Copyright newsday

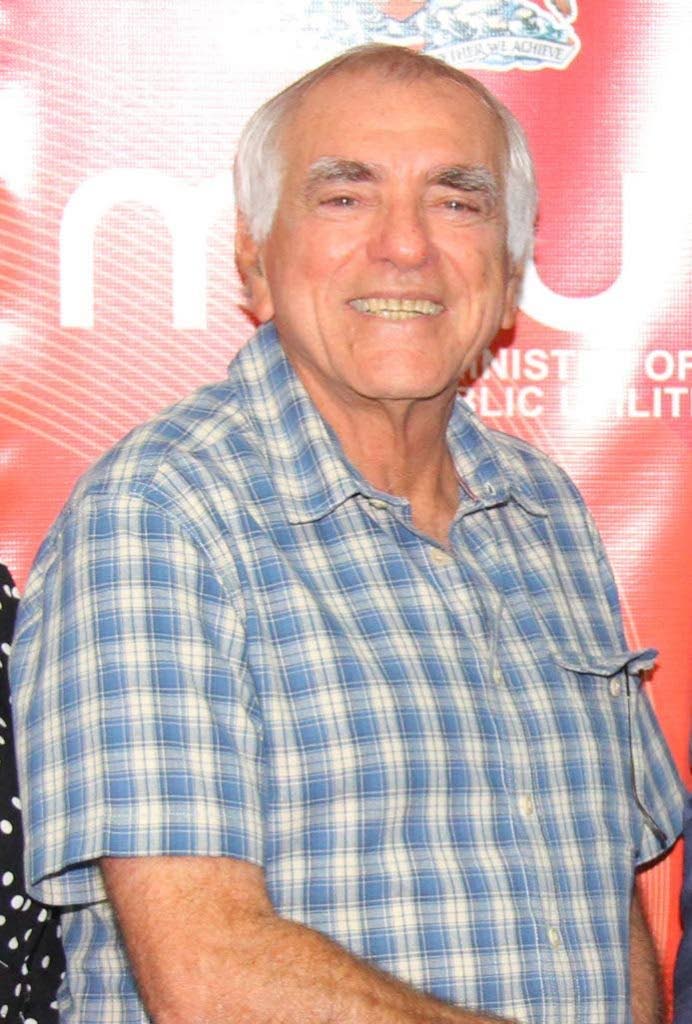

LOCAL mega contractor NH International (Caribbean) Ltd (NH) is spearheading a co-ordinated business community response to combat an emerging fraud threat and has called on the TT Chamber of Industry and Commerce and regional chambers to assist in distributing comprehensive prevention guidelines as criminals increasingly target merchants during the high-volume Christmas period. The company announced the initiative in a release on November 4. The release said NH has developed detailed fraud alert materials. This comes after the company identified a sophisticated impersonation scheme in which criminals forged NH documents and counterfeit cheques to defraud merchants. “NH has documented at least six incidents where fraudsters falsely claimed to represent the company, with the most recent case in October 2025 resulting in a merchant losing TT$377,000.” While NH has suffered no financial losses, the company said it viewed protection of the wider business community as a corporate responsibility, particularly heading into October through December, historically the period when fraud attempts peak. "We're taking this directly to the business community because merchants need actionable information now," said executive chairman Emile Elias. "This isn't about legal obligation — NH is the victim of identity theft. But when our name is being weaponised against fellow businesses heading into their busiest season, silence isn't an option." The company said the fraud scheme has evolved beyond simple counterfeit cheques with criminals now depositing fraudulent instruments directly into merchant accounts, creating false confidence that payments have cleared. By the time banks identify the fraud — typically three to five business days — goods have been collected and perpetrators have vanished, the company added. NH’s security manager Antonio Ventour noted the timing is critical: "Merchants handling peak holiday volumes face compressed decision windows. Fraudsters exploit exactly this pressure. Our guidelines provide the specific protocols businesses need to protect themselves without slowing legitimate operations." The comprehensive Fraud Alert Reference Sheet details verification procedures designed for quick implementation. The central protective measure: merchants should contact NH's main line to speak directly with the procurement manager for verification of any transaction. Warning indicators include purchase requests outside NH's construction operations, communications from personal email domains instead of @nh.tt addresses, unusual urgency, and transactions late in business hours limiting verification time. "One phone call prevents loss," Elias said. "We welcome verification. It's sound business practice." NH has advised never releasing goods until payments fully clear—minimum five business days even for manager's cheques deposited directly to accounts. "Manager's cheques can be counterfeit despite authentic appearance," Ventour said. The company is reaching out to regional chambers in Tobago, Point Fortin, Couva, Chaguanas, and south Trinidad to leverage their established business networks for rapid alert distribution, the release noted. "This affects our entire commercial ecosystem," said Elias. "We're choosing transparency and collective protection. The Christmas season should be about legitimate commerce thriving, not merchants getting victimised." NH said it is also co-ordinating with law enforcement and urges businesses suspecting fraud or already victimised to file immediate reports with the Fraud Squad while preserving all documentation. The company's Fraud Alert Guidelines are available by contacting NH's main office and will be distributed through chamber networks as partnerships are confirmed.