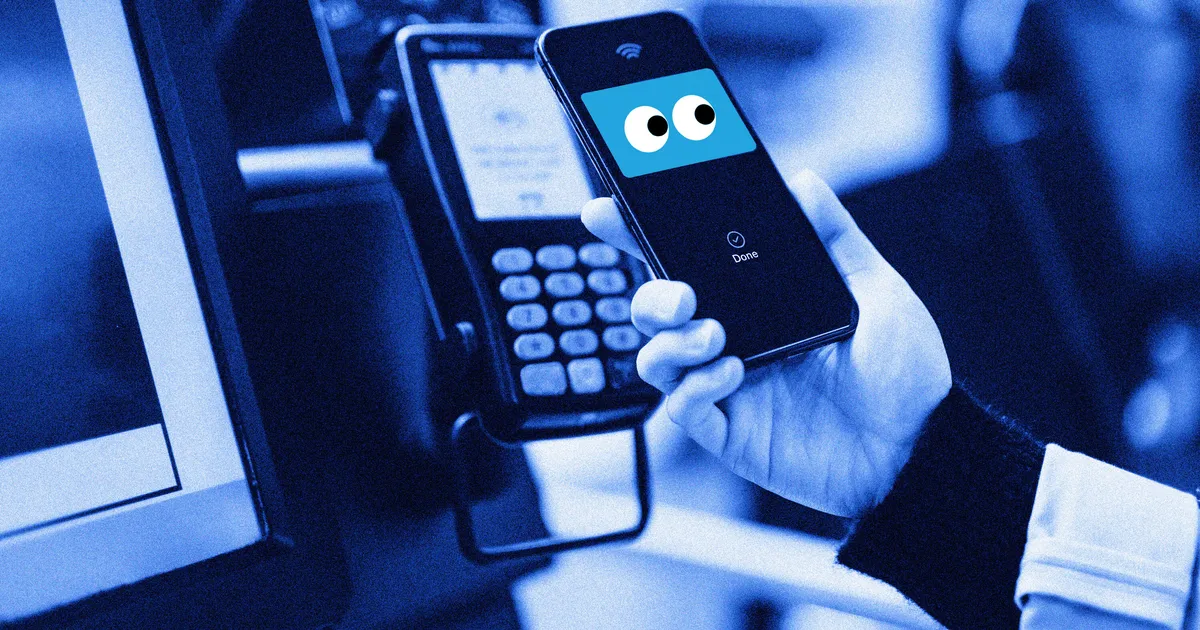

Copyright HuffPost

Tapping your phone to pay has become a common and easy way to purchase treats and gifts –– but it could also be a hidden way for fraudsters to scam you out of money. That’s because some scammers might be “ghost tapping” and taking advantage of the tap-to-pay and mobile wallet technology when you buy goods on the street, according to a new alert by the Better Business Bureau, a nonprofit that tracks bad advertisements and customer complaints in North America. In the scam reports, people say they unwittingly thought they were tapping to pay for legitimate purchases, only to later see they were being overcharged hundreds, and in some cases, thousands, of dollars. Advertisement In Illinois, a young man with a clipboard claimed that he was raising money for funeral expenses for a family member who had been shot and killed, according to one BBB report. “I said I could donate $5...I handed my credit card to one of the men, who took my credit card and attempted tap-to-pay on his phone,” the victim recalled. “The interaction felt off to me, so I immediately checked my credit card accounts which both showed multiple charges for $2,496 each to a PayPal account.” Advertisement In the reports, scammers would avoid showing buyers what they were tapping for on the mobile pay terminals. That’s why asking to see the screen “to see exactly what’s happening is a great way to protect yourself,” said Melanie McGovern, the BBB’s director of public relations and social media. ‘Ghost Tapping’ Is Rare, But It’s A Good Reminder To Be On Guard Don’t be scared to use tap-to-pay at legitimate vendors. To put this alarming scam in perspective, McGovern said her organization has only gotten less than 10 reports of “ghost tapping” so far. But she is concerned there could be more instances during the holiday season. During holiday craft fairs, “people have the great convenience of tap-to-pay,” she said. “So...it’s always good to make sure that you’re protecting yourself and you know exactly how much you’ve spent.” Advertisement Although it is technically possible for a scammer to “ghost tap” and use your phone’s tap-to-pay feature without you tapping, it would be highly unusual for this to happen without your knowledge. That’s because the near field communication that powers tap-to-pay technology requires a distance of four centimeters or less. “That’s essentially the length of a paper clip,” said Michael Jabbara, senior vice president and head of payment ecosystem risk and control at Visa. “If you have any awareness of your personal space, if somebody is getting to you within that distance, you are going to kind of be aware of that, and you’re likely going to move away.“ But the idea of “ghost tapping” is a good reminder to always be alert to what’s happening on your credit cards that you upload to your phone. Advertisement Scammers “rely on the victims to not check their bank accounts until the end of the month or two months later,” Jabbara said. “My recommendation is always to do your research ahead of time, versus when you’re dealing with a [credit card] dispute.” There’s An Easy Way To Combat Online Fraud If you do lose money to this kind of scam, you can dispute a charge or file a consumer complaint with your local attorney general’s office. But one of the best ways to combat “ghost tapping” ― or any kind of online payment fraud ― is to prevent it. Be vigilant about what is being charged to your phone, and by whom. Here’s how: Advertisement Turn on credit card transaction alerts. Many fraudulent charges will get flagged before being approved by your credit card’s risk signals. But even if somehow that transaction gets approved, “You have the ability to turn on your transaction alerts that can be a ‘first line of defense’ against fraud,” Jabbara said. That way, you can immediately know if your card made a transaction for a merchant name you don’t recognize for an amount that you wouldn’t have approved. Always ask for a receipt. Receipts are helpful proof of purchase if you need to later dispute a charge with your bank or credit card company. Advertisement And it’s also a good way to suss out a scammer. McGovern said a vendor telling you “I can’t give you a receipt. [My pay terminal is] broken” is a red flag that someone is scamming you.