Copyright newsweek

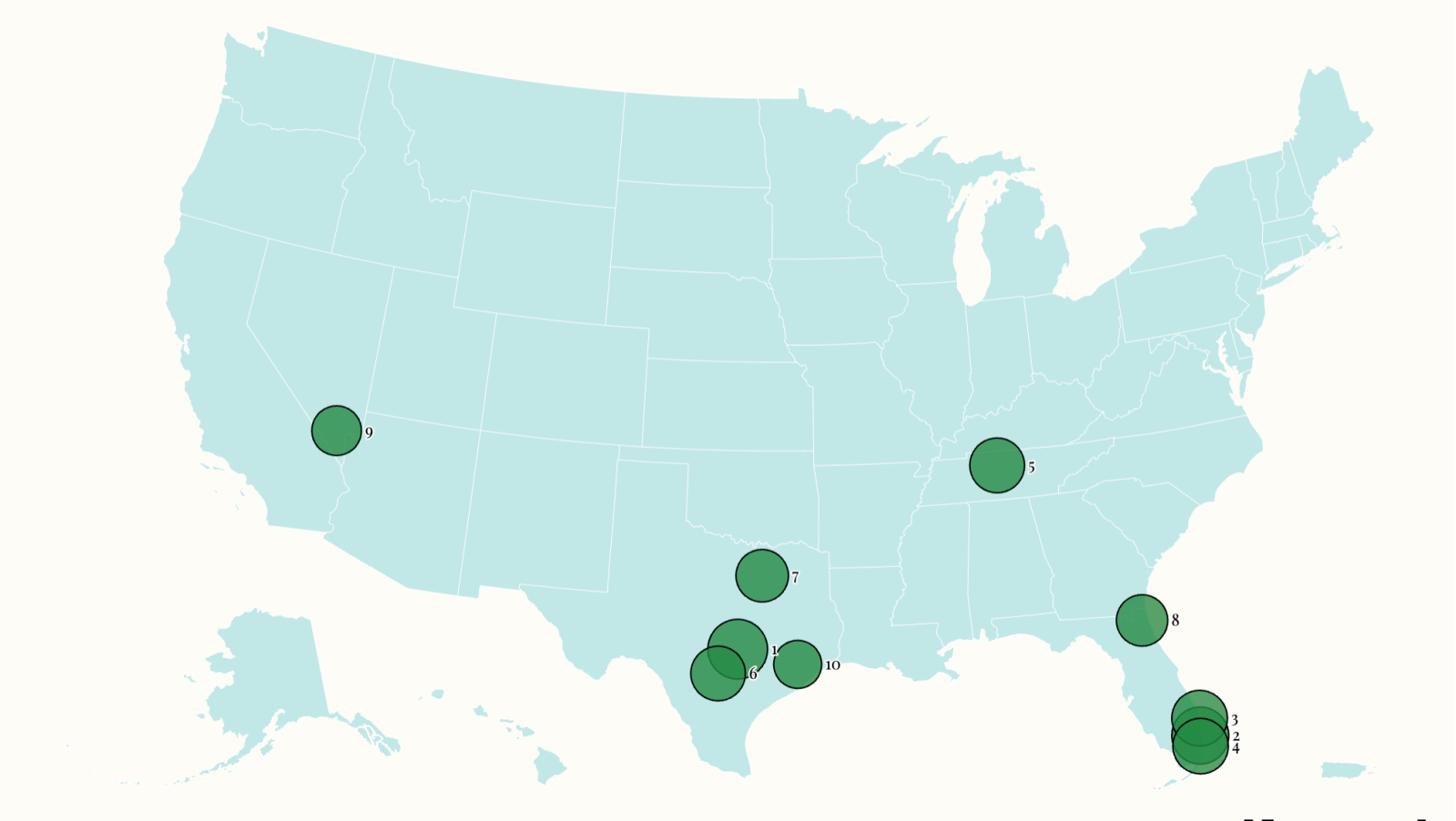

Eight out of 10 of the strongest buyer’s markets in the country are in Florida and Texas, according to a new report by Redfin, as the two states are experiencing a starker correction than any other in the nation. What Is a Buyer’s Market? A buyer’s market is one where the number of homes available for sale exceeds the number of potential buyers. Redfin defines a market where there are over 10 percent more sellers than buyers as a buyer’s market. This imbalance gives those looking for a home more leverage over sellers and more negotiating power, often leading to price cuts and other advantages being offered to close a deal. The number of homes for sale has reached above pre-pandemic levels this year, exceeding 2 million active listings every month since April, according to Redfin data. This is due to a combination of two factors: on one hand, homeowners who were locked into their properties by lower monthly payments have stopped waiting for mortgage rates to come down and put their properties on the market. On the other hand, many buyers have withdrawn from the market due to ongoing affordability issues, including rising prices, stubbornly high borrowing costs, and higher property taxes and home insurance premiums. While inventory has grown all across the country, some regions have seen more dramatic increases than others. In the South—especially in states like Florida and Texas, which have been experiencing a construction boom over the past five years—inventory has risen much more than in the Northeast and Midwest, where the shortage of homes remains acute. As a result, the strongest buyer’s markets in the country are focused on the South and in the West. Where Are The Strongest Buyer’s Markets In The U.S.? The strongest buyer’s market in the U.S. last month, according to the latest data available, was Austin, Texas. The city had the highest gap between sellers and buyers, with sellers outnumbering buyers by 130 percent. At the national level, U.S. sellers outnumbered buyers by a much more modest 36.7 percent in the same month, the equivalent of over 500,000. The second-strongest buyer’s market was Fort Lauderdale, Florida, with sellers outnumbering buyers by 118.5 percent. In West Palm Beach, Florida, the gap was 113 percent; in Miami by 112.2 percent. Nashville, Tennessee, had the fifth-strongest buyer’s market in the country, with sellers outnumbering buyers by 109.4 percent. San Antonio, Texas, followed with 108.9 percent, after which came Dallas (100.4 percent), Jacksonville, Florida (96.3 percent), Las Vegas (89.6 percent), and Houston (83.8 percent). Why Are Nearly All of These Markets in the Sun Belt? The Sun Belt became particularly popular during the pandemic, when historically low mortgage rates sparked a home-buying frenzy and the rise of remote work allowed people to move around the country seeking more affordable places to live. Florida and Texas in particular experienced a boom in demand which, combined with a relatively low shortage of homes, pushed prices through the roof. Developers in the state started building new homes to meet demand, but by the time they landed on the market, conditions had changed: mortgage rates had more than doubled since their pandemic lows, and many workers who had migrated away from their place of employment were being asked to return. As a result, much of this inventory piled up on the market, unsold. “Austin was the poster child for pandemic boomtowns, with home prices soaring nearly 60 percent in just two years. Builders saw that strong demand and rushed in to build both multifamily and single-family homes,” Daryl Fairweather, Redfin chief economist, told Newsweek. “In the first years of the pandemic, sellers had their pick of offers. But when mortgage rates spiked in 2023, demand cooled and prices fell—just as a wave of new construction hit the market,” she said. A similar situation has unfolded in many other Texas and Florida cities in recent months. “Now that there are more homes for sale than buyers in the market, buyers have the upper hand. They’re negotiating on price, securing concessions and seeing real gains in affordability,” Fairweather said. “I expect prices in Austin to remain soft for a while, but with new construction slowing, the pendulum of power could swing back to sellers.” A map showing the 10 strongest buyer’s markets in September 2025, based on the percentage by which sellers outnumber buyers. (Redfin)