Tesla has publicly demonstrated limited but relevant physical capabilities for Optimus. Across videos and staged demonstrations through 2024 and 2025, Optimus has been shown walking with improved gait dynamics, performing basic manipulation and household-style chores, completing simple pick-and-place operations, and interacting in staged social settings.

One of the most noticeable areas of improvement is walking with a more natural heel-to-toe stride, and while that may not be monumental, most humanoid robot companies are still stuck at this stage. Though Optimus has always been marketed as an industrial robot, Tesla has been riding the trend wave. Like many other humanoid robot companies, it has shown Optimus getting a hang of household chores.

While Optimus is not yet the American humanoid robot poster boy (Atlas still holds that title), it can certainly stir a pot, sweep, and vacuum. It can now open and close cabinets and curtains, tear a paper towel, take out a trash bag, and handle a Model X car component for placement on a dolly.

But here’s the catch. Tesla positions these demonstrations as the product of a unified control policy (a “single neural network”) trained with vision-based inputs, and it has emphasized a training pipeline that uses human video data to accelerate skill acquisition, which is a big deal. It is worth noting that these demonstrations indicate that Optimus currently operates reliably only in structured or lightly staged settings where objects are known, lighting is controlled, and failure modes are limited. They do not yet establish robust autonomy in unstructured homes or fully operational factory cells.

At the same time, Tesla’s core EV business has faced headwinds in 2025, including large market-cap declines and profitability pressure that have sharpened scrutiny of whether Optimus can deliver commercial returns at scale.

Where Optimus shows measurable progress

The clearest advances in the latest Optimus iterations are integration-level rather than singular dramatic breakthroughs. First, the robot’s gait and full-body coordination have become smoother than those of the earliest prototypes. Tesla frames this as progress in whole-body control rather than isolated limb scripts.

Second, Tesla’s training approach, shifting toward vision-only imitation learning from human camera data, represents a strategic attempt to scale skill acquisition without hand-crafting controllers for each task. Third, Tesla’s demonstrations have stitched together locomotion, perception, and basic manipulation under a single control stack, which, if it generalizes, would reduce engineering brittleness and simplify adding new behaviors. A robot that walks without frequent falls and can reliably pick and place in moderately predictable environments is useful for repetitive and low-risk chores. Whether those capabilities can be extended and hardened for long hours and high-stakes industrial settings remains to be seen.

