Copyright Newsweek

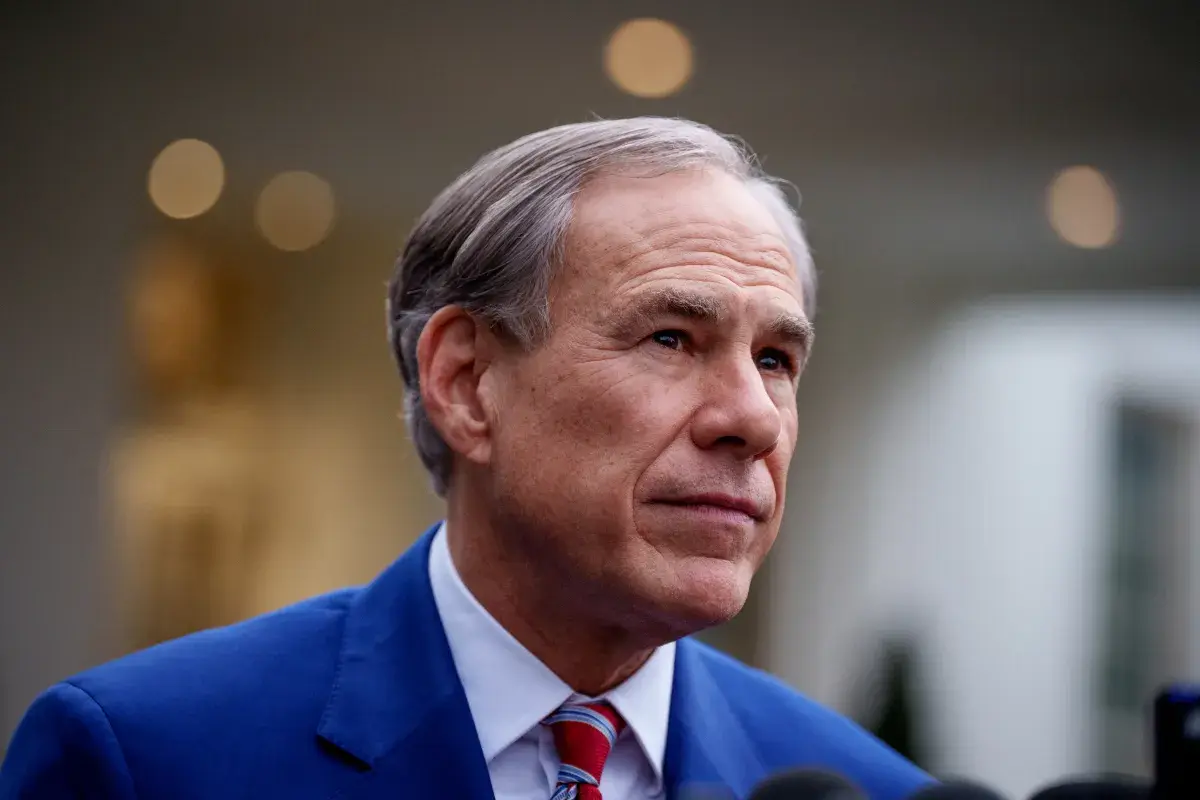

Texas Governor Greg Abbott has proposed a series of property tax changes for people living in the state. Speaking during an event launching his reelection campaign on Sunday, Abbott, a Republican, announced his intention to give voters more power to set tax rates including via referendums and other votes. Newsweek reached out to Abbott's campaign by email to comment on this story outside of normal business hours. Why It Matters Property taxes create increased costs for homeowners. In Texas, the median property tax rate was $4,274, according to 2023 Tax Foundation data. A number of states including Florida and Ohio are working to slash these taxes to stop bills from soaring amid rising house prices. Abbot has been in office since 2015 and is the second-longest serving governor of the Lone State and is vying for another term in office. In the year before the election, he will likely make policy announcements to attract potential voters. What To Know Speaking at an event in Houston on Sunday, Abbot said voters should have the power to decide whether to eliminate property taxes that fund public schools. He also proposed that any future tax rises should be subject to the approval of two thirds of voters. "It's time to drive a stake through the heart of local property tax hikes for good," he said. "We are going to turn the tables on local taxing authorities, put the power with the people, and put an end to out-of-control property taxes in Texas." He also proposed that voters roll back property tax rates through referendums. For these plans to go ahead, there would need to be a constitutional amendment in the state. This could only be placed on the ballot with 100 votes in the Texas House and 21 in the Senate. It comes after Texas voters backed two constitutional amendments to offer property tax relief to homeowners in the state. One proposal included tax exemptions for elderly and disabled Texans and the other proposed a ban on any state-level estate, inheritance, or gift tax. Andrew Sanders, a senior lecturer in politics and international relations at De Montford University in the U.K. said the idea could be "a potential vote winner because many people in Texas are very much against the idea of taxation, and even those who do believe in the utility of tax will have felt the pinch in terms of their rising property tax over recent years." However, he said that "Abbott would have to get the support of the statewide party on this matter as he cannot unilaterally raise or lower taxes as the Governor." He continued: "Abbott, although a highly popular politician across the state, will have to run in a midterm where national voters will be voting in reaction to the first half of the second Trump administration. This is typically a tough time for incumbent Presidents, and the hits to the GOP vote could be felt down ballot." Meanwhile, Calvin Jillson, a politics professor at Southern Methodist University told Newsweek the plan might prove "implausible." "The ‘three-legged stool’ of state and local government funding across the U.S. is a combination of income taxes, sales taxes, and property taxes. Texas does not have a state income tax, so, naturally, its property and sales taxes are high. But eliminating property taxes in the state, as some Republicans have been advocating for years, is implausible because sales taxes simply cannot carry the load.” He added: "Governor Abbott’s plan, introduced as central to his reelection campaign, proposes half a dozen major property tax reforms that mostly limit local governments and schools by capping appraisals, limiting spending, and requiring two-thirds approval by voters for local property tax increases. He will likely get some, though not all of these reforms, which will increase pressure on local governments and their already underfunded public schools but might well fuel his reelection campaign. Don’t hold your breath on elimination of property taxes in Texas.” What People Are Saying Posting on X on Saturday, Abbott wrote: "Texas is the beating heart of America—strong, free, and full of promise. We’ll defend our values, protect our future, and keep Texas shining bright." What Happens Next