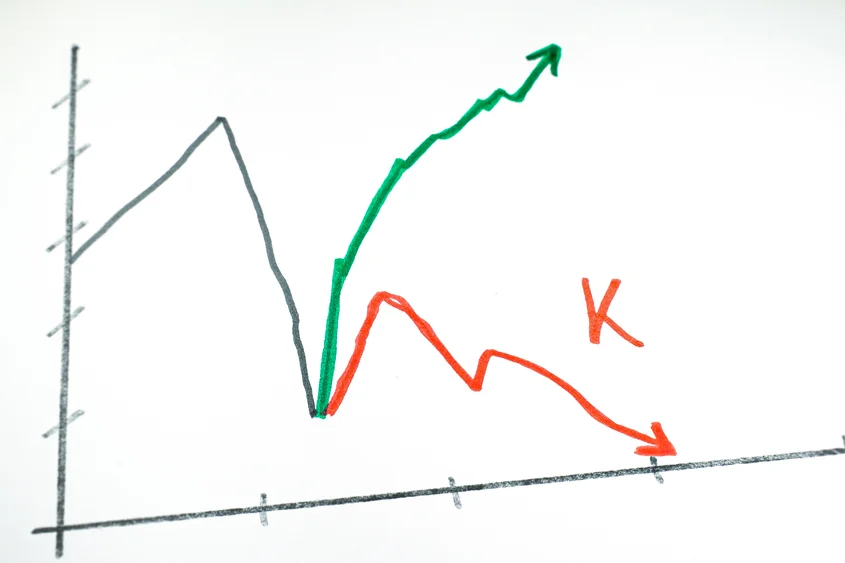

Wall Street continues to break records while signs of stress mount for everyday Americans, underscoring the K-shaped nature of the U.S. economy—where the top climbs higher while the bottom stagnates or falls behind.

“Wall Street is now six times the size of Main Street,” recently said Bank of America chief investment strategist Michael Hartnett in a recent note.

Yet, while equity wealth is at all-time highs and top earners outpacing everyone else in wage growth, the first cracks in subprime credit markets and consumer finance stocks suggest parts of the economy are not as strong as market averages imply.

Higher-Income Households Power Economic Growth

Despite the absence of official jobs statistics due to the government shutdown, Bank of America’s internal data shows that wage growth picked up across income tiers in September.

After-tax pay for high-income households rose 4.0% year-over-year—the fastest pace since October 2021. For middle-income households, wage growth was 2.4%, while lower-income households saw just 1.4%, underscoring a persistent and widening gap.

The divergence in wage growth mirrors the broader labor market slowdown. Payroll growth, based on direct deposit inflows into BofA accounts, rose just 0.5% YoY in September—its slowest pace in months. Meanwhile, unemployment insurance payments surged 10% YoY in October, double the 5% pace reported by the Bureau of Labor Statistics in August.

Wall Street Booms, Main Street Wavers

Despite these labor market headwinds, risk assets are soaring amid expectations that the Fed will continue to cut interest rates.

The Nasdaq 100, tracked by Invesco QQQ Trust (NASDAQ:QQQ), has rallied 50% since April, fueled by expectations of lower interest rates and resilient corporate earnings.

Wealth effects are at record highs, particularly among the highest-income Americans who control the majority of equity ownership.

According to Federal Reserve data, the top 10% of earners now hold 87% of all U.S. equities. The top 1% alone control 38%.

“Equity ownership is always concentrated at the high end, but a bit more so recently,” said 22V Research analyst Gerard MacDonell in a recent note.

This concentration means that rising stock prices disproportionately benefit the wealthy—and may continue driving spending and confidence at the top, even if economic conditions weaken elsewhere.

“If you want to worry about the cycle, I would worry mostly about things that affect rich people and their behavior,” MacDonell added.

Cracks Emerge In Subprime And Private Equity

On Main Street, the picture is far less rosy. The widening gulf between Wall Street and Main Street just claimed a major casualty.

First Brands Group, the auto-parts maker behind names like FRAM and Raybestos, filed for bankruptcy in September with $10 billion in debt—another sign that the low-income slice of the economy is under acute stress.

First Brands’ business model was heavily geared toward lower-income drivers—those who repair aging cars instead of replacing them. As inflation squeezed budgets and pandemic-era health care subsidies rolled off, those drivers pulled back on maintenance spending.

The fallout of First Brands was a wake-up call for private equity investors.

Firms like KKR Inc. (NYSE:KKR), Blackstone Inc. (NYSE:BX) and Apollo Global Management Inc. (NYSE:APO) have seen their shares sharply underperform the S&P 500 in recent weeks as fears grow over the exposure to consumer-facing, low-income-leveraged companies.

Hartnett at Bank of America notes that private equity stocks are trading close to their 2022 relative lows compared to the broader index.

Bottom Line

The U.S. economy is increasingly bifurcated. On one side, asset holders and high-income earners are enjoying a historic wealth surge. On the other, job growth is slowing, wage gains are uneven, and credit pressures are rising for lower-income Americans.

For now, equity markets are betting that these fractures won’t spread. But in a K-shaped recovery, fortunes depend more than ever on where you fall on the curve.

Read now:

Trump’s Tariffs Remain Fed’s Biggest Risks To Rate Cuts, Minutes Say

Photo: Shutterstock