By Jesus Mesa

Copyright newsweek

President Donald Trump’s new executive order has cleared the way for a $14 billion sale of TikTok’s U.S. operations to a group of American investors. While the move is being framed by the administration as a national security fix, some analysts and policy experts say the unusually low valuation and politically connected investor lineup point to a different question: who benefits most from the forced sale?

Under the proposed terms, TikTok’s U.S. business will be spun off into a new joint venture. Oracle, Silver Lake, and other U.S. investors will hold an 80 percent stake, while ByteDance, the Chinese parent company, will retain just under 20 percent—the maximum allowed under U.S. law. Despite giving up control, ByteDance is expected to collect up to 50 percent of the new company’s profits through licensing fees and profit-sharing agreements.

“The valuation is a deep discount to what I and many have thought,” Angelo Zino, senior vice president at CFRA Research, told Newsweek. “The forced sale and the fact that the administration didn’t entertain competing bids or an open auction largely reflects the deep discount.”

Milton Mueller, a professor at Georgia Tech specializing in digital governance, told Newsweek the deal was shaped more by geopolitics than market logic. “This was not a fair-market transaction,” Mueller said. “It’s a politically determined restructuring. ByteDance retains a financial interest, but not strategic control.”

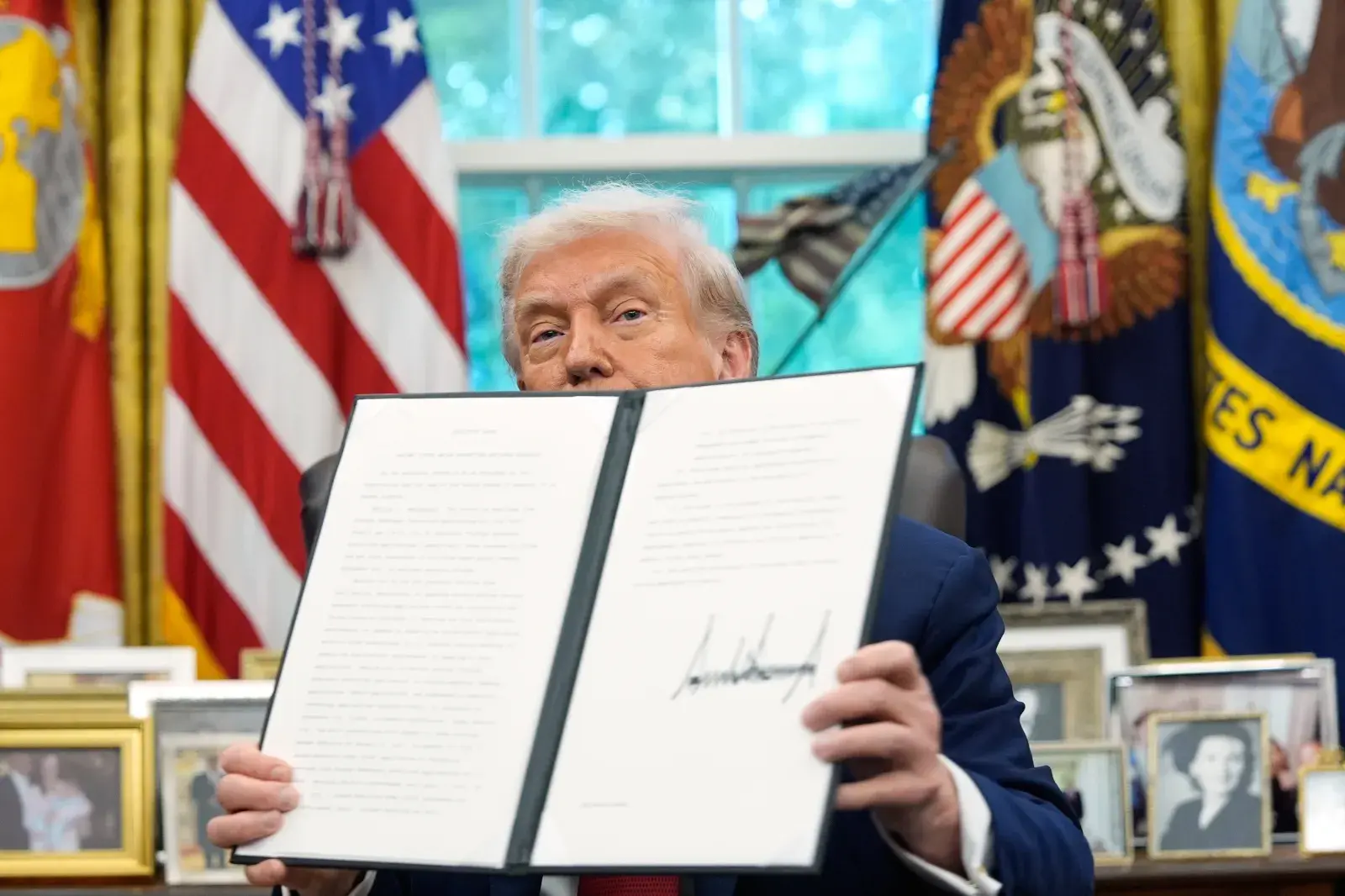

President Donald Trump holds a signed executive order regarding TikTok in the Oval Office at the White House, Thursday, Sept. 25, 2025, in Washington. (AP Photo/Alex Brandon)

The $14 billion valuation surprised many in the tech world, especially given TikTok’s vast U.S. user base and advertising revenue. Elon Musk paid $44 billion for Twitter in 2022, and Snap—another platform with far less user engagement—is currently valued near the same amount. In 2020, Microsoft was reportedly willing to pay more than $50 billion to acquire TikTok outright, and the platform has doubled its user base since. A ByteDance employee share buyback this year internally valued TikTok at $330 billion.

“$14 billion seems to be a fire sale price for this prize asset,” Anupam Chander, professor at Georgetown Law, told Newsweek. “Advertisers love TikTok, which reaches about half of Americans.”

