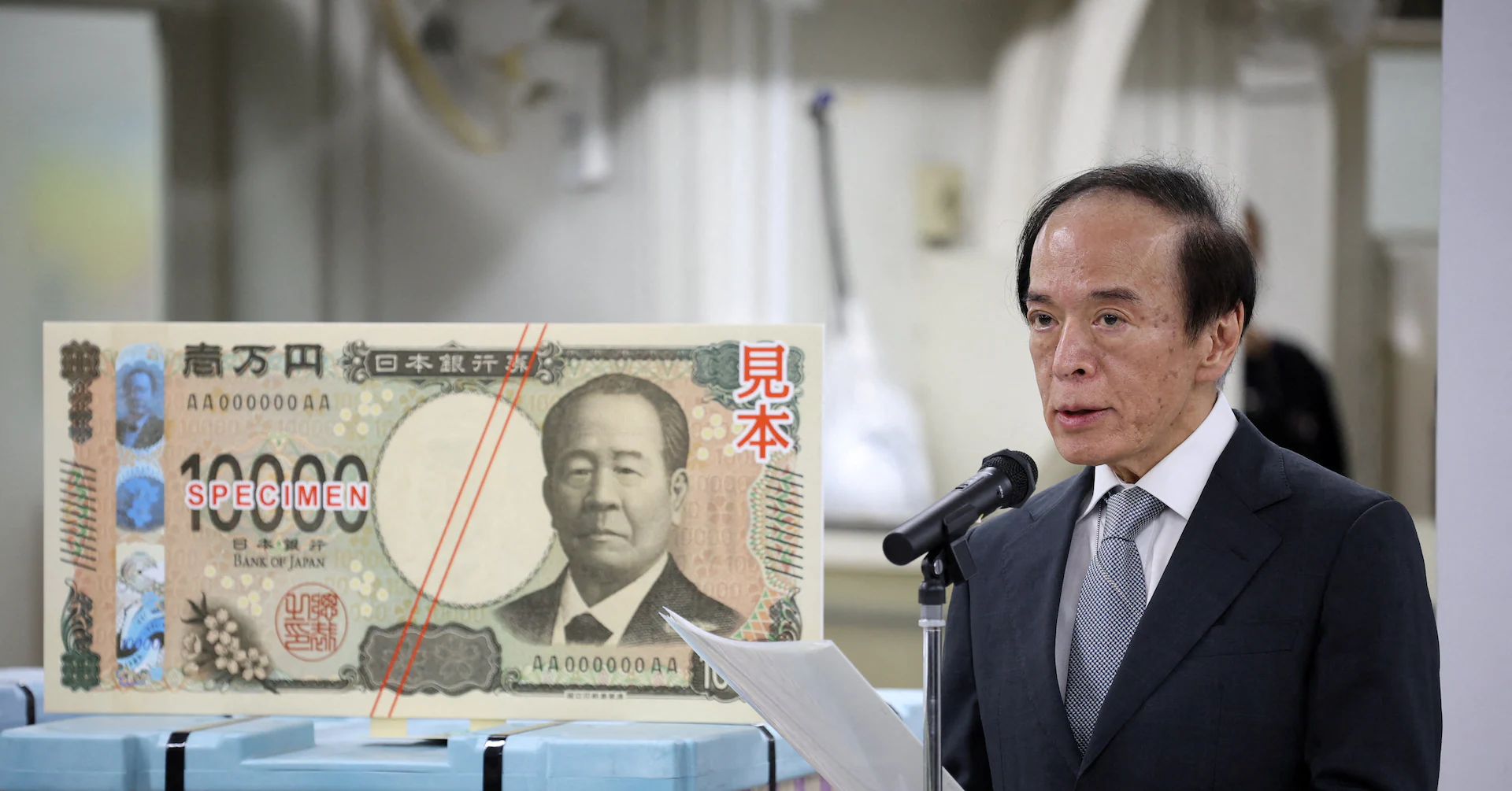

Copyright Reuters

ORLANDO, Florida, Nov 11 (Reuters) - The yen's fall against the U.S. dollar is raising the specter of Japanese intervention to slow or reverse the slide. While imminent action is unlikely, investors should remain on high alert. The Japanese currency is already below levels that prompted Tokyo to intervene to support it in the recent past, and is now hovering close to the 155 per dollar level that many Japanese companies say is a pain threshold. Last year's record low near 162 per dollar isn't all that far away either. Sign up here. Tokyo's first yen-buying intervention in over a decade came in September and October of 2022 when it spent around $60 billion boosting the currency, first after dollar/yen rose above 145 and then again as it approached 152. The Ministry of Finance also spent some $36 billion in July last year buying yen as the dollar pushed multi-decade highs near 162 yen. Does that mean intervention is imminent? Not necessarily. That's primarily because of the fundamentals putting pressure on Japan's currency. The yen's current swoon partly reflects the stabilization of the U.S. dollar since mid-year and recent appreciation as traders bet that the Federal Reserve is cooling on interest rate cuts. Domestic policy is also playing a role. The yen's drop has accelerated in the past month on expectations that the new Japanese government could be preparing a fiscal stimulus package worth close to $100 billion, while the Bank of Japan's rate-hiking cycle seems to have stalled. These dynamics were brought into sharp focus on Monday by new Prime Minister Sanae Takaichi. She sketched out plans to allow for more flexible spending in the years ahead, essentially watering down Japan's commitment to fiscal consolidation, and renewed calls for the BOJ to go slow with any tightening. Little wonder the yen is falling. Given how these fundamentals are stacked up against the currency, Japan's Ministry of Finance is unlikely to sanction yen-buying intervention, as it would likely be ineffective. What's more, it's unclear if Japan would get buy-in from Washington, no matter how much the Trump administration would probably like the dollar to weaken. CORPORATE PAIN THRESHOLD That said, the close correlation between dollar/yen and U.S.