Copyright Inc. Magazine

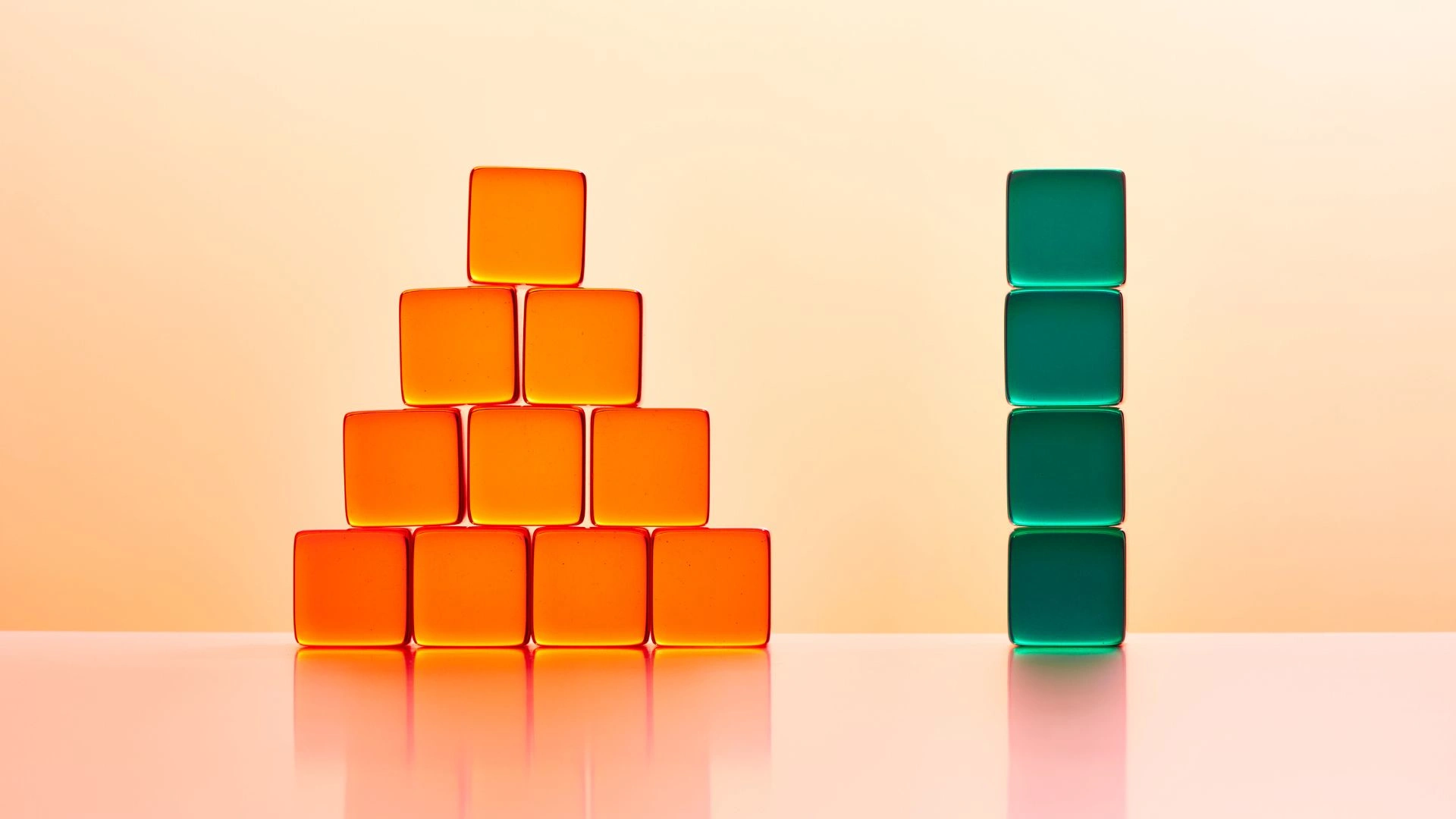

Leaders face storms of decisions. Sometimes the seas are calm, but more often they are turbulent. Costs rise, markets shift, competition intensifies, and resources feel strained. In those moments, every choice matters. Do you bail to stay afloat, or build to harness momentum? Often the answer is both, but only when each action is purposeful and aligned. Too often, leaders treat build and bail as opposites. They believe a company must either grow or retreat, not both. Real cycles seldom provide such simple choices. Growth without stability risks collapse, while austerity without vision stifles opportunity. The real danger is misalignment: When build actions contradict bail actions, or when bail is applied so broadly that it chokes growth. Behavioral research warns of the sunk cost fallacy, the tendency to keep investing in failing initiatives simply because past effort seems to demand it. At the same time, Harvard Business Review cautions that cost cutting by itself does not create lasting strength. Reducing costs for short-term relief often sacrifices investments that fuel future capability. Likewise, growth for its own sake can destroy value when it diverts resources from the company’s core strengths. The role of financial leadership Featured Video An Inc.com Featured Presentation The key to balancing both lies in financial insight. Strong financial leadership turns uncertainty into understanding. It reveals whether a company’s actions are truly sustainable or merely reactive. Cash flow, margin analysis, and scenario modeling show which moves protect the core and which drive growth. Without that visibility, leaders risk acting on instinct rather than information, cutting where they should invest, or expanding where they should conserve. Financial leadership creates focus amid noise. It turns vague assumptions into actionable intelligence. When leaders see their financial story clearly, they recognize patterns—when expenses are rising faster than returns, when pricing erodes profitability, or when growth is straining capacity. Those insights guide the shift from bailing to building and back again. They also allow leaders to communicate strategy with confidence, aligning teams around what the numbers actually support rather than what they hope to achieve. Effective financial leadership reframes the build-or-bail decision as a continuum rather than a choice. It provides the clarity to see how one action enables the other. Real financial insight does more than report results; it guides decision making, aligning operational moves with strategic intent. Stories from the field Theory becomes meaningful only when it meets reality. The following stories show how leaders translate the balance of building and bailing into decisive action. Each example illustrates the discipline required to act with intent rather than impulse, and the judgment to know when stability must take priority and when growth must lead. The lesson is not simply what these organizations did, but how they decided—with focus, financials, and leadership guiding every move. Amazon versus Pets.com during the dot-com crash: Both companies faced the same storm but navigated it with entirely different mindsets. Amazon practices purposeful bailing by tightening expenses, prioritizing cash flow, and eliminating inefficiencies. At the same time, it continued to build in the areas that defined its long-term model: customer