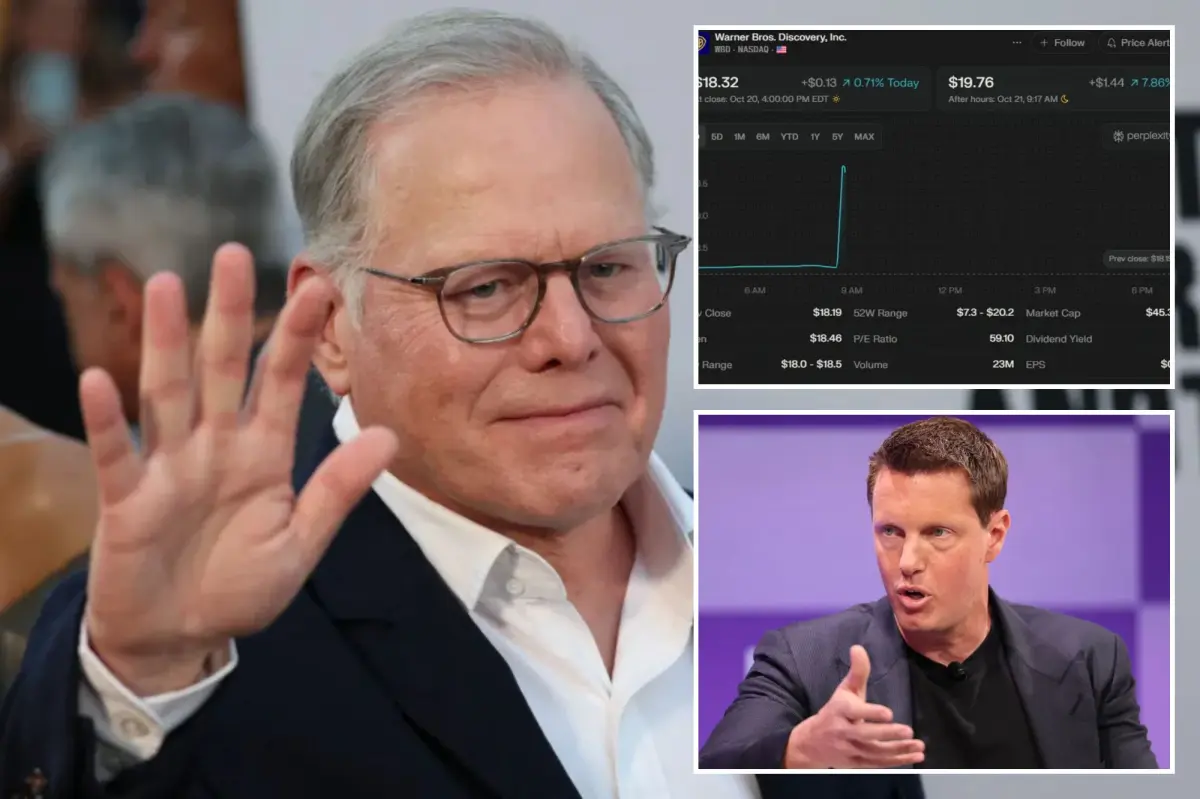

Copyright New York Post

Warner Bros. Discovery on Tuesday said it is open to a sale after receiving “unsolicited interest” from multiple parties — sending the media giant’s stock up more than 8% in early trading. The surprise announcement came as CEO David Zaslav expanded the company’s ongoing strategic review, confirming that the embattled entertainment giant will consider offers for all or part of the business. Zaslav said Warner Bros. Discovery, which owns HBO, CNN and the Warner Bros. studio, has been preparing to split into two companies next year — one housing its streaming and studio assets, and another for its global cable and networks division. But after buyout interest intensified, Zaslav said the company is now evaluating “all options” to maximize value for shareholders. “We took the bold step of preparing to separate the company into two distinct, leading media companies, Warner Bros. and Discovery Global, because we strongly believed this was the best path forward,” Zaslav said in a statement Tuesday. “It’s no surprise that the significant value of our portfolio is receiving increased recognition by others in the market.” He added that Warner Bros. Discovery has “initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.” The announcement confirmed weeks of rumblings across Hollywood and Wall Street that Zaslav could soon field formal takeover bids from a growing list of suitors, including Paramount Skydance chief David Ellison and cable powerhouse Comcast. Ellison, whose Skydance Media merged with Paramount Global this summer in an $8 billion deal, has been circling Warner Bros. Discovery for months. He has reportedly lined up financing partners such as Apollo Global Management and has weighed an offer valued between $50 billion and $60 billion, according to people familiar with the matter. Sources previously told The Post that Ellison is eyeing a more aggressive move after learning that Comcast’s Brian Roberts may enter the fray once his company completes the spinoff of its Versant cable assets. That restructuring will leave Comcast with NBC, Universal Studios, Peacock and Xfinity — and a cleaner balance sheet to pursue a blockbuster deal. Ellison’s bid is backed in part by his father, Oracle co-founder Larry Ellison, whose estimated $400 billion fortune could give the younger Ellison an edge in a bidding war. But the 42-year-old media mogul is still believed to be weighing whether to go public with a formal offer after months of informal feelers. Zaslav has so far resisted Ellison’s initial overtures, calling his rumored $20-a-share price “lowball” and signaling he would demand closer to $30 a share — or roughly $60 billion — for a full sale, according to sources who spoke to The Post earlier this month. The Warner Bros. Discovery boss has told associates he is confident the company’s post-split studio and streaming arm could fetch that valuation on its own, especially given the recent profitability of its Max streaming platform and a string of box-office hits. Zaslav’s decision also follows weeks of internal restructuring at WBD, where executives have been working toward the May 2026 spinoff that would separate its faster-growing assets from the debt-laden cable division. The company’s $30 billion debt load has weighed heavily on its share price, which had been hovering around $18 before Tuesday’s rally. Analysts at Wells Fargo predicted last week that Ellison could soon go public with a “low $20s per share” hostile offer. The Post has sought comment from WBD, Paramount Skydance and Comcast.