Copyright The Hollywood Reporter

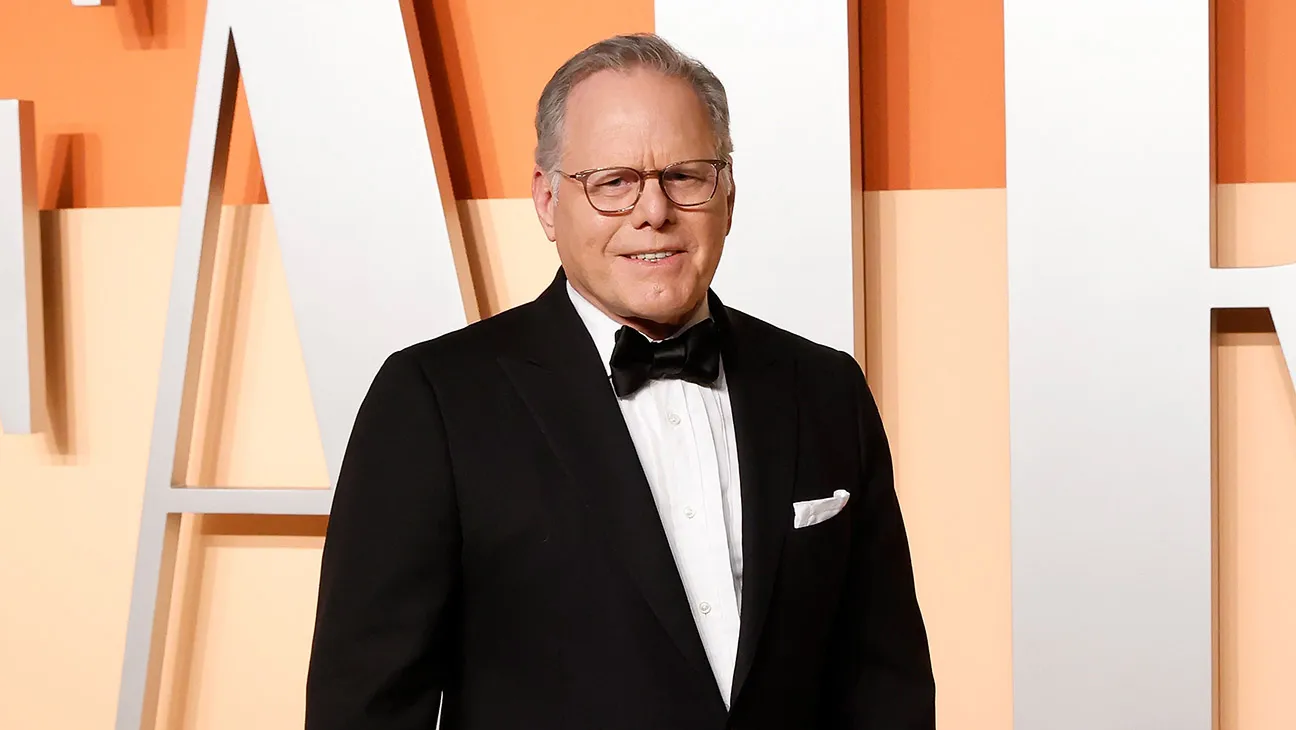

Shares of Warner Bros. Discovery (WBD) popped on Tuesday, hitting a 52-week high after the entertainment conglomerate said that its board of directors has launched “a review of strategic alternatives to maximize shareholder value.” The news came after weeks of deal chatter surrounding the Hollywood giant, led by CEO David Zaslav and just ahead of Netflix’s third-quarter earnings report. Netflix’s stock hit a 52-week high of $20.58 in early trading. As of 1:15 p.m. ET, the stock was up 10.8 percent at $20.29. Citing “unsolicited interest” from “multiple” parties, WBD said the options include continuing with the its planned split and spin, a “transaction for the entire company” and “separate transactions for its Warner Bros. and/or Discovery Global businesses.” Plus, it mentioned the option of “an alternative separation structure that would enable a merger of Warner Bros. and spin-off of Discovery Global to our shareholders.” The company indicated that there was no timeline for the strategic review. Said Zaslav: “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market.” TD Cowen analyst Doug Creutz, in a reaction note, shared: “We view the announcement from the company as a formality as news reports had already indicated that the company was already in discussions with multiple parties.” His take on what is likely to happen on the deal front: “We continue to think a transaction with Paramount Skydance is reasonably likely,” Creutz concluded. “We are more skeptical that other, more attractive bidders will emerge.” The analyst has a “hold” rating with a $14 stock price target on the company’s shares. Benchmark analyst Matthew Harrigan boosted his stock price target on WBD from $18 to $25 following Tuesday’s announcement. “Even with [the] morning’s around 10 percent price advance, WBD stock has a plausible sustainable higher single-digit or better free cash flow yield post 2025,” he concluded. “The higher $25 valuation simply reflects pushing realization to 2026.” He and his colleague Daniel Kurnos are bullish that David Ellison’s Paramount Skydance can walk away with WBD. “Although Larry Ellison may have qualms about supporting a further Paramount Skydance ‘old media’ acquisition under the mantle of his son, both Benchmark analysts following the respective companies feel this prospective combination offers the best strategic value in tandem with high likelihood for regulatory approval,” Harrigan wrote. “Apple, Amazon, and almost certainly Comcast would likely confront ‘transactional’ friction from the current Administration, while Netflix co-CEO Greg Peters has expressed disinterest.” And Harrigan sees benefits in a deal pre-WBD’s separation. “A nearer-term bid is likely less expensive than a post-separation takeout reflecting more Warner Bros. studio and HBO Max momentum, as well as a possible tax-driven further 12-month timing lag post-separation,” he explained. Earlier this month, Guggenheim analyst Michael Morris raised his WBD stock price target by $8 and stuck to his “buy” rating. “Investor discussion remains focused on the potential for a total company bid versus the planned 2026 business separation,” he wrote. And he concluded: “We see further consolidation as possible and anticipate investors will continue to consider asset value as a primary basis for share price targets. As such, we update our valuation approach to a sum-of-the-parts methodology, which yields a $22 12-month target versus $14 prior.”