Copyright Naked Capitalism

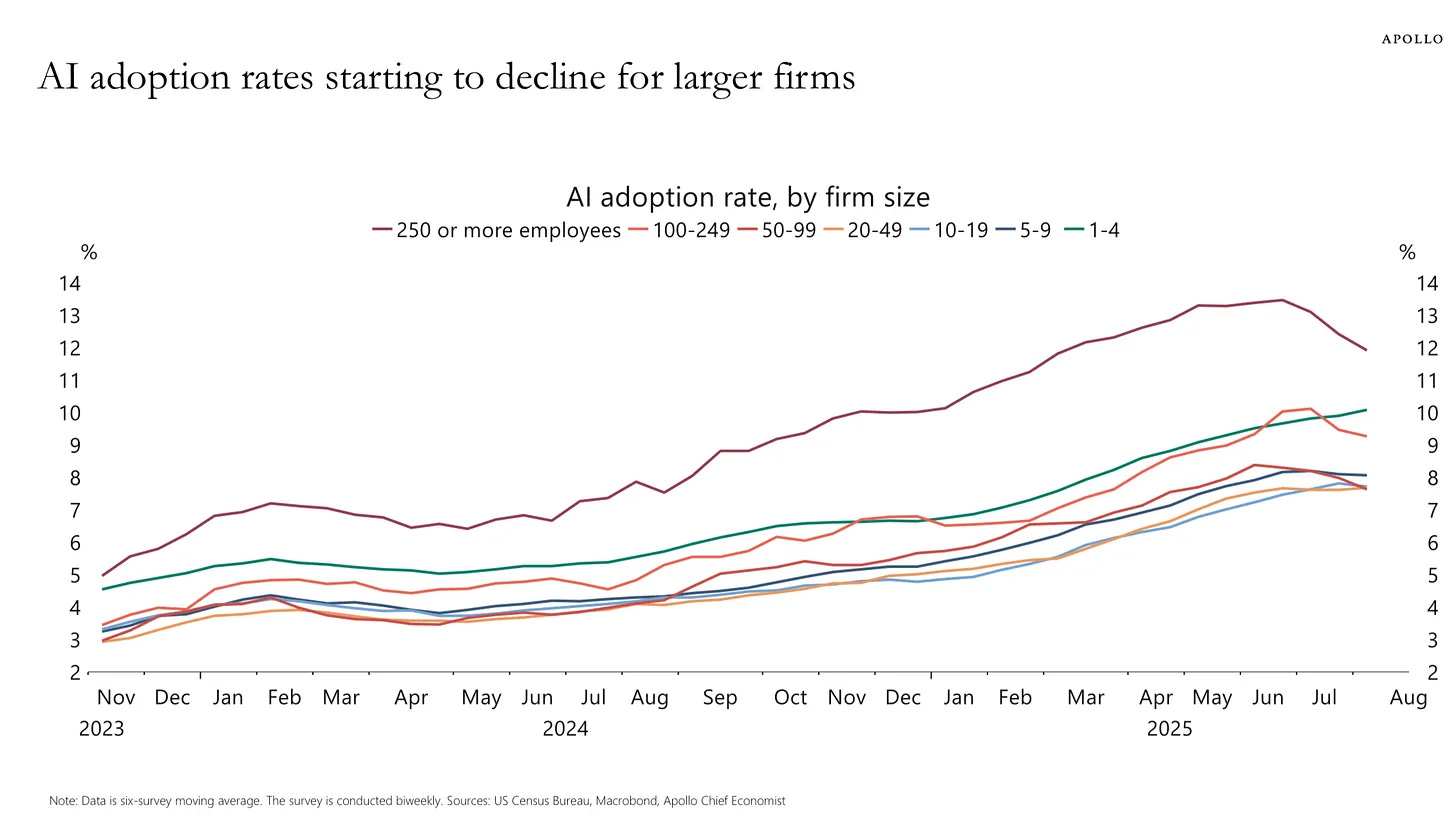

Seemmingly contradictory processes are at work. We may have reached peak AI, at least in terms of growth of use of the seemingly dominant type, large language models, which are conflated with “generative AI” (sticklers are encouraged to clear up fine points in comments) by several measures are stalling out or even falling in uptake. Yet a wave of igh profile employers like Amazon, UPS, and Walmart announcing of big headcount cuts, citing AI implementation as the driver of the firings, says AI uptake is gaining steam. What gives? And more important, even if AI is not performing all that well in terms of accuracy and reliabilty, that may not matter much as long as it is (barely) good enough to corporate executives to screw down furhter on workers, here in comparatively well-paid white collar roles, to the benefit of their bonuses and shareholders. While an AI bubble crash (and accompanying reports of AI not living up to its promise) may put this trend on pause or even in reverse, if this trend continues at its current pace and intensity, it will further damage the career and income prospects of college educated workers, most of all recent graduates, so as to be counter-revolutionary. It will upend the heretofore tacitly accepted responsiblity of governments and the managerial classes to provide for an adequate level of employment and social safety nets in a system that requires most of the population to sell its labor as a condition of survival. It will also reverse the virtous circle created by Henry Ford1 of giving workers steady enough jobs at high enough pay levels that they could afford to buy the new products made possible by widespread electrification and the mass uptake of automobiles….including in due course suburban homes. And it will further erode class mobilty, aka The American Dream. The further thinning of the already increasingly precarious middle class will also greatly weaken social stability, particularly at a time when social safety nets are being gutted. Go long bodyguard services. While we don’t have definitive answers on what is happening in Corporate America, particularly given the diversity of the perps, at least one motivation is to take advantage of the AI mania, still very much alive in the markets, and goose the stock by wrapping what is largely good old fashioned work force squeezing/process re-engineering in the AI mantle (although CEOs are going to some lengths to depict AI implementations as pervasive). We may get a better grip on what is happening internally in the coming months. On the one hand, a well-publicized MIT study found that 95% of corporate pilots of AI did not pan out. On the other hand, there are more and more breathless stories of big employers and professional services firms reducing hiring, particularly of newbies, and even, slashing white collar staff levels. So is the way to square this circle that AI actually does not perform well, save as a weapon in class warfare? The Corporate AI Firing Frenzy Before unpacking the implications in more detail, let’s first look at the apparent magnitude of this trend. We’ve reported before that company leaders, in a sharp departure from histofical practice, are touting running their companies with fewer warm bodies. This pursuit of corporate anexoria is long-standing (and extends to capex); we described it in 2005 in a Conference Review Board article, The Incredible Shrinking Corporation. The Wall Street Journal reported on this new enthusism in June and affirmed by Chief Executive Council: In today’s rapidly evolving business landscape, it’s no longer rare to hear leaders celebrate layoffs as a badge of honor. CEOs are openly touting staff reductions; not as last-resort damage control, but as strategic wins. Companies are embracing workforce slimming as a deliberate tactic to prop up profitability and signal AI-readiness to investors. As reported by Wall Street Journal by Chip Cutter on June 27th, 2025. CEOs Are Shrinking Their Workforces—and They Couldn’t Be Prouder Big companies are getting smaller—and their CEOs want everyone to know it. The careful, coded corporate language executives once used in describing staff cuts is giving way to blunt boasts about ever-shrinking workforces. Gone are the days when trimming head count signaled retrenchment or trouble. Bosses are showing off to Wall Street that they are