experience, logistics, and data. Pets.com, by contrast, mistook activity for progress. It built rapidly without stabilizing its foundation, increasing marketing and distribution faster than its economics could supports. Where Amazon balanced short-term discipline with strategic investment, Pets.com pursued growth without grounding. Starbucks in 2008: By 2008, Starbucks had grown faster than its foundation could sustain. Stores were opening on nearly every corner, yet profitability and customer experience were slipping. When Howard Schultz returned as CEO, he made difficult choices to stabilize the company. Starbucks closed roughly 600 underperforming U.S. locations and later announced the closure of an additional 300 internationally, focusing resources on markets with stronger demand and higher returns. At the same time, Schultz doubled down on the brand’s long-term promise. He invested in retraining baristas, improving espresso machines, and expanding the company’s digital presence through its mobile app and loyalty program. These were not contradictory moves. They were the balance of bail and build: removing what weakened the company while reinforcing what would fuel its next phase of growth. Starbucks emerged leaner, more focused, and better positioned to thrive once the storm passed. Pandemic pivots: During the pandemic, many workers were forced to stay home and people were not shopping in person as much. As a result, many businesses renegotiated leases, cut discretionary costs, and paused nonessential projects (bail) while simultaneously investing in e-commerce and new revenue channels (build). The companies that survived most often did both with financial clarity guiding their choices. These stories illustrate that translating the balance of building and bailing into practice requires structure. Leaders who navigate uncertainty effectively rely on a clear framework to guide decisions, ensuring that every action serves a defined purpose. I think this quote from The Old Man and the Sea says it well: “It is better to be lucky. But I would rather be exact. Then when luck comes you are ready.” Build and bail with purpose The following principles offer a way to approach both stabilization and growth with focus and intention, helping organizations move forward with confidence rather than reaction. Clarify intent: Label each action clearly as stabilization or expansion. Conserve wisely: Bail activities should protect cash and the core; they must be precise, not sweeping. Invest deliberately: Build actions should align with long-term vision, deliver measurable return, and complement stability. Check alignment: Ensure that bailing does not undermine building, and that building does not exceed your ability to sustain it. Building and bailing are not opposing forces; they are complementary disciplines when approached with intention. Stabilizing actions are not signs of weakness but essential steps that create the foundation for sustainable growth. Growth, in turn, demands stability to succeed. Leaders who understand this rhythm act with purpose rather than panic. They use insight to decide where to conserve and where to invest, recognizing that clarity and alignment are what separate those who drift from those who steer. Storms will come. The difference is not whether you face them but how you respond. When guided by sound financial insight, leaders can build and bail with purpose, turning every moment of uncertainty into an opportunity for lasting strength.