Copyright forbes

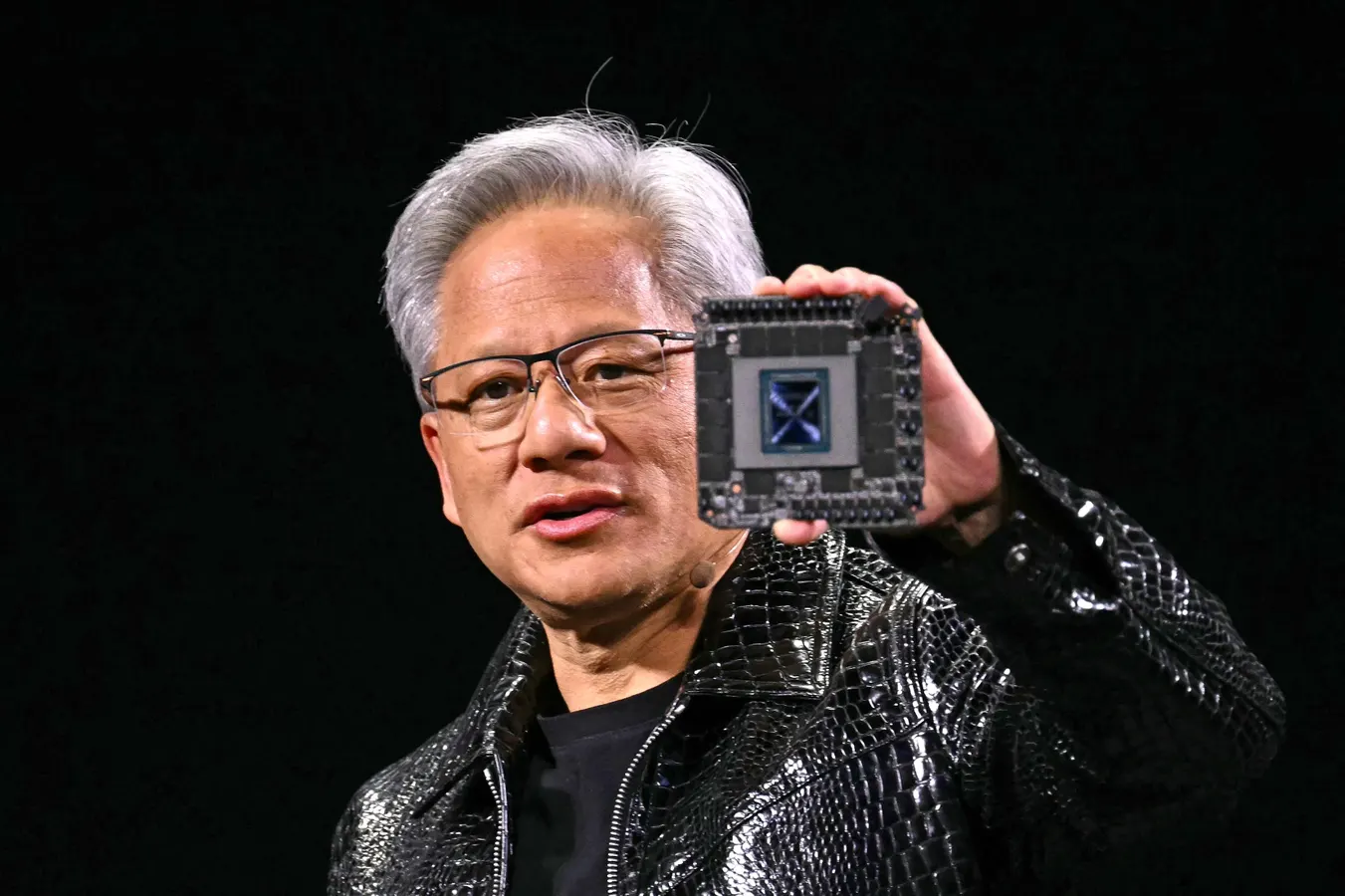

Historically, Nvidia has staged multiple powerful rallies - from riding the cryptocurrency boom to capitalizing on the Covid-era gaming and remote work surge. The stock’s latest ascent, fueled by the generative AI revolution that began in 2022 has been the biggest and most transformative wave in the company’s history. Nvidia CEO Jensen Huang delivers a keynote address at the Consumer Electronics Show (CES) in Las Vegas, Nevada on January 6, 2025. Gadgets, robots and vehicles imbued with artificial intelligence will once again vie for attention at the Consumer Electronics Show, as vendors behind the scenes will seek ways to deal with tariffs threatened by US President-elect Donald Trump. The annual Consumer Electronics Show (CES) opens formally in Las Vegas on January 7, 2025, but preceding days are packed with product announcements. (Photo by Patrick T. Fallon / AFP) (Photo by PATRICK T. FALLON/AFP via Getty Images) AFP via Getty Images In fact, the stock increased by more than 50% within a two-month period on 11 occasions, particularly notable in 2016 and 2024, and rose over 30% during similar times 15 times, including crucial years such as 2017 and 2024. If past patterns persist, forthcoming catalysts could propel NVIDIA shares sharply upward once more, providing considerable profits to investors. Factors That May Elevate The Stock AI Data Center Leadership Blackwell drives Q2 FY2026 Data Center revenue to $41.1B, marking a 56% increase year-over-year. Sequential growth from Blackwell reached 17%. Potential drawback: hyperscalers are developing custom chips. Software Ecosystem The high-margin software/support annual run rate is anticipated to reach $2B by the end of 2025. The CUDA platform enhances customer loyalty, though competition in AI software is intensifying. New Market Growth Q2 FY2026 recorded significant expansion in the automotive sector. Sovereign AI openings are expected to target low double-digit billions this year. Potential drawback: restrictions on exports to China. Investing in single stocks can be risky, but there is immense value in a broader, diversified strategy such as the one we implement