Copyright scmp

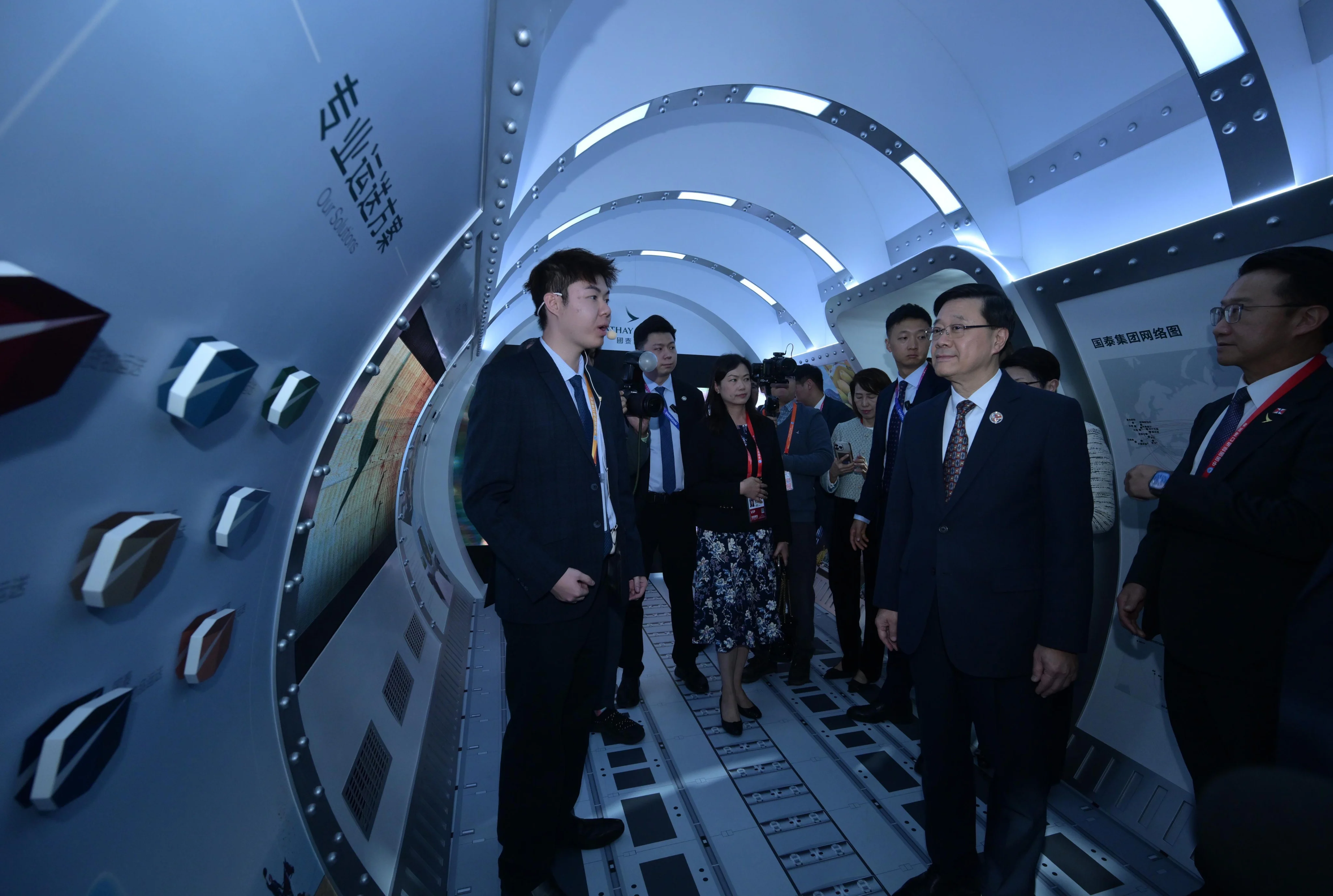

China’s trade has displayed remarkable resilience this year. Its goods trade expanded 4 per cent year on year for the nine months so far in yuan terms, according to customs data. Quarterly growth accelerated from 1.3 per cent at the start of the year, to 4.5 per cent by midyear and finally to 6 per cent. This steady momentum reflects both the robustness of demand and continued refinement of China’s trade structure. But the regional performance has been uneven. Exports to the United States fell 27 per cent year on year in September under the weight of tariffs, continuing August’s decline. The European market, however, provided a counterbalance. Chinese exports to the European Union rose 14.2 per cent in September, likely supported by an improvement in the euro area manufacturing purchasing managers’ index (PMI), an indicator of economic recovery. Emerging markets offered further impetus. Exports to Africa, for instance, surged 56.4 per cent in September, while shipments to the Association of Southeast Asian Nations (Asean) region remained buoyant, rising 15.6 per cent. These figures underscore the growing importance of diversification in China’s foreign trade strategy. Within this shifting landscape, Hong Kong’s role has been particularly striking. The goods trade between the mainland and Hong Kong was officially valued at US$261.56 billion for January-September. Mainland imports from Hong Kong alone for the nine months soared by 86.6 per cent year on year in dollar terms, far surpassing the 35.8 per cent increase for all of 2024. Mainland exports to Hong Kong for the period also rose, by 12.6 per cent, outpacing last year’s performance. This robust expansion highlights Hong Kong’s enduring strategic significance amid an increasingly complex and risk-laden global trading environment. Confidence among Hong Kong exporters has strengthened accordingly. The Hong Kong Trade Development Council revealed in September that its export confidence index for the third quarter had climbed decisively above the 50-point threshold for both current and expected readings, reaching a record high since the index’s revision. Notably, 64 per cent of those surveyed expected profit margins to either stabilise or improve, with optimism concentrated on the mainland and Asean markets. Hong Kong serves as an indispensable “accelerator” for the mainland’s import ecosystem. As a free port, it combines a liberal business environment, sophisticated financial system and world-class logistics infrastructure. These attributes make it a critical gateway for mainland enterprises seeking high-value added products, advanced equipment and intermediate goods. Hong Kong’s re-export function is equally