Copyright forbes

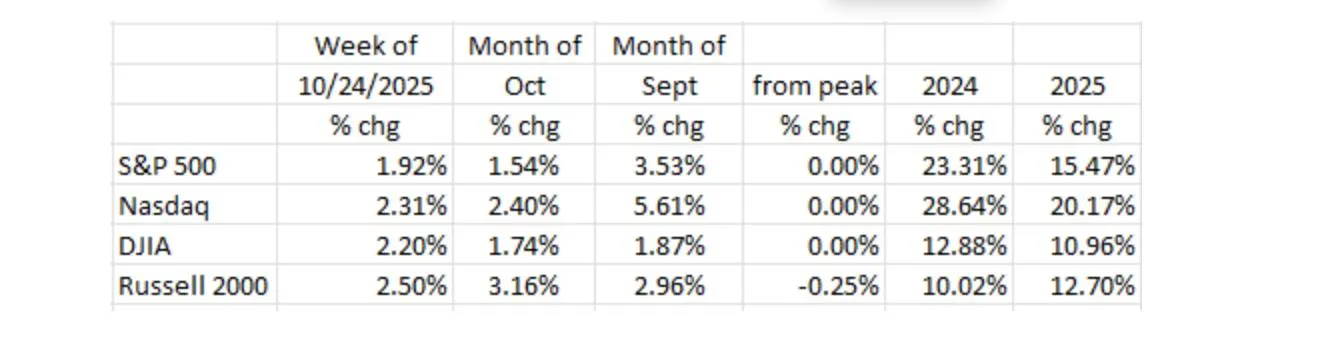

The equity market continues to ignore the government shutdown (perhaps treating it as a positive) and, more importantly, the slowdown signals emanating from the economy itself. For the week ending Friday, October 24th, the euphoria continued with the major indexes all up in the two percentage point range for the week, putting the month of October, which had been lackluster, solidly in the green (see table). The three major indexes all closed at new record highs on Friday, a rare feat. Google and Apple, of the Magnificent 7, also closed at new record highs while Nvidia and Microsoft are within striking distance of such. The consolidated reporting charts are for informational purposes only and should not replace the official reporting made available by each index, custodian, market and/or security. Dr. Robert Barone As of this writing, the Federal Government remains shutdown. But we don’t need the Federal Government to know what is happening in the economy. The Federal Reserve’s most recent Beige Book for October, a compendium of what is happening economically in each of the twelve Federal Reserve Districts, indicated that only 18% of the economy is growing according to Rosenberg Research. That’s down from 43% in August and 100% at last year’s end. (Rosenberg Research, Breakfast With Dave, October 24, 2025.) S&P Case-Shiller Home Price Index S&P/Case-Shiller In the absence of the “official” Bureau of Labor Statistics’ (BLS) labor market report, the private sector payroll firm, ADP, showed negative employment readings for the private sector in three of the last four months. The September report showed a loss of -32K jobs in the private sector.1 The labor market is on a downslope. Even the juggernaut in home prices, as measured by the Case-Shiller Home Price Index, has seen a flattening and even modest declines of late (see chart above). Rents continue to flatline, as they have done so for the past two years (left side of the below chart), with little prospect of turning up, as the vacancy rate for rentals continues to rise and sits at an all-time high of 7.1% (data back to 2017)(right side of chart). Year-Over-Year Rent Growth + US Multifamily Vacancy Index Apartment List Because the cost-of-living increase for Social Security recipients was due, we received the September data from the Bureau of Labor Statistics on Friday despite the government shutdown. (They called key employees during the week to do the CPI and the cost-of-living increases for Social Security recipients.) The CPI headline number rose +0.3% for the month of September, besting the +0.4% consensus estimate, but moving the 12-month number up to 3.0% from 2.9% in August.2 The “Core” CPI number (excludes food and energy) rose a lesser +0.2%, the lightest since June (the consensus estimate was also for +0.3%). It, too, has risen 3.0% over the past year. Some good news can be found in the details. Owners’ Equivalent Rent (an estimate by homeowners of the potential rent their homes could receive in the BLS telephone survey) rose only +0.1% in the September survey.3 The last time OER was this low was in January 2021. MORE FOR YOU Getting into the weeds, oil prices were down -0.8% for the month, and commodity food prices fell -4.4%.4 Used car prices (Manheim Used Car Price Index), which have been spiking over the past couple of years, fell -1.6% in October after a slight -0.2% September retreat. And residential rents were off -0.4% in September’s CPI release vs. -0.1% in August. (Note that we have been anticipating a fall-off in rents as BLS’s data is nearly a year stale and we have been following the more than year long series of rent decreases in the Apartment List data series (see chart above)). Since rents have a 35% weight in the CPI and even a higher percentage in Core CPI, as we have forecast for several months, we expect to see the CPI at or near the Fed’s 2% goal in next year’s first quarter. Thus, we see the Fed lowering rates over the foreseeable time horizon. Specifically, at its October 28-29 meeting, we expect a 25-basis point rate reduction (though we think 50-basis points would be more appropriate). Depending on the economic data between now and its December (9-10) meeting, the Fed is highly likely to lower again as we think economic weakness will continue to appear in the data. Credit Card Delinquencies (90+ Days) / Auto Loan Delinquencies (90+ Days) Bloomberg/FRBNY Consumer Credit Panel/Equifax The Consumer The key to future economic growth is a healthy consumer. But what we see is a consumer now choking on debt. According to Rosenberg Research (Breakfast With Dave, October 16 edition), while expenditures rose +2.7% in the April to August 2025 period, personal income during that time stretch fell -1.2%. The