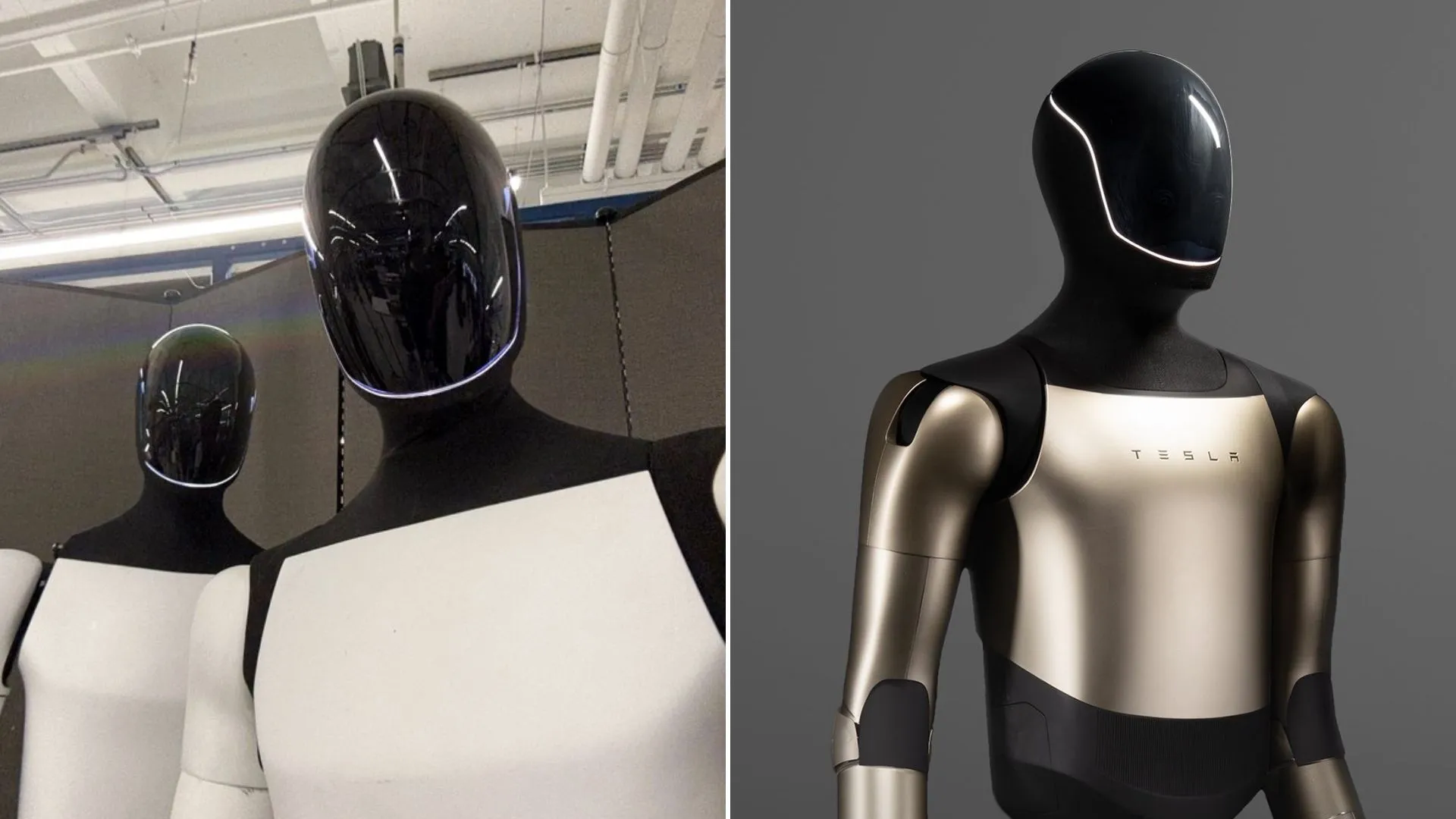

The 2.5 (“golden”) iteration improved exterior design and cosmetic finish, but many observers and reviewers viewed its recent social media reveal as underwhelming in terms of function. In the unofficial demo, the humanoid responds to voice commands slowly and takes awkward pauses. The motion is tentative, and the gait looks nothing like what you would expect from a newer Optimus variant—as for the 2.5, cosmetic refinement outpaced demonstrable capabilities. The robot’s practical limits remain the primary uncertainty until Tesla publishes operational metrics such as quick responses to human speech, cycle times for common tasks, or independent field trials.

How Optimus stacks up against other humanoids

Mobility and agility: the benchmark vs. Boston Dynamics

Boston Dynamics’ Atlas has long set the public standard for dynamic agility. Vaults, jumps, and rapid balance recovery remain Atlas’s calling cards. In 2024–2025, Boston Dynamics emphasized an all-electric Atlas that continues to demonstrate advanced dynamic behaviors and serves as a technical benchmark for high-performance balance and locomotion.

Optimus has never shown the same level of dynamic athleticism. Instead, its improvements have prioritized steadier, energy-efficient walking and whole-body coordination. For applications that require acrobatics, aggressive recovery, or high-speed obstacle negotiation, Atlas-class performance is leagues ahead of what Tesla has publicly demonstrated.

Task usefulness and commercialization: Digit, Figure, Apptronik

Companies such as Agility Robotics (Digit), Figure, and Apptronik are approaching humanoids from a use-case and commercial-validation perspective. Digit has entered paid pilots and logistics deployments and is the clearest example of a humanoid already producing measurable value in a warehouse context; agreements such as Digit’s multi-year deployment with GXO illustrate an early route to monetization.

