WASHINGTON — While some of the prime real estate on the show floor at the Air and Space Forces Association conference this year may have been dominated by large unmanned aerial vehicles, some more compact components had an outsized presence: small engines destined for more attritable systems.

“It’s clear there’s some sort of demand signal,” Byron Callan, managing director at Capital Alpha Partners, said in an interview with Breaking Defense about the raft of companies making a play for smaller engines at AFA and elsewhere. “It did strike me.”

From startups to established primes, companies used the AFA conference this year to show off their wares suited to the lower-end engine space, which could potentially be used for Collaborative Combat Aircraft drones, cruise missiles or other air vehicles that would provide an affordable mass of munitions.

Among those at AFA, Honeywell, for example, unveiled a new 1,600-pound thrust engine dubbed the HON1600, adding another powerplant to the company’s CCA offerings alongside its existing, higher-thrust F124. TJ Pope, Honeywell’s senior director for engines strategy, said in an interview at the show that the company’s approach is “low risk,” in part by leveraging extensive experience manufacturing auxiliary power units, whose supply chain and production facilities can be repurposed for producing small engines.

FULL COVERAGE: AFA 2025

Pratt & Whitney, a subsidiary of defense giant RTX, said in a press release published during AFA that it’s pursuing “a new family of engines” that can scale from 500 to 1,800 pounds of thrust.

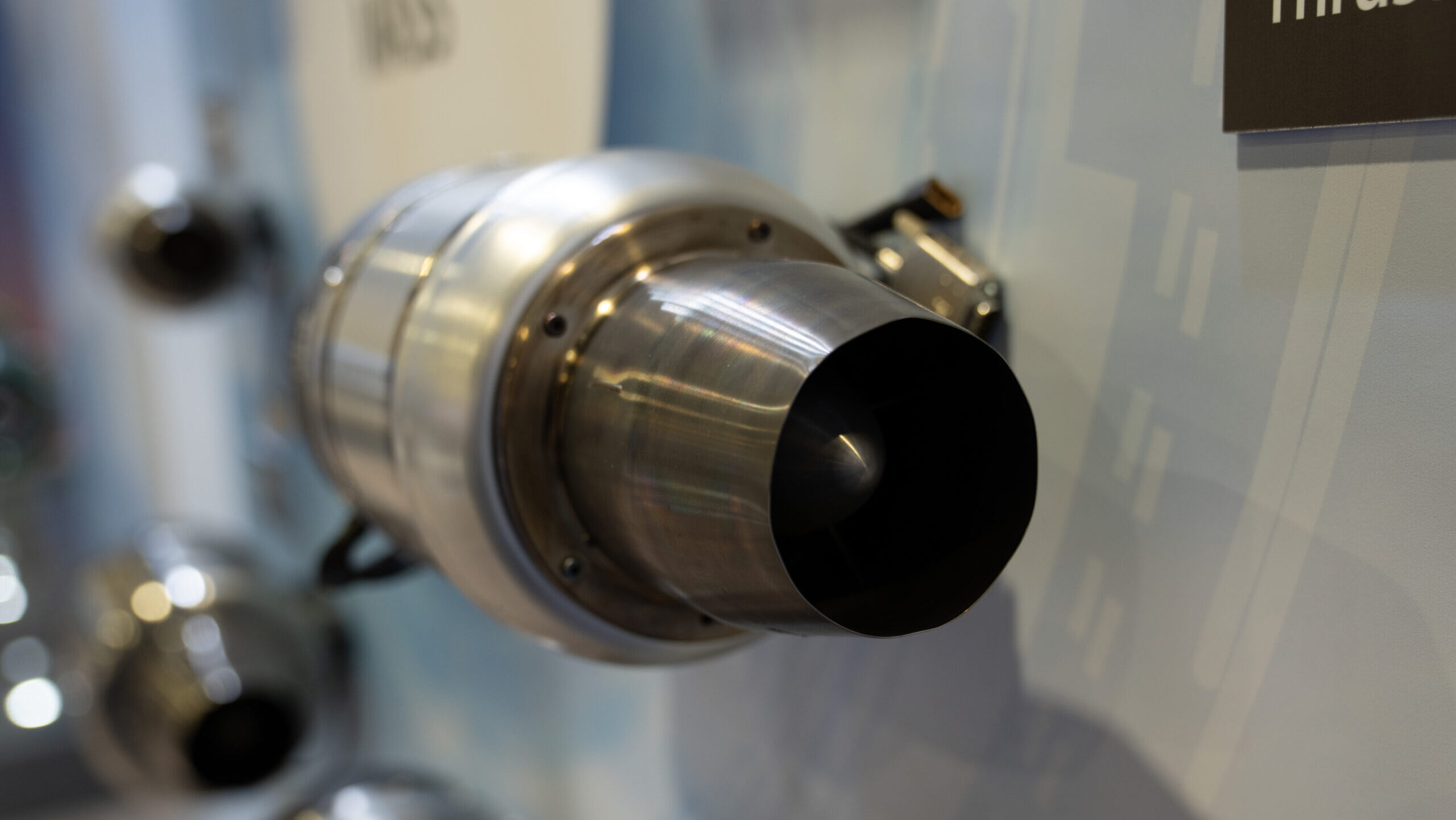

Rolls-Royce, for its part, displayed the Orpheus engine, a family of powerplants jointly under development with the UK’s Ministry of Defense.

“The Orpheus family is targeting multiple potential future opportunities, one of which is the attritable CCA market,” OrpheusWorks Program Manager Emma Russell told Breaking Defense in an interview on the show floor. Highlighting roughly 120 test events and 40 hours of engine run time, Russell said the company has “great knowledge” of the Orpheus design, which is “really targeting a different supply chain [compared] to what Rolls Royce is used to using” to achieve “a route to low cost production.”

