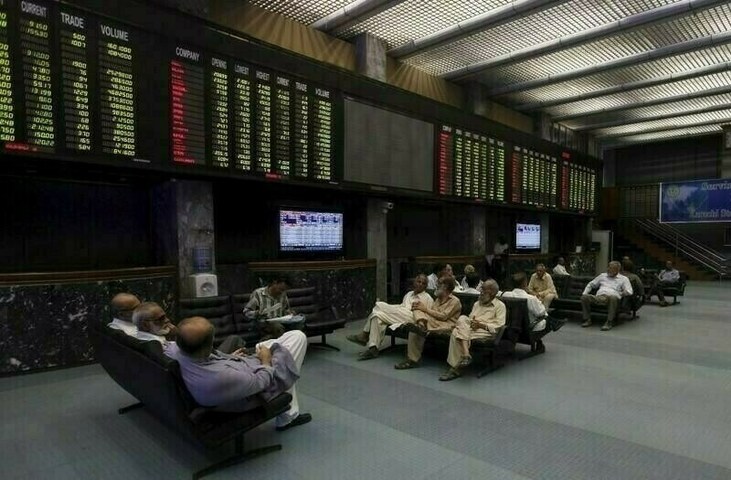

Copyright brecorder

KARACHI: A new study titled “Predictive Performance of LSTM Networks on Sectoral Stocks in an Emerging Market” has found that Long Short-Term Memory (LSTM) deep learning models can effectively forecast stock price movements in Pakistan’s equity market, particularly in stable and high-liquidity sectors. Conducted by Ahad Yaqoob of North London Collegiate School Dubai and Syed Muhammad Abdullah of Lahore University of Management Sciences (LUMS), the research evaluated the model on ten major Pakistan Stock Exchange (PSX) stocks using historical OHLCV data and technical indicators. The model achieved strong predictive accuracy (R² above 0.87) for companies like Hub Power Company, Nishat Chunian Power, Lucky Cement, and Fauji Fertilizer. However, predictions were less reliable for volatile or externally influenced stocks such as Pakistan State Oil and Gillette Pakistan. The researchers highlighted that LSTM networks excel in recognizing medium- and long-term market trends but struggle during high-volatility or macroeconomic shocks. They recommended integrating external variables such as news sentiment and global commodity prices to enhance prediction robustness. The study concludes that deep learning can serve as a practical forecasting tool for emerging markets like Pakistan, offering valuable insights for investors and analysts seeking data-driven strategies in environments with limited financial transparency. Copyright Business Recorder, 2025