Copyright thehindubusinessline

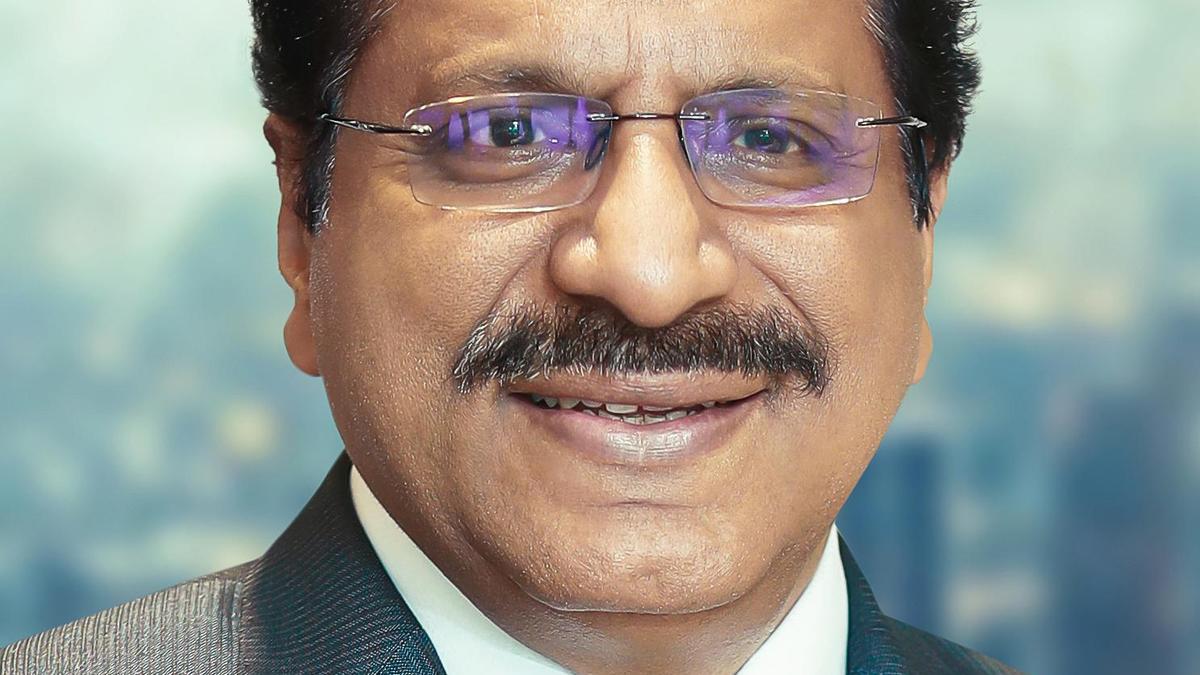

Manappuram Finance has recorded 29 per cent growth in its gold loan assets under management (AUM) to ₹31,505.33 crore in Q2 of FY26 from ₹24,365.07 crore in the same period of the previous financial year (Q2 FY25). Sequentially, AUM grew 9.39 per cent compared to ₹28,801.66 crore of the previous quarter (Q1 FY26). The company’s total AUM grew to ₹45,789.42 crore. In the previous quarter (Q1 FY26), it was ₹44,304 crore. The company achieved ₹217 crore PAT in Q2 of FY26. The company’s gold holdings (in volume terms) also improved to 54.71 tonne from 54.62 tonne in Q1 FY26. On standalone basis, the company’s gross NPA is 2.97 per cent, which shows the asset quality is better. Net NPA also stands at 2.56 per cent for the quarter under review (Q2 FY26). “Our AUM has seen robust growth since the start of FY26, accompanied by improved income performance over last year. This reaffirms that we are firmly on track in strengthening and expanding our core businesses while driving greater operational efficiency. While the sector continues to face challenges, our robust fundamentals and forward-looking approach give us the confidence to sustain momentum and pursue stronger growth across all business verticals in the quarters ahead,” said V P Nandakumar, Chairman and Managing Director, Manappuram Finance. More Like This Published on October 31, 2025