Smaller firms had their say too, including JetCat Defense, a joint venture between a German company and an American arm of an Israeli firm. It brought along its new P420 and P850 powerplants, which the company says provide 100 and 200 pounds of thrust, respectively.

Startup BeeHive Industries also announced at the show that its 200 pound-thrust Frenzy engine on contract with the US Air Force hit development milestones and plans to begin flight testing “early in 2026.”

CCA Design Uncertainties

While demand for more affordable powerplants for munitions is high, firms are also charging ahead with offerings without full information about a major incentive driver: the CCA program.

The Air Force has chosen two larger airframes for its first increment of the program, but has not said whether it would emphasize low-end, high-end or systems in between for a next round of CCA contracts. It has moved ahead with a request for proposals for engines in the lower thrust range, though one service official said that RFP is aimed at propping up a dormant segment of the market to give the government more options. (The Navy will likely be another significant buyer of CCA and recently issued contracts for its own drone wingman program, as Breaking Defense previously reported, though those awards are only for “conceptual designs.”)

The exact details of what the Air Force is asking of industry, at least in the public domain, is difficult to pin down, since the service appears to be withholding some information due to security concerns. The Air Force did not respond to Breaking Defense’s query by press time when asked what has been communicated to industry.

The Air Force did previously make one industry survey public, which was roughly in the medium-thrust class domain: a request for information on engines in a thrust range of 3,000 to 8,000 pounds issued in late 2023.

One industry source, who was granted anonymity to discuss sensitive details, said what the Air Force has released in the medium class of thrust “fits in the envelope of what you’ve seen before.” Still, the service has not released an RFP for an engine in that range, they said, much less issued requirements for an air vehicle.

So far, details are more readily available for the Air Force’s first CCA round, or “increment,” where Anduril and General Atomics are facing off. According to Aviation Week, Anduril’s CCA offering will fly with a Williams International FJ44-4 engine that features 3,600 pounds of thrust. General Atomics has not disclosed the powerplant for its CCA bid, but has said the aircraft is compatible with multiple engines.

RELATED: RTX, Shield AI picked to give Collaborative Combat Aircraft autonomous capabilities

Callan pointed out that part of the reason for the uncertainty, beyond enduring questions about how CCA will be used operationally, may have to do with leadership changes at the Air Force. Gen. Kenneth Wilsbach has only now been nominated to serve as the next Air Force chief of staff, and civilian leaders like Air Force Secretary Troy Meink have only been in their roles for a few months.

“I still think we’re kind of in a transition period,” Callan said, adding that a “better line of sight” may come in the Pentagon’s fiscal 2027 budget.

A key challenge for industry too is manufacturing engines that are not necessarily built to last for what would be more attritable aircraft, contrary to aerospace engineers’ traditional task of designing engines with long lifespans and high tolerances.

“Shifting that paradigm is certainly not an easy thing to do,” Honeywell’s Pope said, pointing to innovations like additive manufacturing and tradeoffs in cooling and lifespan, since the engines aren’t meant to operate as long. When it comes to smaller CCA engines, “my assumption is that it’s going to be a two digit number from a life cycle standpoint,” he added, referring to the number of flight hours the engine is expected to log.

For engines that are “something in the middle” between being expendable and lasting thousands of hours, “that’s a completely new approach, or a combination of approaches,” Richard Aboulafia, managing director at AeroDynamic Advisory, said in an interview with Breaking Defense.

“I would think that the incumbents” — some of whom can repurpose commercial offerings for military applications — “still have the advantage,” Aboulafia observed. “Turbines are not a space that’s easily disrupted with new technology. But on the other hand, maybe this is one of those areas where a startup could take a totally clean sheet approach.”

Market Considerations And ‘Prudent Bets’

The budding entrants hoping to supply lower-thrust engines join a field that has become increasingly crowded over the past year, featuring teamups like one consisting of GE Aerospace and Kratos. Firms making a foray into smaller engines will further go toe-to-toe with established providers like Williams International, which supplies engines for the Tomahawk missile among other systems.

Still, analysts told Breaking Defense there will likely be a good amount of opportunity for these companies to chase.

“This is certainly a growth market. It’s gonna take awhile to get there, but you could easily see hundreds of air vehicles,” some with potentially different sizes and requirements, “built per year in this market sometime in the early 2030s,” Aboulafia said.

“The bets” companies are making to invest in engine development “aren’t necessarily major ones,” Callan said. “I’d call them prudent bets.”

A global ramp up in defense spending also carries some tension for companies, who have shown they’re eager to do CCA business abroad. Aboulafia and Callan both pointed out that it’s likely foreign buyers may want to have some sovereign control over their programs, including by having key systems manufactured within their borders.

RELATED: Europe is pouring money into defense. Can US firms reap the reward amid trans-Atlantic tension?

“I generally believe Europeans are going to buy European,” Callan said as an example. “For now, I think the US companies, their largest market is gonna be the US,” he continued, pointing to the added possibility of “multidomestic” manufacturing footprints.

Asked whether the market for smaller engines is already becoming oversaturated, Callan said it’s “just too soon to tell.” Still, he said, “The one thing I would be skeptical of is, it’s gonna be winner-take-all” — a philosophy the Pentagon has also tried to instill in its CCA programs.

“There’s almost universal consensus that CCA are the future of air combat, but there is very little consensus about what they look like,” Aboulafia said, noting the “irresistible” allure of providing powerplants for potentially thousands of systems. “So will there be winners and losers? Absolutely. But you can’t ignore this market.”