Copyright ZeroHedge

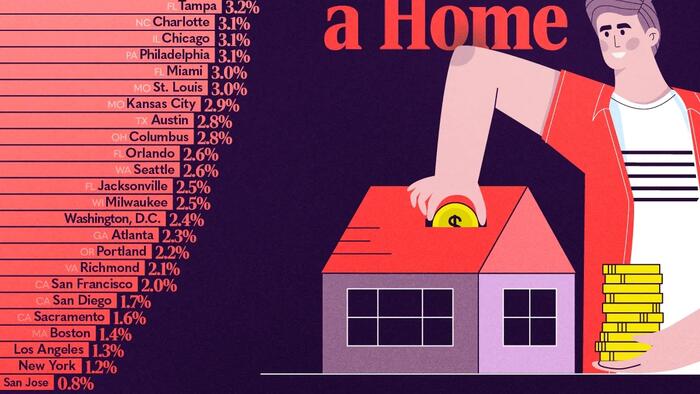

Visual Capitalist's Pallavi Rao ranks the 50 largest U.S. metropolitan areas by the share of adults under 30 who have a mortgage, painting a clear picture of where today’s twentysomethings can realistically afford a home. Data for this visualization comes from LendingTree. They analyzed 32,000 anonymized fourth-quarter 2024 credit reports of adults under 30 in the 50 largest U.S. metros to create this ranking. Please see their methodology section for more details. The American Dream is Still Within Reach In These Cities At 9.4%, Nashville claims the highest share of under-30 mortgage holders in the country. RankCityStateShare of Americans Under 30 With Mortgages1NashvilleTennessee9.4%2IndianapolisIndiana8.4%3PittsburghPennsylvania7.0%4CincinnatiOhio6.5%5LouisvilleKentucky5.8%6Oklahoma CityOklahoma5.7%7San AntonioTexas5.3%8HartfordConnecticut5.0%9Virginia BeachVirginia4.9%10BuffaloNew York4.7%10Salt Lake CityUtah4.7%12RaleighNorth Carolina4.6%13DetroitMichigan4.5%14MinneapolisMinnesota4.3%14PhoenixArizona4.3%14ProvidenceRhode Island4.3%17BirminghamAlabama4.1%18MemphisTennessee4.0%19DenverColorado3.7%19Las VegasNevada3.7%21New OrleansLouisiana3.5%21RiversideCalifornia3.5%23HoustonTexas3.4%24ClevelandOhio3.3%25BaltimoreMaryland3.2%25DallasTexas3.2%25TampaFlorida3.2%28CharlotteNorth Carolina3.1%28ChicagoIllinois3.1%28PhiladelphiaPennsylvania3.1%31MiamiFlorida3.0%31St. LouisMissouri3.0%33Kansas CityMissouri2.9%34AustinTexas2.8%34ColumbusOhio2.8%36OrlandoFlorida2.6%36SeattleWashington2.6%38JacksonvilleFlorida2.5%38MilwaukeeWisconsin2.5%40Washington, D.C.District of Columbia2.4%41AtlantaGeorgia2.3%42PortlandOregon2.2%43RichmondVirginia2.1%44San FranciscoCalifornia2.0%45San DiegoCalifornia1.7%46SacramentoCalifornia1.6%47BostonMassachusetts1.4%48Los AngelesCalifornia1.3%49New YorkNew York1.2%50San JoseCalifornia0.8% The Music City’s housing-price growth has slowed from its pandemic peak, and a steady influx of jobs in healthcare, tech, and entertainment is giving young workers both stable incomes and loan approval power. Indianapolis (8.4%) and Pittsburgh (7.0%) follow, proof that mid-sized metros with diversified economies and moderate price tags remain happy hunting grounds for first-time buyers. These leaders share several traits: median home prices well below the national average, shorter commute times that widen the geographic radius of affordable neighborhoods, and state-level programs that reduce down-payment hurdles. ℹ️ Related: Here’s the latest median home prices by state. Midwest Cities and South Dominate Home Affordability Beyond the top three, the next dozen cities are heavily concentrated in the Midwest and South. Cincinnati, Louisville, Oklahoma City, and San Antonio all break the 5% threshold. Lower land costs and more flexible zoning keep construction pipelines open, while relatively low student-debt balances reduce the debt-to-income ratios that lenders scrutinize. ℹ️ Related: See how Ohio, Kentucky, Texas, and Oklahoma perform on average student debt by state. Even mid-tier Rust Belt metros such as Detroit (4.5%) and Minneapolis (4.3%) do better than larger coastal cities. Their affordable starter-home inventories help offset slower wage growth. This illustrates that absolute price matters more than headline salary figures when it comes to qualifying for a mortgage before age 30. Coastal State Economies Are Punishing for Home Ownership At the other end of the spectrum stand San Jose (0.8%), New York City (1.2%), and Los Angeles (1.3%). Sky-high property values inflate required down payments to six figures, while stricter land-use rules limit new supply and keep entry-level stock scarce. Even Boston (1.4%) and Seattle (2.6%), cities with strong job markets, show that surging demand can overwhelm wage gains. This can and push homeownership beyond the reach of many young professionals. ℹ️ Related: The median age of first-time home buyers in the U.S. is now 38, the oldest ever recorded.