Copyright forbes

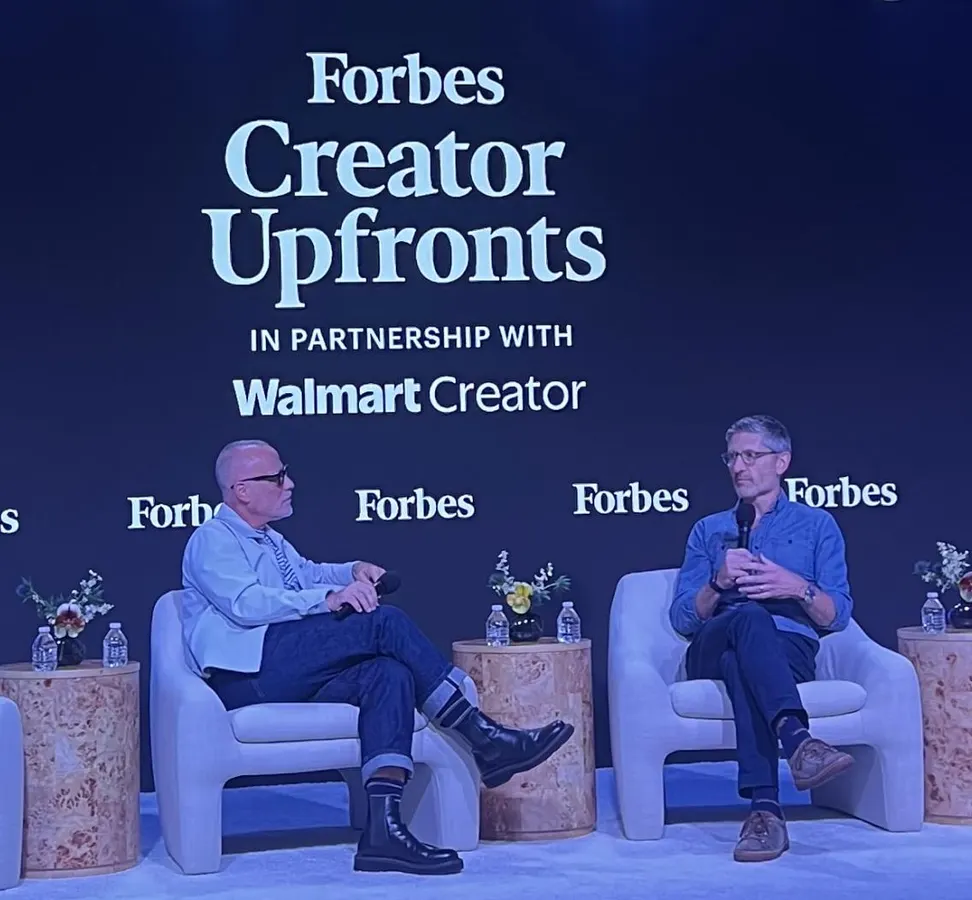

Affiliate Marketing’s Evolution Into Creator Commerce Creator commerce has evolved into a trillion-dollar force reshaping retail. While traditional retail faces headwinds, creator commerce is experiencing rapid growth. Three companies - a retailer, a platform, and a luxury brand - demonstrate the breadth of opportunity: Walmart, the world’s largest retailer, has invested in infrastructure to turn thousands of creators into a core sales channel. LTK operates a $6 billion business that provides retailers with a third growth engine beyond their stores and their own websites. And ShopMy, recently valued at $1.5 billion, is building the system that connects luxury brands to curated discovery. Walmart CMO William White joined Forbes’ Seth Matlins at as the presenting sponsor for the Second Annual Forbes Creator Upfronts to discuss how the retailer is turning its massive scale into a creator-powered commerce engine How Walmart Is Turning Creators Into a Core Sales Channel Walmart’s commitment to creator commerce was on full display at the second annual Forbes Creator Upfronts in Los Angeles. Chief Marketing Officer William White, in conversation with Seth Matlins, Managing Director of the Forbes CMO Network, explained why Walmart is investing heavily in creators. “Creators really are becoming one of the most trusted points of sale in retail,” White said. Walmart’s scale turns that trust into a competitive advantage. The company operates nearly 10,750 stores and clubs across 19 countries, serving 255 million customers weekly. With the ability to deliver within one hour to 95 percent of the country, Walmart gives creators and shoppers something no other platform can: immediate access from discovery to delivery. Launched in 2022, the Walmart Creator Program enables influencers to run businesses within Walmart’s ecosystem: discovering products, tracking sales, and building custom storefronts. White outlined two recent expansions shaped by creator feedback. The first is a bonus program that pays creators when they hit sales thresholds across Walmart’s general merchandise categories. This approach treats high performers as sales partners, not just commission-based affiliates. The second expands commission opportunities across both Walmart’s owned inventory and third-party marketplace sellers. The marketplace expansion is significant. Creators can now earn commissions from both Walmart and individual sellers, dramatically expanding their product selection and earning potential. MORE FOR YOU “We always say we’re people-led and tech-powered,” White said, describing how the company balances retail scale with creator-driven commerce. The strategy is working beyond Walmart’s traditional consumer base. “The majority of our recent share gains are coming from households with incomes over $100,000, which historically wasn’t our sweet spot,” White shared. “The changes we’ve made have given us more appeal to more people.” Why LTK’s $6 Billion Platform Solves Creator Commerce’s Biggest Challenge. While Walmart deepens its creator infrastructure, LTK has spent more than a decade building the connective tissue between creators and brands. Since launching in 2012, the platform has driven $6 billion in annual retail sales across 7,000 retailers, reaching approximately 30 percent of Gen Z and millennial women. The company identified the challenge limiting growth: visibility, not budget. Research from LTK and Northwestern University shows 97 percent of CMOs plan to increase creator budgets in 2026, naming creators their top investment priority. But algorithmic feeds now limit creator reach. On average, fewer than 20 percent of followers see a creator’s posts. “The constraint isn’t budget,” said Amber Venz Box, Co-Founder