Copyright The Street

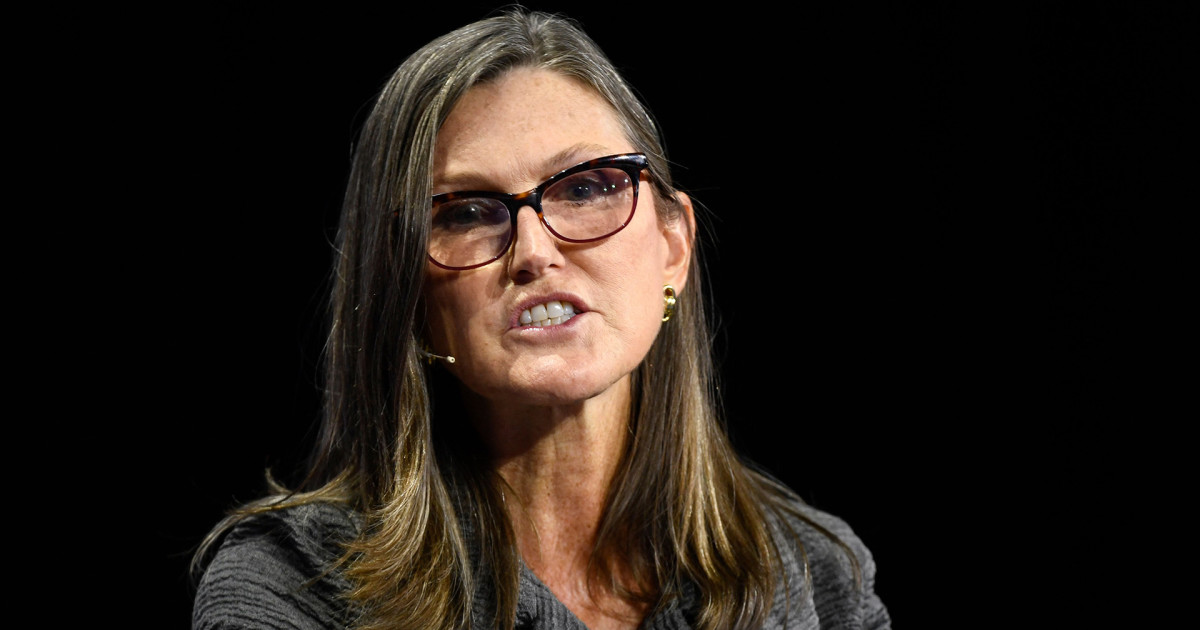

Cathie Wood’s love affair with Tesla is no secret. The EV giant remains the top weight (over 13%) in the ARK Invest’s combined portfolio, valued north of $180 million. Wood has said on multiple occasions that if she had to own just one stock, it would be Tesla. Also, ARK assigns a base-case price target of a lofty $2,600 on Tesla by 2029, built around its conviction that Robotaxis and AI will drive the bulk of Tesla’s future value. In ARK’s latest modeling, Robotaxis represent nearly 90% of Tesla’s enterprise value by 2029. Nevertheless, the backdrop continues getting trickier for Tesla’s core EV business. Deliveries recently hit a record 497,000 in Q3 2025, but growth has mostly been uneven, and margins remain under pressure following multiple price cuts. In China, which is the world’s most competitive EV market, sales remain mostly choppy as local rivals continue to push on pricing, tech, and design. Then there’s BYD (BYDDY), the Chinese automaker once backed by Warren Buffett, which continues topping Tesla at its own game. It has notched up multiple quarters where it has surged past Tesla on pure battery-electric deliveries, a sign of its growing global scale. That level of volume compels investors to rethink assumptions about pricing power and market share domestically. That brings us back to Wood. She still views Tesla as a solid platform play, spearheaded by AI, autonomy, and energy, with optionality far beyond cars. Yet an Oct. 21 disclosure revealed Wood’s quiet move, which hints at how she’s handicapping China’s EV surge, and the one rival she believes Elon Musk cannot ignore. Cathie Wood keeps buying BYD as China’s EV demand accelerates Cathie Wood’s ARK Invest isn’t looking past China’s massive EV boom. In back-to-back trades, ARK’s Autonomous Technology & Robotics ETF (ARKQ) added to its position in BYD (BYDDY), often referred to as the “Tesla killer.” In the latest disclosure dated Oct. 21, ARKQ scooped up 55,523 shares of BYD worth roughly $757,888. That followed a 69,000-share purchase the day before valued at $941,160, taking the total two-day investment to nearly $1.7 million. Fund manager buys and sells: Cathie Wood drops $12 million on resurgent tech giant Cathie Wood sells shares in major AI stock Why 2 major asset managers just suspended investments into silver The move points to a steady and growing interest from Wood’s team, with optimism building around China’s EV recovery, along with BYD’s expanding export footprint. BYD has been mostly charting an aggressive growth path, outpacing global peers with a sharp jump in hybrid and battery-electric sales. Yet its shares recently took a hit following the company’s largest-ever recall, covering more than 115,000 vehicles, for design and safety issues. Her timing suggests that Wood may potentially be looking to buy the dip, underscoring confidence in BYD’s long-term fundamentals. Wood isn’t a long-time BYD “super-bull.” ARK trimmed China exposure between 2021 and 2023, warning the market at the time was facing “a day of reckoning.” Nevertheless, she did voice her admiration for BYD’s execution, calling its cars “fabulous… fit, finish, design” while insisting that Tesla remains a lot more competitive in terms of range and performance. As of Oct. 21, 2025, BYD represents nearly 1.06% of ARK’s combined portfolio, over a $14.5 million position, which is middle-tier by fund weight. Quick takeaways: Cathie Wood’s ARKQ fund scooped up over 124,000 BYD shares in the past couple of days, adding about $1.7 million in fresh exposure. BYD now makes up roughly 1.06% of ARK’s combined portfolio, valued at $14.5 million. Wood admires BYD’s design and execution but still calls Tesla the stronger long-term play, with a greater focus on autonomy and margins. BYD widens lead over Tesla in pure EV deliveries BYD isn’t playing second fiddle to Tesla anymore; it’s effectively setting the pace. The Chinese automaker outperforms Tesla in terms of deliveries, continuing to grow its global volume lead. In Q4 2023, BYD’s 526,409 BEV deliveries beat Tesla’s 484,507, which marked the first time a Chinese brand took the global crown. A year later, the margin expanded even further as BYD sold close to 595,000 BEVs against Tesla’s 496,000. That consistency shows that BYD’s immense scale isn’t a one-off story. The monthly numbers continue to back it up. In August, BYD’s passenger BEV sales surged 34.4% year over year to 199,585 units, while plug-in hybrids dropped 22.7%. In September, BEV sales rose again, up 24.3% year-over-year to 205,050, crossing the 200,000 mark for a second consecutive month. Overseas shipments stayed remarkably strong at 71,256, up triple digits from last year. All this plays out against a Chinese EV market that continues to impress, with new-energy vehicle (NEV) penetration reaching 58% in September and wholesale volumes increasing to 1.5 million, up 22% year over year. Despite the price wars, China’s NEV sales are up 32% year to date, showing that demand hasn’t cooled. Moreover, BYD’s scale story is going global. It’s building plants in Hungary and Turkey, increasing production in Thailand, and assembling kits in Brazil.