By Ettech Last Updated

Copyright indiatimes

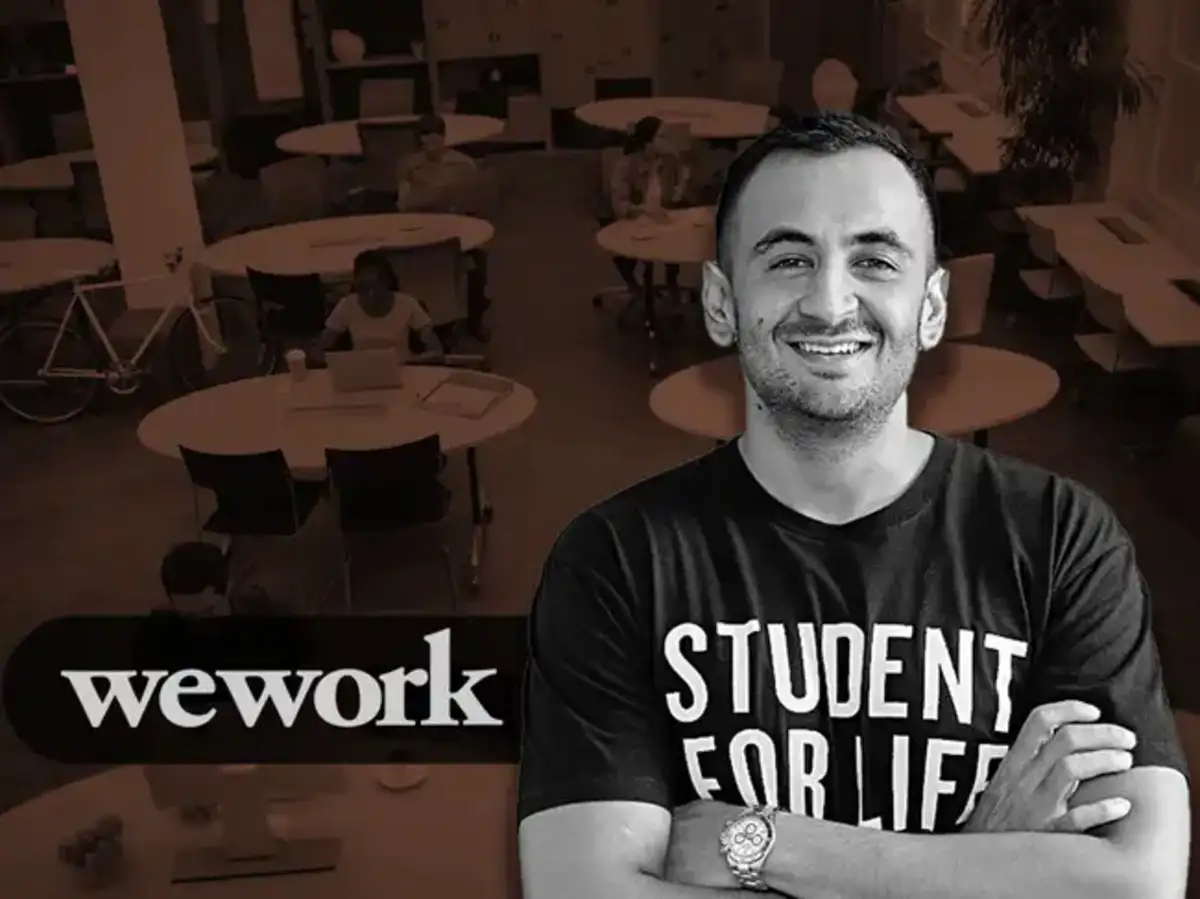

Flexible workspace provider WeWork India has set a price band of Rs 615-648 per share for its initial public offering (IPO). The issue, comprising only an offer for sale of 46.2 million shares, is expected to raise up to Rs 3,000 crore at the upper end of the band.The IPO will see its promoter Embassy Group, a Bengaluru-based real estate firm, offload up to 35.4 million shares, while 1 Ariel Way Tenant, a subsidiary of WeWork Global, will sell up to 10.8 million shares.The IPO will be open from October 3-7, with an anchor round on October 1.“Over the last eight years, we’ve really grown the business and been through a lot of ups and downs, and a lot of headwinds that the industry and the businesses face. But gratefully, we’re able to have grown the business now to a point where it’s completely self-sustaining,” Karan Virwani, founder and managing director of WeWork India, told ET. “We are operating about 8 million square feet of space today, and we see the kind of demand and the traction that both the business and the sector are seeing is immense.”The IPO follows the collapse of WeWork’s plan to sell its 27% stake in the Indian arm and exit the country in September 2024 due to a valuation mismatch, even after clearance from the Competition Commission of India. Embassy Group currently owns 73%.Following the listing, Embassy Group will hold around 50%, while WeWork Global, through 1 Ariel Way Tenant, will retain about 15%, according to the red herring prospectus.On the failed deal, Virwani said, “That was a deal that was supposed to happen at a moment in time before WeWork Global went into bankruptcy when they required cash. Today, they’ve come out of bankruptcy, and don’t require a large disinvestment or anything like that. Also, the deal just a year back was at a far lower value. Today, we’re listing at a much higher value and maybe it was just meant to happen.”For 2024-25, the company reported operating revenue of Rs 1,949.2 crore, a 17.06% increase year-on-year.JM Financial, ICICI Securities, Jefferies India, Kotak Mahindra Capital and 360 ONE are the book-running lead managers for the issue.