Copyright Adweek

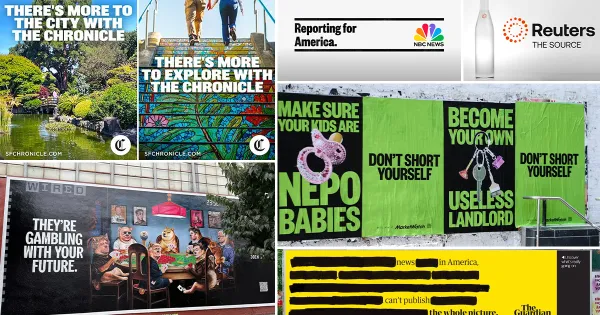

In recent months, a growing number of premium publishers have unveiled ambitious, expensive brand marketing campaigns, splashing bespoke creative across digital, social, and physical channels to draw consumer attention to their companies. More intriguingly, the vast majority of these publishers have never run such campaigns before. In January, Hearst Corp. announced its first agency of record partnership in company history, selecting PMG to ideate and lead a series of brand marketing campaigns for titles across its portfolio. The project began in May with brand campaigns for The Houston Chronicle and San Francisco Chronicle, but it has since expanded to several of its other editorial brands and will continue into next year. In September, the Condé Nast title Wired unveiled its first national brand marketing campaign as part of a larger effort to promote its politics issue. That same month, The Guardian debuted its ambitious new work, The Whole Picture, across subways, billboards, and digital channels. And MarketWatch, a News Corp. brand, recently also ran the first brand marketing campaign in its 28-year history. This week alone, two more publishers unveiled brand marketing campaigns, both noteworthy in their novelty. On Monday, NBC News launched the first brand marketing campaign in its history, deploying creative across digital and physical channels to underscore the trustworthiness of its brand. Historically, NBC has marketed its individual franchises, but this effort marked the first time it had pushed for awareness as an organization, according to its senior vice president of communication Dana Klinghoffer. And on Thursday, Reuters plans to debut just the second brand marketing campaign in its 174-year history, ADWEEK can exclusively report. Its first such effort came four years ago, in 2021. Taken together, the explosion of brand marketing campaigns marks a significant moment in the industry. For one, news publishers rarely engage in these kinds of efforts, largely because they are expensive and publishers generate plenty of awareness through their reporting. In recent years, The New York Times, The Wall Street Journal, and Bloomberg have run a handful of brand campaigns each, but outside of that, they are few and far between. But more critically, the widespread nature of this trend, combined with the uncanny coordination of its timing, suggests that these publishers have grasped a similar truth or been motivated by a shared concern. So why have so many publishers opted to do something they have largely never done, and why have they chosen now to do it? A response to dwindling discovery The most obvious reason publishers are amping up their brand marketing efforts is because the ways in which consumers are engaging with the news has changed. Referral traffic from social platforms has been in decline, and disruption posed by artificial intelligence to search engines has only compounded the issue. With fewer consumers now passively encountering news content, publishers need to increase their proactive efforts to reach them, according to Mark Silver, the senior director of strategy at media agency Code and Theory. In particular, younger generations that have come of age after these shifts in traffic patterns are more likely to be unfamiliar with these publishers in the first place. Publishers can no longer rely on simply producing content and assuming it will find its way in front of these audiences. MarketWatch, for instance, targeted Gen Z specifically with its marketing, employing a brat green font and cheeky copy to entice young audiences interested in financial literacy. “The way that consumers make decisions is increasingly around brands,” Silver said. “We have to think of consumers as consumers of information—you can’t just expect them to know what you’re about. You have to tell them.” Raising brand prominence amid AI disruption AI figures into this equation in more ways than one. In addition to disrupting search traffic, answer engines rely on publisher data to power their responses. This reality has led to the emergence of a marketplace dynamic, as AI firms look to strike deals with publishers to license their content. Already, AI companies have struck deals with around a dozen premium publishers, including The New York Times, Condé Nast, Vox Media, Axel Springer, and more. But these are one-off arrangements, and no consistent framework has been established as to how smaller publishers will be compensated when their data is used to answer user queries. These campaigns can be seen as an effort by publishers to raise their consumer awareness and