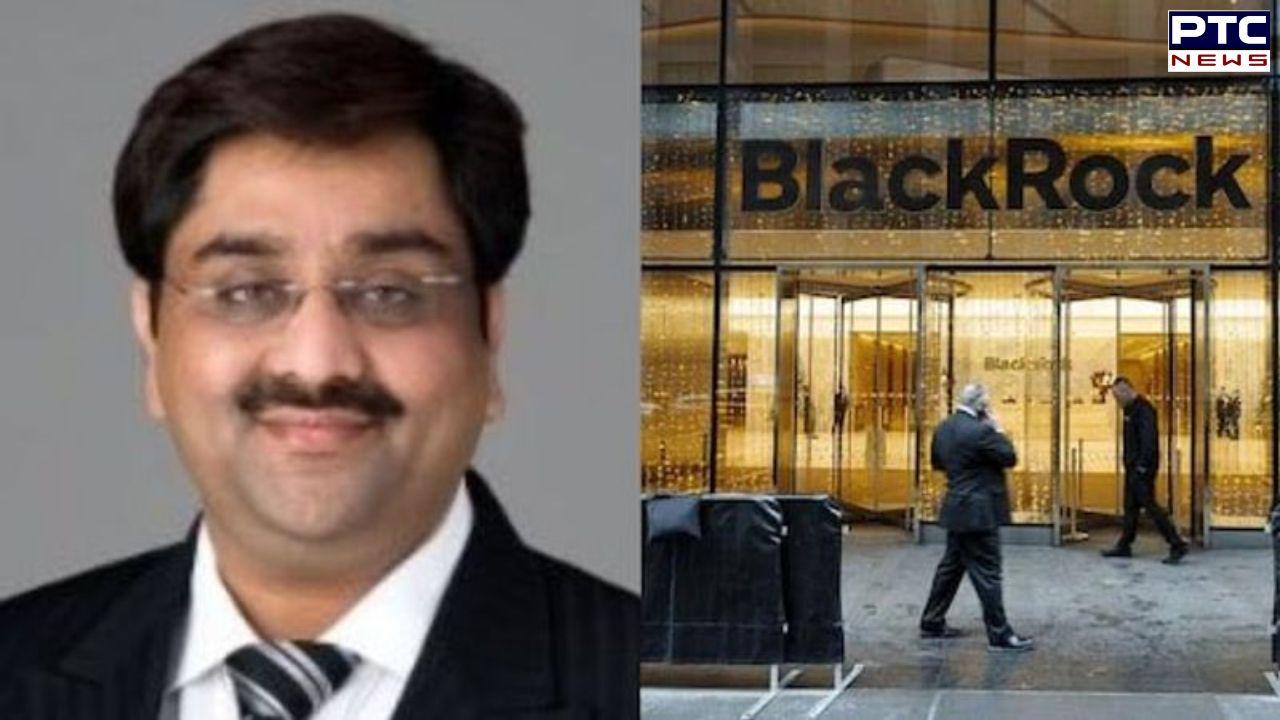

PTC News Desk: Bankim Brahmbhatt — the Indian-origin CEO of a US-based telecom firm — gained international recognition after being named in Capacity’s Power 100 List, which honors the top 100 leaders in the global telecom industry. Today, the Gujarat-born executive is at the center of a massive $500 million (₹4,200 crore) financial scandal involving the American investment giant BlackRock.Brahmbhatt, who owns relatively unknown firms Broadband Telecom and Bridgevoice under the Bankai Group, is now facing a lawsuit in the United States filed by HPS, the private credit investment division of BlackRock. Once celebrated as a self-made entrepreneur, he now stands accused of orchestrating one of the most audacious financial frauds in recent years.The $500 Million ScamAccording to The Wall Street Journal, lenders including HPS described the scheme as a “breathtaking” fraud. They allege that Brahmbhatt fabricated invoices and falsified accounts receivable, using them as collateral to secure large loans. He reportedly created a complex network of financing vehicles — Carriox Capital and BB Capital SPV — to raise millions from private-credit investors.HPS, a major private-credit firm recently acquired by BlackRock, began lending to Brahmbhatt’s companies in 2020. Its exposure grew from $385 million in 2021 to roughly $430 million by 2024. European banking giant BNP Paribas helped finance these loans.Broader Market ConcernsThe case has sparked fresh concerns about vulnerabilities in the fast-expanding private-credit market, where loans are often backed by projected revenues or business assets. Experts point to a rise in fraud-related bankruptcies in this sector, referencing recent collapses of First Brands and Tricolor — both accused of exploiting similar financing models.Bankruptcy and DisappearanceOn August 12, Brahmbhatt filed for personal bankruptcy, coinciding with his companies’ Chapter 11 filings — a legal process in the US that allows debt-ridden firms to restructure operations while negotiating repayment with creditors.However, when reporters visited his Garden City, New York office, it was found locked and abandoned. Neighbours claimed they hadn’t seen anyone there in weeks, and visits to his listed residence also went unanswered.Where Is He Now?Sources familiar with the matter told WSJ that HPS suspects Brahmbhatt may have fled the US for India. His lawyer has denied all allegations, calling the claims in the lawsuit “baseless and unfounded.”