Figure and Apptronik have likewise emphasized pragmatic deployments and manufacturing partnerships. In comparison, Optimus’s demonstrations have recently started emphasizing breadth (household chores plus industrial-style handling) and the promise of scale, more than verified, revenue-driven field deployments. Tesla’s advantages are its production and AI infrastructure, and the bot has also been deployed to train at Tesla factories.

China’s approach: Unitree, UBTECH, and the industrial focus

Chinese firms have pursued optimization methods: rapid iteration, manufacturability, and duty-cycle engineering. Unitree’s recent humanoid models (and lower-cost research units) emphasize agile maneuvers and accessible hardware. UBTECH’s Walker family has demonstrated mission-oriented features such as autonomous battery swapping to enable continuous 24/7 operation, a practical advantage in factory settings where uptime matters more than occasional acrobatics.

Recent reporting shows Chinese firms reducing price points and pursuing factory deployments aggressively. Their emphasis is less on demonstrating a singular “humanlike” generalist and more on producing reliable, maintainable machines for real operational roles. That narrow, production-centric approach is exactly the kind of progress that can outcompete headline demos if it yields lower unit cost and higher uptime in factories.

Release timeline, supply risks, cost, and the near-term outlook

Tesla’s public timeline has shifted repeatedly. Leadership has described ambitious targets. Musk spoke of producing a “legion” of roughly 5,000 Optimus units in 2025 and scaling to tens of thousands in 2026. Still, independent reporting suggests Tesla is behind the pace needed to meet those targets, with production counts in 2025 reportedly in the hundreds rather than thousands. Tesla has also signaled continued development toward a Gen-3 customer-ship model beyond the cosmetic 2.5 units. Given the company’s wider 2025 financial pressures and organizational turnover in key robotics roles, these production targets should be considered aspirational unless Tesla supplies verifiable production and deployment data.

A second constraint is material supply. In 2025, China imposed export restrictions on certain rare earths and magnets as part of broader trade measures. Those controls, and the subsequent diplomatic and market responses, have introduced volatility into supply chains for high-performance electric motors and magnetics that many robots rely on. Policy steps by governments and negotiations with Chinese suppliers have eased some disruption. Still, the episode highlights how geopolitical supply-chain risk can materially affect production economics and timelines for any large-volume hardware program. This risk compounds the engineering and validation challenges Tesla already faces.

Finally, cost and customer economics remain unresolved. Musk’s public price target, roughly $20,000–$30,000 at scale, frames Optimus as affordable relative to cars and other industrial robots. Still, until Tesla demonstrates replicable manufacturing cost curves, warranty and service models, and the real operational economics of robots in factories or homes, that price should be viewed as a target rather than a fact.

The commercial test that will decide competitiveness is straightforward. Can Optimus deliver more value than its total cost of ownership over the lifetime compared with existing automation alternatives? Until field-trial data and third-party validations appear, that question is open.

So what to expect?

After four years of public development, Optimus has demonstrated credible progress in integrated walking, vision-based training, and basic manipulation in staged settings. Tesla’s scale, integrated AI stack, and clear strategic focus make Optimus an important effort to watch.

However, the project’s current strengths are primarily systems integration and ambition. Operational maturity, continuous uptime, field-proven reliability, and demonstrable unit economics remain to be shown. Recent cosmetic advances (the 2.5 “golden” units) and Musk’s high-profile claims have yet again raised expectations, but the most commercially consequential competition will not be decided by stage choreography.

It will be decided by robots that can work long shifts, be serviced cheaply, and consistently perform valuable tasks in real facilities. Whether Optimus becomes America’s poster child for humanoids depends on Tesla moving from spectacle to sustained, independently verifiable results and its ability to manage supply-chain, production, and service economics at scale.