-Japanese bond yield spreads has completely broken down, suggesting the yen may be unusually weak. Analysts at Mizuho say current spreads are consistent with dollar/yen below 145.00. Meanwhile, Finance Minister Satsuki Katayama said last week the government continues to monitor "one-sided and rapid movements" in the yen with a "high level of urgency." And Takaichi's nod on Monday to more accommodative fiscal and monetary policies pushed the dollar back up to within touching distance of 155.00 yen. That's potentially a key level. A survey carried out last year by Nikkei Research for Reuters showed that it was a pain point for around half of the 229 companies that responded. None of the firms in the survey saw a dollar/yen rate above 160.00 as favorable. So the yen is in recent intervention territory. WEAK YEN IS STOKING INFLATION Inflation dynamics are worth considering too. Although BOJ officials see business and consumer inflation expectations settling around 2%, actual inflation is still around 3%. The yen is already historically weak, so one wonders how much more currency weakness authorities are willing to accept. Economists at Mizuho estimate that a 1% depreciation in the yen increases core inflation by around 0.05%. So a move in dollar/yen to 160.00, perhaps the peak in Tokyo's tolerance, from 147.00 early last month, would therefore increase inflation by around 0.4 percentage points. That's meaningful. Right now, though, analysts are reasonably confident nothing is imminent. The yen's slide hasn't been excessively rapid and Japanese policymakers' 'verbal' intervention hasn't yet reached the most serious alert levels. What will change that calculus? Deutsche Bank analysts reckon a quick dollar burst above 157.00 yen might do it. They say a 10-yen move in a month is a decent intervention trigger - so far, the dollar is in a fairly normal 6-7 yen move territory. Analysts at Goldman Sachs are more sanguine. They say the yen isn't particularly weak right now, although that would change if the dollar were to spike to 161-162 in short order. History suggests Tokyo is likely to intervene if market conditions - speculators' positioning, flows, and the speed of the yen's move - give it a chance of succeeding. The stars may not be aligned right now. But they could be soon. (The opinions expressed here are those of the author, a columnist for Reuters) By Jamie McGeever. Editing by Susan Fenton Our Standards: The Thomson Reuters Trust Principles., opens new tab Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.