Copyright Benzinga

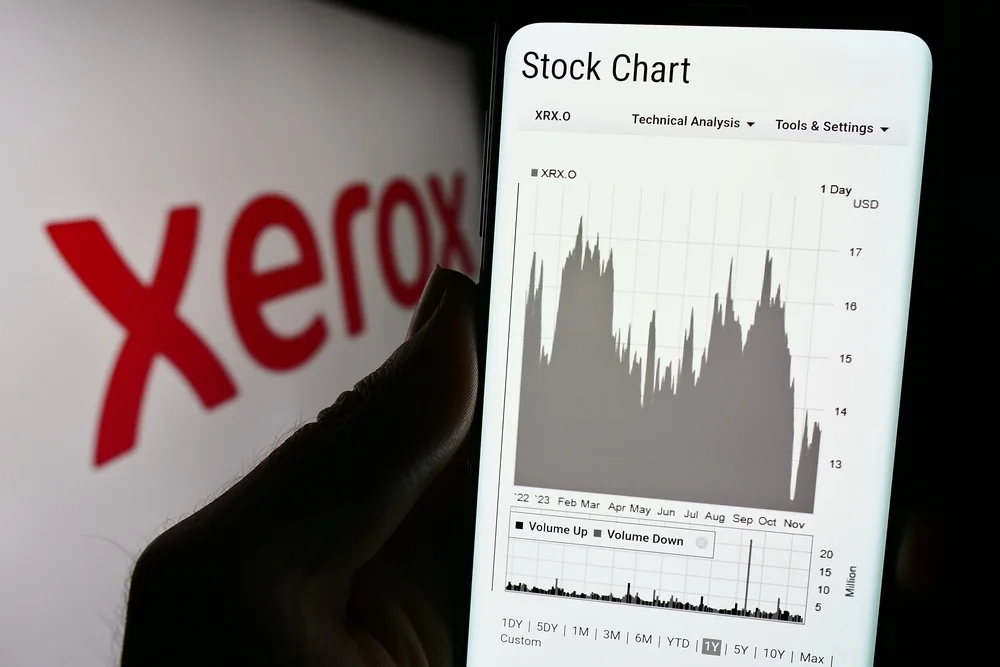

Xerox Holdings Corp (NASDAQ:XRX) shares tumbled sharply on Thursday after the company reported its fiscal third-quarter results. The document management and technology services provider posted a 28.3% year-over-year revenue growth to $1.96 billion, missing the analyst consensus estimate of $2.04 billion. On a constant currency basis, revenue rose 27%. However, the company's bottom line topped Wall Street expectations, with adjusted earnings per share of 20 cents topped the analyst consensus estimate of 12 cents. Also Read: Xerox Misses Q1 Estimates In Seasonally Lowest Quarter, CEO Cites Macro And Trade Uncertainties The equipment segment sales rose 13%. The post-sale revenue, which includes services, consumables, and financing, edged up 32.7%. Gross margin contracted by 970 basis points to 22.7%. Equipment gross margin dropped 240 basis points to 26.1%, while post-sale margin decreased by 1,170 basis points to 21.8%. Adjusted operating income fell to $65 million from $80 million a year ago, with the operating margin narrowing by 190 basis points to 3.3%. Xerox ended the quarter with $479 million in cash and equivalents, and generated $159 million in operating cash flow. Xerox CEO Steve Bandrowczak said macroeconomic volatility and uncertainty around government funding decisions affected transactional print in the quarter, but steady page volume trends and strong IT Solutions performance reinforced confidence in the company's Reinvention strategy. He added that the combined Xerox and Lexmark teams are aligning go-to-market operations, identifying at least $300 million in expected cost synergies through this integration. Outlook Looking ahead, the company struck a cautious tone. Xerox lowered its full-year free cash flow guidance to from around $250 million to around $150 million (down from prior outlook of $250 million). It also cut its expected adjusted operating margin to around 4.5% to around 3.5% (down from previous guidance of 4.5%). The company reiterated constant currency revenue growth of 16% to 17%, implying $7.240 billion-$7.360 billion versus $6.974 billion analyst consensus estimate. Price Action: At last check Thursday, Xerox stock was trading down 11.43% at $3.04. Read Next: Mastercard’s Strong Earnings Signal Americans Are Still Spending, Despite Inflation Fears Image: Shutterstock