with Trefis High Quality Portfolio. We extend our focus beyond just stocks. A portfolio consisting of 10% commodities, 10% gold, and 2% cryptocurrency, in addition to stocks and bonds, may yield higher returns over the next 1 to 3 years and offer better protection if markets decline by 20%. We have analyzed the data. Current Financial Overview It's beneficial if the fundamentals align well. For insights on NVDA, read Buy or Sell NVDA Stock. Below are several important figures. Revenue Growth: 71.6% LTM and an average of 92.0% over the last 3 years. Cash Generation: Approximately 43.6% free cash flow margin and 58.1% operating margin LTM. Valuation: NVIDIA stock has a P/E ratio of 51.4 Opportunity Compared to S&P: When compared to the S&P, NVIDIA offers a higher valuation, greater revenue growth, and improved margins MORE FOR YOU But How Does The Stock Perform During Adverse Conditions? Examining NVIDIA’s past during market downturns reveals that there remains considerable risk despite its advantages. The stock declined close to 85% during the Global Financial Crisis and 68% during the Dot-Com bust. The sell-off in 2018 and the inflation shock each exhibited decreases exceeding 55%, with the latter around 66%. Even the relatively short Covid downturn caused a nearly 38% drop in the stock. Strong fundamentals are important, but when the market declines, NVDA is not shielded from significant drops. However, risk is not confined to major market crashes. Stocks can decline even in favorable market conditions—consider events like earnings reports, business updates, and changes in outlook. Read NVDA Dip Buyer Analyses to explore how the stock has bounced back from sharp declines historically. The Trefis High Quality (HQ) Portfolio, comprising a selection of 30 stocks, has demonstrated a record of consistently outperforming its benchmark, which includes all three indices—the S&P 500, S&P mid-cap, and Russell 2000. What accounts for this? Collectively, the stocks in the HQ Portfolio have offered better returns with reduced risk compared to the benchmark index; providing a steadier performance, as highlighted in HQ Portfolio performance metrics. Editorial StandardsReprints & Permissions