embracing artificial intelligence and serious about becoming lean. After all, it is no easy feat to cut head count for 20 consecutive quarters, an accomplishment Wells Fargo’s chief executive officer touted this month. The bank is using attrition “as our friend,” Charlie Scharf said on the bank’s quarterly earnings call as he told investors that its head count had fallen every quarter over the past five years—by a total of 23% over the period. Loomis, the Swedish cash-handling company, said it is managing to grow while reducing the number of employees, while Union Pacific, the rail operator, said its labor productivity had reached a record quarterly high as its staff size shrank by 3%. Last week, Verizon’s CEO told investors that the company had been “very, very good” on head count. Translation? “It’s going down all the time,” Verizon’s Hans Vestberg said. The shift reflects a cooling labor market, in which bosses are gaining an ever-stronger upper hand, and a new mindset on how best to run a company. Pointing to startups that command millions of dollars in revenue with only a handful of employees, many executives see large workforces as an impediment, not an asset, according to management specialists. Some are taking their cues from companies such as Amazon.com, which recently told staff that AI would likely lead to a smaller workforce. A new Wall Street Journal article recaps some of the recent headcount cuts, with Amazon layoff of 14,000 (initially mis-reported by Reuters as 30,000) driving a new set of press sightings: The nation’s largest employers have a new message for office workers: help not wanted. Amazon.com said this week that it would cut 14,000 corporate jobs, with plans to eliminate as much as 10% of its white-collar workforce eventually. United Parcel Service UPS 1.14%increase; green up pointing triangle said Tuesday that it had reduced its management workforce by about 14,000 positions over the past 22 months, days after the retailer Target said it would cut 1,800 corporate roles. Earlier in October, white-collar workers from companies including Rivian Automotive, Molson Coors TAP -2.43%decrease; red down pointing triangle, Booz Allen Hamilton and General Motors received pink slips—or learned that they would come soon. Added up, tens of thousands of newly laid off white-collar workers in America are entering a stagnant job market with seemingly no place for them… A leaner new normal for employment in the U.S. is emerging. Large employers are retrenching, making deep cuts to white-collar positions and leaving fewer opportunities for experienced and new workers who had counted on well-paying office work to support families and fund retirements. Nearly two million people in the U.S. have been without a job for 27 weeks or more, according to recent federal data. Behind the wave of white-collar layoffs, in part, is the embrace by companies of artificial intelligence, which executives hope can handle more of the work that well-compensated white-collar workers have been doing. Investors have pushed the C-suite to work more efficiently with fewer employees. Factors driving slower hiring include political uncertainty and higher costs. Altogether, these factors are remaking what office work looks like in the U.S., leaving the managers that remain with more workers to supervise and less time to meet with them, while saddling the employees fortunate enough to have jobs with heavier workloads. The cascade of restructurings has created a precarious feeling for managers and staff alike. It is also tightening the options for those who are looking for employment. Around 20% of Americans surveyed by WSJ-NORC this year said they were very or extremely confident that they could find a good job if they wanted to, lower than in past years. Mind you, this is not the first time we have seen this movie, but this time, the production promises to be on an unprecedented scale. For instance, tarting in the 1980s, big companies started greatly thinning their corporate centers. The leveraged buyout wave precipitated this shift. Raiders targeted over-diversified conglomerates, which tended to be over-manned at their head offices, breaking them up and reducing need for big bureaucracies to ride herd on the operations. Many companies greatly trimmed the size of these activites to make themselves less attractive as prey. The rise of personal computers and improved management information