Those who did participate include several of Trump’s prominent supporters. Oracle co-founder Larry Ellison, Rupert Murdoch and his son Lachlan of Fox Corporation, and Dell Technologies founder Michael Dell are all expected to hold stakes in the new company. Trump acknowledged the group’s involvement at Thursday’s signing ceremony and addressed concerns that the app could become politically skewed toward the right.

“If I could, I’d make it 100 percent MAGA-related,” Trump said to reporters on Thursday. “But it’s not going to work out that way… every philosophy, every policy, will be treated very fairly.”

Chander noted that while American users benefit by avoiding a shutdown, the buyers clearly secured favorable terms. “The buyers seem to be getting a huge asset at a fraction of its actual value,” he said.

Zino pointed to the deal structure — and the limited pool of approved buyers — as the main reason for the low price. “The fact that certain industry players were never going to be allowed to participate also likely meant that TikTok would not get near its true valuation,” he said.

U.S. President Donald Trump speaks to reporters in the Oval Office of the White House on February 03, 2025 in Washington, DC. Trump was joined in the Oval Office by (L-R) White House staff secretary Will Scharf, Howard Lutnick, his nominee for Commerce Secretary, and Former Executive Chairman of Fox Corp Rupert Murdoch.

Algorithmic Control and Future Risks

While TikTok may soon escape the threat of a nationwide ban in the United States, the 170 million Americans who use it may not be getting the platform they recognize. Though no final product has been announced, ByteDance engineers have spent much of 2025 preparing for the possibility of a split.

That uncertainty has already raised concerns across the platform’s creator ecosystem.

According to sources familiar with the project who spoke to Reuters, the company has been duplicating TikTok’s codebase, algorithm, and core functions to create a U.S.-only app that would be developed and stored entirely within the United States. The platform would reportedly be trained on American user data and inaccessible from overseas devices.

The move would mirror how ByteDance already operates Douyin, the China‑only version of TikTok. Though it shares many surface features with its international counterpart, Douyin is hosted on domestic servers, built on a different codebase and is heavily regulated under Chinese cybersecurity and media laws.

Natalie Kerby, a researcher at AI Forensics, pointed to the risk of a more insular and mani…