Copyright Benzinga

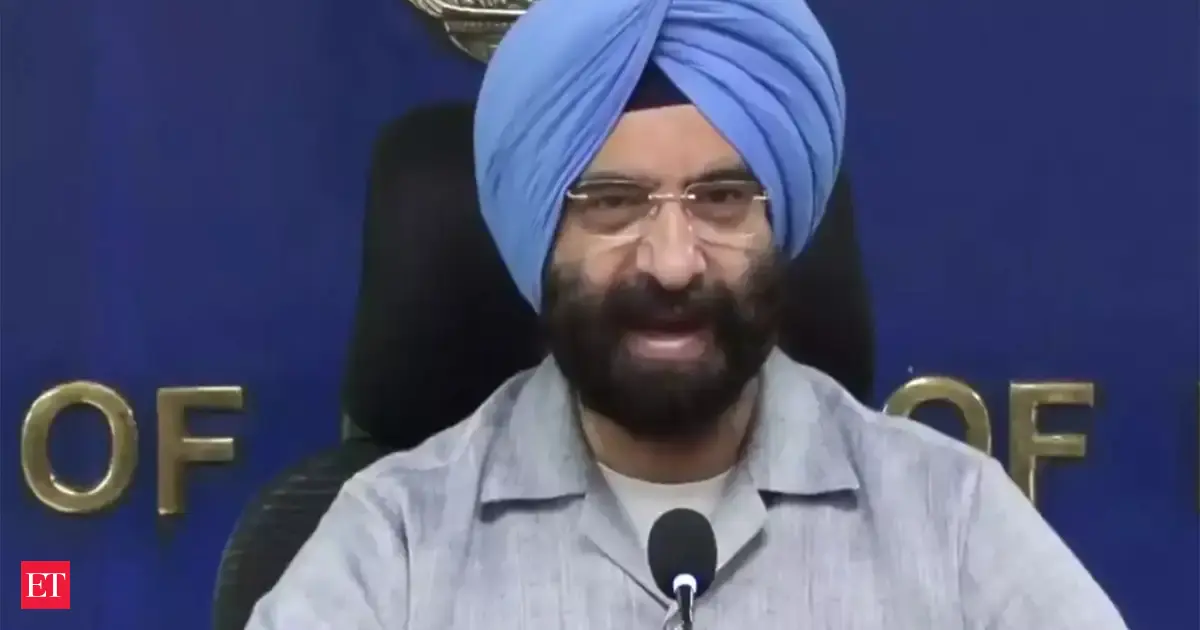

Builders FirstSource (NYSE:BLDR) shares rose Thursday after the company reported better-than-expected third-quarter results that topped Wall Street estimates, but the stock has since given up its earlier gains. The company posted quarterly adjusted earnings of $1.88 per share, exceeding Wall Street expectations of $1.64, though down 38.8% from a year earlier. Revenue for the quarter came in at $3.94 billion, narrowly above analysts' forecast of $3.85 billion, but still 6.9% lower than the same quarter last year. Also Read: What’s Going On With Builders FirstSource Stock Today? Gross profit margin fell 240 basis points to 30.4%, weighed down by a below-normal housing starts environment. While adjusted EBITDA margin declined 380 basis points year over year to 11.0%, reflecting lower gross profit margins and reduced operating leverage. Core organic sales down 10.6% year-over-year. Single-family sales fell 12.1%, multi-family dropped 20.2%, and repair and remodel/other declined 1.2%, mainly driven by lower housing starts and market demand. By product category, value-added products such as manufactured components and windows, doors, and millwork declined 11.6% to $1.86 billion, while specialty building products and services rose 3.6% to $1.09 billion, partially offsetting declines in lumber and sheet goods, which was down 7.9%. Builders FirstSource generated $547.7 million in operating cash and used $102.5 million in investing, resulting in free cash flow of $464.9 million, down from $634.7 million a year earlier on lower net income. As of September 30, 2025, Builders FirstSource reported liquidity of about $2.1 billion, comprising $1.8 billion in net borrowing capacity under its revolving credit facility and $300 million in cash on hand. Year-to-date, Builders FirstSource has repurchased 3.4 million shares of its common stock at an average price of $118.65 per share, for a total of $403.6 million, including fees and taxes. Since initiating its share repurchase program in August 2021, the company has repurchased 99.3 million shares, or 48.1% of its total outstanding stock, at an average price of $80.90 per share, for a total cost of $8.0 billion, inclusive of fees and taxes. Year to date, the company has achieved about $33 million in productivity savings and expects to generate an additional $45 million to $60 million in savings for full-year 2025. Outlook Builders FirstSource expects full-year 2025 sales between $15.1 billion and $15.4 billion, compared with analysts' estimate of $15.30 billion. The company also expects its gross profit margin to range between 30.1% and 30.5%, and adjusted EBITDA margin to range between 10.6% and 11.1% for the full year. CEO Commentary Peter Jackson, CEO of Builders FirstSource, commented, “Our third quarter results reflect the strength of our strategy and disciplined execution in a weak housing market. Over the past several years, we have transformed into a stronger organization powered by our leading network of value-added solutions, a relentless focus on operational excellence, and capital deployment.” Price Action: BLDR shares were trading higher by 2.94% to $111.90 at last check Thursday. Read Next: Why Is Shake Shack Stock Gaining Today? Photo by Ken Wolter via Shutterstock