systems facilitated this shift. It also became common simply to fire managers and require the survivors to do what had formerly been one and a half or even two jobs. Similarly, the outsourcing of tech jobs to foreign body shops and H1-B holders may not have reduced headcounts overall (Robert Cringley claims total manning increased) but did make it well-nigh impossible to land an entry level job in software at large companies, as over two decades of frustrated new graduates seeking advice at Slashdot attests. For another summary (with a preview of broader implications, which we’ll discuss later), see this Breaking Points segment: Signs of Weakening AI Demand Due Given all the wonderous things AI is supposedly able to do, a slackening of demand would seem to reflect performance shortfalls. Admittedly these data points are indicative as opposed to dispositive: A must-read post by Gary Marcus contains more contra-hype signtings. For instance: 3. This also fits with this graph from Apollo Global Management’s Chief Economist Torsten Slok, based on Census Data, from early September: 4. TechCrunch just reported that “ChatGPT’s mobile app is seeing slowing download growth and daily use” based on data from Apptopia Even with these signs of more and more dogs rejecting the AI dogfood, the C Suite is still heavily populated with true believers. As we indicated above, AI might not have to work well to suit their purposes. In most types of goods and services, crapification has become the norm. Customer service and product qualty too often stink. So the top brass may feel, particularly in a world of too many big incumbents (as in few alternative providers), that they can degrade their offerings further at no/minimal risk. What Happens as the Gutting of the Middle Class Accelerates? Cynics might point out that office workers are finally being hosit on their own petard. They participate in, or at least did not object to, the outsourcing and offshoring of US jobs. We have pointed out that in many, arguably most, the business case was weak, even before factoring in the increase in risk due to greater complexity and dependence on outside contractors. But it made perfect sense if you viewed outsourcing as mainly intended to increase the pay and authority of executives and middle managers at the expense of hourly/lower level workers. One of the big rationalizations of the AI boom, from an economic perspective, is that the implementation of new technology increases prosperity on a broad basis. Aside from ignoring externalities like pollution and the fact that these big changes produce winners and losers, and the winners seldom ameliorate the damage done to the losers, the idea that incomes rise isn’t even always true. The Industrial Revolution in England ushered in at least a geneartion, and according to some studies, two generations of a decline in living standards. Victorian workhouses were one indicator of how bad conditions became for those in the lower orders who failed to find employment. In Europe, living standards have already been falling due to the sanctions-induced energy shock producing de-industrialization, as in job losses and pay cuts, in tandem with higher consumer power costs and often increased food expenses due to climate change reducing agricultural output. And that’s before getting to reductions in social safety nets due to falling tax revenues (see Russia sanctions blowback), turbo-charged by commitments to militarize even as the US trade wars are adding to economic damage. In the US, while power costs are not dire (although the AI is increasing electrical bills and more is in the offing), food, housing, and medical expenses are high and genearlly rising. And tariff costs are kicking in as many producers have exhaused inventories stockpiled before Liberation Day. A new Financial Times story confirms that the young, traditionally the most employable, are hardest hit: Income growth in the US has slowed to a near-decade low, with young workers especially hard hit, in a sign American consumers are struggling with a weakening labour market and persistent inflation. Real income growth for workers aged between 25 and 54 this year dropped to its slowest pace — excluding periods of pandemic volatility — since the 2010s when the 2008 financial crisis led to high levels of unemployment, according to new research by the JPMorgan Chase Institute. The slowdown is the latest sign of an