vital: re-exports to the mainland grew 16.5 per cent in the first nine months of the year, outpacing last year’s 15.9 per cent. By channelling certain high-end products through Hong Kong, companies can circumvent trade barriers and tariff restrictions, enhancing efficiency and flexibility. The city’s financial intermediation amplifies this role. As the world’s largest offshore yuan hub, Hong Kong provides a comprehensive suite of instruments and risk management tools that enable mainland companies to navigate exchange rate volatility and international settlement challenges. This strengthens the effectiveness of cross-border procurement and enhances the city’s role as a financial anchor for regional trade. Just as vital is Hong Kong’s function as a launch pad for mainland exports. Its extensive shipping network, liberal trade regime and preferential agreements with major economies make it a natural springboard into global markets. Beyond logistics, Hong Kong offers unique advantages in brand cultivation and market positioning. Mainland companies frequently establish distribution centres, showcase platforms and join local trade fairs to enhance their international image and consumer recognition. This is particularly valuable in premium consumer goods, electronics and green technologies, where Hong Kong’s market intelligence and consumer insights provide strategic guidance. Its financial ecosystem also supports exporters with financing and hedging solutions, enabling them to better manage order volatility and extended payment cycles. China’s trade diversification continues apace. In the first three quarters of this year, the value of its goods trade with Belt and Road Initiative partner countries grew by 6.2 per cent year on year, accounting for 51.7 per cent of the total – an increase of 1.1 percentage points from a year earlier. Trade with Asean, Latin America, Africa and Central Asia also expanded, by 9.6 per cent, 3.9 per cent, 19.5 per cent and 16.7 per cent respectively. China is now among the top three trading partners for 166 countries and regions. Yet the global trade landscape remains fraught with challenges: rising protectionism, intensifying geopolitical frictions, the restructuring of supply and value chains, and the accelerating imperative of the green transformation. Looking ahead, Hong Kong’s institutional strengths, strategic location and service capabilities position it as a pivotal enabler of China’s evolving trade architecture. Priorities should include deepening integration within the Greater Bay Area, advancing cross-border e-commerce platforms and fostering green trade cooperation. These initiatives will not only provide stability but also inject fresh dynamism into China’s foreign trade development.