perception at a critical juncture in their negotiations with AI firms, according to Upwave chief executive officer Chris Kelly. The volume, quality, and awareness of a brand could help inform the market rate for its data. One of publishers’ main arguments in these discussions, that an answer engine without their data would be inferior to one with it, hinges on consumer demand for that brand. By making, say, Reuters a more top-of-mind source of news, an answer engine without Reuters content would be less enticing to a user. Increasing favorability at a critical moment AI is not the only external force roiling the news media industry. In recent months, President Trump has levied broadsides at a broad swath of publishers, taking legal action against The New York Times, Wall Street Journal, ABC News, and NBC News. These assaults come at a particularly vulnerable moment for the news industry, as trust in the media continues to plummet and the industry as a whole struggles to find commercial sustainability. Many of these brand campaigns, particularly the ones from NBC News and Reuters, are meant specifically to engender trust in audiences. More broadly, they all aim to raise audience affinity for the brands, according to Kelly. In any contest between the president and the media, the court of public perception is a critical battleground. A successful effort to win over audiences could prove to be valuable insurance in future disputes. Investing in subscriber acquisition On a more prosaic level, every publisher that launched one of these brand campaigns has a consumer subscription business. Some of these offerings differ from one another in meaningful ways. The Guardian, for instance, solicits donations but does not paywall its content. Reuters only launched its digital subscription product last October, and NBC News is expected to launch its consumer subscription offering this quarter. Taken together, all of these publishers have a means of turning consumer support directly into recurring revenue, which means that top-of-funnel efforts are ultimately key to their bottom line. All good marketers know that investing in brand equity is integral to, and upstream of, paid acquisition efforts. David Carey, senior vice president of public affairs and communications at Hearst, referred to the company’s brand marketing efforts as “preparing the ground” for its subscription business. These kinds of efforts can seem like expensive luxuries, as the return on investment is harder to track. But time and again they are proven to be essential, according to Kelly, the Upwave CEO. “These companies all have ad sales teams that offer brand lift measurement services to their advertisers, so they should have the mental frameworks and vendors lined up to track whatever upper-funnel KPIs they have set,” Kelly said. “Ultimately, if a consumer has a chance to read a version of the same story from four different outlets, that is the news media version of the shelf that a consumer is grabbing a product from.” The intangible made tangible The benefits of brand marketing campaigns are often difficult to point to specifically, which is why they are rarer than performance campaigns. But in some instances, the value of that brand equity makes itself very apparent. Consider the recent story of Hearst Corp. acquiring The Dallas Morning News, which I have covered in depth. In that situation, The Dallas Morning News accepted a lower bid from Hearst Corp. over a higher offer from private equity firm Alden Global Capital specifically because its ownership trusted Hearst to be a better steward of its brand and its journalism. That is about as clear of an example as you get of how brand reputation can yield tangible, strategic benefits. Relatedly, it should come as no surprise that all of the publishers running these brand marketing campaigns have the benefit of patient, long-term ownership. The Roberts, Murdochs, and Thomsons control the voting shares in News Corp., NBC parent Comcast, and Reuters, respectively. The others are privately held and controlled by family ownership or trusts, as is the case with The Guardian. These kinds of ownership models enable publishers to invest in their brands for the long term, with the understanding that these efforts will produce dividends over a multiyear timeline. And while not every publisher can afford to finance these kinds of campaigns, these initiatives underscore their importance and will hopefully inspire similar efforts. “Maybe a smaller brand will see this and find a version of this that they can do,” Carey said. “Consumers have great awareness of news brands, but sometimes they can use reminders of why that is.”