rise was funded by a drawdown in the savings rate from 5.7% to 4.6%. The earliest indicator of a struggling consumer is rising credit card delinquencies (non-collateralized debt). The next debt category to show problems is auto loans (because they need transportation, consumers have an incentive to pay their car loans). And the last category is the mortgage, as shelter is the most important payment for the household each month. As seen above, both credit card and auto loan delinquencies are at or near cycle highs. What is telling is the chart below showing mortgage delinquencies now higher than in the Covid era. Mortgage Delinquencies (90+ Days) FRBNY Consumer Credit Panel/Equifax While Existing Home Sales rose +4.1% in September from year earlier levels, the 4.06-million-unit annual rate was well below the 5.25 million rate that was standard fare pre-Covid (during Covid, the rate skyrocketed to more than a 6.5 million annual rate).5 Mortgage applications for new homes have been falling (negative for 5 weeks in a row (week of October 17)), a negative streak not seen in more than two years. Overall, existing home sales are down by almost -40% from their cycle peak.6 In fact, the existing level of home sales is at a level that is close to the worst levels experienced during the Great Recession. In addition to the slowdown in demand, median home prices have flatlined since the Spring of 2024. Because the gap between actual supply and demand continues to enlarge (as noted, sales are up 4.1% but units “for sale” have risen by 14%), we look for some home price deflation over the next few quarters. Final Thoughts Despite the Federal Government shutdown (or perhaps because of it!!) the major equity market indexes (S&P 500, Nasdaq, DJIA) all closed at historic record highs on Friday (October 24th). So did Google and Apple, two of the so-called Magnificent 7. The economy continues to slow with the Fed’s Beige Book indicating that only 18% of the economy is growing, down from 43% in August and 100% at the end of last year. Because the social security cost of living increase was due, some Bureau of Labor Statistics’ workers were recalled to calculate CPI. They reported headline and core CPI rose +0.3% and +0.2% respectively in September with Owners’ Equivalent Rent (OER, a significant component of the CPI) coming in at +0.1%, the lowest it has been since early 2021. The consumer has continued to spend (+2.7% growth in spending April-August) despite falling (-1.2%) Personal Income during that period. This was accomplished by a drawdown in the savings rate. But the most telling signs about the real condition of the consumer are the rapid rises in credit card, auto loan, and mortgage loan delinquencies. J.P. Morgan reported higher loan delinquencies. Its President, Jamie Dimon, at a news conference, issued his cockroach theory (i.e., there is always more than one cockroach) referring to J.P. Morgan’s rise in loan delinquencies (i.e., other banks have similar loan issues). We expect to see this in the upcoming Q3 bank reports. Consumption has been supported by upper income families which have benefited from the “wealth effect” of rising equity markets. What happens when the equity market pauses, or even “corrects?” Even the once hot housing market is beginning to fade. Existing Home Sales are close to the worst levels experienced in the Great Recession. So it isn’t any wonder that the Case Shiller Home Price Index has flatlined. Robert Barone, Ph.D. (Joshua Barone and Eugene Hoover contributed to this blog.) Robert Barone, Joshua Barone and Eugene Hoover are investment adviser representatives with Savvy Advisors, Inc. (“Savvy Advisors”). Savvy Advisors is an SEC registered investment advisor. Material prepared herein has been created for informational purposes only and should not be considered investment advice or a recommendation. Information was obtained from sources believed to be reliable but was not verified for accuracy. Ancora West Advisors, LLC dba Universal Value Advisors (“UVA”) is an investment advisor firm registered with the Securities and Exchange Commission. Savvy Advisors, Inc. (“Savvy Advisors”) is also an investment advisor firm registered with the SEC. UVA and Savvy are not affiliated or related. 1 https://www.wsj.com/economy/jobs/u-s-lost-32-000-jobs-in-september-says-payroll-processor 2 https://finance.yahoo.com/news/us-consumer-prices-increase-less-133455559.html 3 https://www.bls.gov/news.release/pdf/cpi.pdf 4 https://www.canadiancattlemen.ca/daily/world-food-prices-dip-as-falls-in-sugar-and-dairy-offset-new-high-for-meat/ 5 https://www.nar.realtor/newsroom/nar-existing-home-sales-report-shows-1-5-increase-in-september 6 https://www.newsweek.com/housing-market-reaches-inflection-point-2115497 Editorial StandardsReprints & Permissions