increasingly distressed US labour market, and comes as Federal Reserve officials are expected to cut rates on Wednesday. George Eckerd, co-author of the report, told the Financial Times: “We’re looking at a level of year-on-year growth that’s actually similar to [the 2010s] when the labour market was a lot weaker and the unemployment rate was higher.” “Inflation is eating into otherwise decent levels of pay gains,” he added. Keep in mind that the measure of inflation impacts the real income computation. Most experts consider inflation to be understated; measurement have been repeatedly jiggered to produce lower results so as to reduce the disbursements for cost-of-living adjustments, as well as for political purposes. So a higher inflation figure would lower the level of real income, and probably push the claimed growth into contraction, consistent with the lived experience of most Americans. There are big implications if the US middle class suffers a big leg down in its size and health. For starters, many, particularly the young, took on student debt to go to college and get a “good” job. But employers are now playing musical chairs, except they suddenly removed all the seats save one. What happens when even more fall behind on payments and are hit with penalty interest rates? And even putting aside the pernicuos effect of student debt, young adults with low and erratic incomes means more living with parents, less household formation (econ speak for getting married and having kids), less home buying. The much-lowered value of a college degree will blow back to universities in terms of less competition for admission, save at the very top schools, and likely lower enrollment overall. If more parents are telling their kids to become plunbers or painting contractors or HVAC techs, that will also somewhat unwind the Elizabeth Warren “two income trap” phenomenon of parents bidding up housing in school districts seen as being advantaged in college admissions terms. In the modern era, in societies that do not have religions that justify yawming class/income differences, a combination of rising income levels, the perception of elite comptence, which includes at least some concern for the welfare of the lower orders, and class mobility have been the bulwark of legitimacy. All these pillars are crumbing in the US. In the Breaking Points segment above, Saagar Enjeti suggested that the AI revolution, if it lives up to its hype, could foment an actual revolution by producing two conditons considered to be key to the Russian revolution: declining living standards and elite overproduction. Based on the flaccidness of the No Kings protests, which had significant middle/upper middle class representation, I don’t see it. The impediements include atomization and weak social ties, the perception that protests with muscle (as that entail a real risk of police thuggery in response) are the province of losers like union workers (and there is also perilous little knowledge what early labor protestors endured to secure basic workplace protections). More practically, in our high survellance/recordkeeping state, organizing and participating in demonstrations, or worse, being arrested, is sure to be a job prospect killer. So many of the newly-downtrodden quite rationally may conclude that they can’t afford to take a personal stand. As for elite overproduction being a factor that will amplify protest, given the lack of competence of our elite incumbents, yours truly is not optimistic that those who put themselves on education tracks for those roles are any more able to manage their way out of a paper bag….or organize a revolt. Again, to use the analogy of the early Industrial Revolution, the enclosure movement, which shifted formerly self-sufficient farmers to factories and cities, did produce William Blake’s “dark Satanic mills” and the eventual 1848 revolts across Europe. However, depending on which historian you believe, that upheaval was either ineffective or produced only some concessions from the ruling classes in terms of improved social protections. But it did not upend the existing order. That is not to say some sort of dislocation of the existing order is not baked in. But I don’t see it as being something as Manichean or potentially decisive as a revolution. If not a full-bore Jackpot, it’s likely to have an anachic flavor of a big increase in dysfunction, disorder, and desperation. _____