Copyright The Street

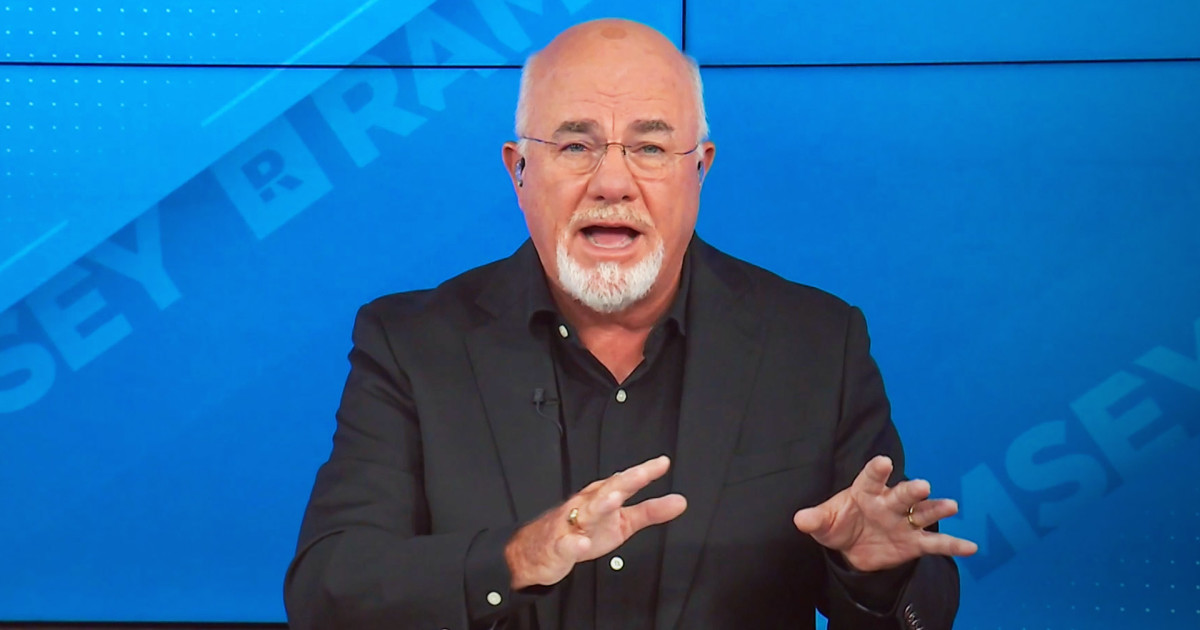

The Medicare Annual Enrollment Period (AEP) — currently running — is often confused with an open enrollment period for traditional health insurance, but they serve different purposes. Bestselling personal finance author Dave Ramsey explains that the AEP is not intended for individuals to enroll in Medicare for the first time. Instead, it is a designated timeframe — Oct. 15 through Dec. 7 — during which current Medicare beneficiaries can make changes to their existing coverage. During AEP, individuals may switch from a Medicare Advantage Plan to Original Medicare, or vice versa. They can also change from one Medicare Advantage Plan to another, or adjust their Medicare Part D prescription drug coverage. For example, someone enrolled in a Medicare Advantage Plan who finds the in-network provider restrictions inconvenient may use this period to return to Original Medicare, which typically offers broader provider access. Ramsey simplifies the separate parts of Medicare (including Medicare Advantage) by describing them succinctly. “Part A is hospital insurance. Part B is medical insurance,” he wrote. “Part C is also called Medicare Advantage and rolls parts A, B and often D into one plan through a private insurance company. Part D is prescription drug coverage.” Dave Ramsey warns Americans on one crucial Medicare fact If one is not participating in the Annual Enrollment Period because they are enrolling in Medicare for the first time, they should know they become eligible to enroll at age 65. They have three months before their birthday month and three months after the birthday month to enroll, for a total of seven months. More on personal finance: Dave Ramsey warns Americans on critical Medicare mistake to avoid Finance author sends strong message on housing costs Scott Galloway explains his views on retirement, Social Security But Ramsey makes an important point for people who choose not to sign up right away. “If you don’t want to sign up for Medicare at 65, you don’t get to just sit back and ignore everything,” he wrote. “You must prove to the government that you have comparable health coverage through your employer or the marketplace — otherwise you’ll get penalized later if you ever want to sign up for Medicare (which you probably will).” “Proof could be as simple as an insurance card with both your and your employer’s names on it,” Ramsey added. Ramsey explains Original Medicare vs. Medicare Advantage Original Medicare and Medicare Advantage, Ramsey clarifies, provide different coverage based on a few fundamental points. Original Medicare Original Medicare includes Part A (hospital insurance) and Part B (medical insurance) as its foundation. Most people add a Medigap policy to help pay for deductibles, copayments, and coinsurance not covered by Original Medicare. A separate Part D plan is typically purchased to cover prescription drug costs. These components — Original Medicare, Medigap, and Part D — are administered independently, and beneficiaries receive separate cards for each. Individuals with Original Medicare can visit any healthcare provider nationwide who accepts Medicare. Medicare Advantage Medicare Advantage combines Part A and Part B into a single plan offered by a private insurance company. These plans often include additional benefits such as dental, vision, and prescription drug coverage. After enrolling in Medicare Parts A and B, beneficiaries can choose a Medicare Advantage plan, which consolidates coverage under one insurance card. All services are coordinated through the private insurer, and enrollees must use providers within the plan’s network. Medicare drug cost changes coming in 2026 The Centers for Medicare & Medicaid Services (CMS) explains that an enrollee’s drug costs will vary based on the plan they choose. And they have to pay a premium, deductible, copayments, or coinsurance throughout the year. New in 2026 is that Americans’ out-of-pocket Medicare Part D drug costs are capped at $2,100. “Your yearly out-of-pocket drug costs for drugs covered by your plan are capped at $2,100 in 2026,” the CMS explains. “Once you reach this limit (from your out-of-pocket spending plus certain payments other people or entities make, including Medicare’s Extra Help program), you won’t have to pay a copayment or coinsurance for covered Part D drugs for the rest of the calendar year.” Prices for the initial 10 drugs that Medicare negotiated with participating drug companies will take effect on Jan. 1, 2026.