and President of LTK. “It’s visibility. Algorithmic feeds actually decide who sees what.” That visibility gap challenges the foundation of how creator marketing works. When creators can’t reliably reach their own audiences on social platforms, brands lose creators’ most valuable asset: consistent access to engaged fan communities. LTK solves this by providing creators with a destination platform where followers actively choose to view their content, rather than relying on algorithms to decide. However, LTK also recognized that brands faced their own barrier: expensive and fragmented tools. The company’s response was to eliminate subscription fees. Brands now get free access to identify creators, launch campaigns, manage gifting at scale, and track performance across LTK and external channels. “You’re not paying for access, you’re paying for success,” Venz Box said. LTK earns commission on transactions instead of charging upfront. The model is working. One in five searches on LTK includes a brand name - consumers know what they want and are ready to buy. The velocity tells the story: LTK creators post Abercrombie content nearly once every minute. Consumers shop a Nordstrom product almost three times per second. They shop Ulta Beauty products every three seconds Brands want in. Nearly 600 are on the waitlist to launch their platform profiles, joining Abercrombie, Nike, Nordstrom, Williams Sonoma, Reformation, Sephora, Ulta Beauty, Zara, and others who are already active. LTK is the global digital shopping platform that connects brands, creators and consumers and drives over $6B in revenue ShopMy’s $70 Million Bet on Curated Creator Commerce ShopMy’s $70 million funding round this month, which brings its valuation to $1.5 billion, signals investor confidence in the premium segment of creator commerce. Led by Avenir with participation from Bain Capital Ventures, Bessemer Venture Partners, and Menlo Ventures, the round validates a bet on curation over algorithms. Founded in 2020, ShopMy has built infrastructure connecting premium brands to culture-driving creators through professional-grade tools and performance data. The company has surpassed $1 billion in annual platform sales, partnering with more than 1,200 premium brands, including Gucci, Net-a-Porter, West Elm, and Therabody, alongside over 185,000 creators. ShopMy, the curated commerce infrastructure for Premium brands recently announced a new raise of $70M based on a $1.5Billion valuation. “ShopMy is fundamentally a bet on authenticity, that lasting brand value comes through curation and taste, not ads and algorithmic recommendations,” said Harry Rein, Co-Founder and CEO. The company’s recent consumer expansion introduced a new feature, “Circles,” allowing users to follow multiple trusted curators simultaneously, combining personalized discovery with sales performance tracking. It’s a direct answer to algorithmic fatigue: let people choose whose taste they trust rather than allowing platforms to decide what they see. “Word of mouth has always been the most powerful force in commerce,” added Tiffany Lopinsky, Co-Founder and President. “We’re building the infrastructure to make it scalable.” The Takeaway: The Future of Retail Belongs to Creator Partnerships The future belongs to retailers that treat creators as strategic business partners. Walmart, LTK, and ShopMy approach the opportunity differently, but share a core belief: growth comes from integrating creators directly into the business model. Performance is increasingly driven by trust, not reach, as William White shared, “The creators that work best for us are not necessarily the biggest ones. They are the ones that have the most loyal followings.” That mindset is redefining how retail operates, powered by people as much as technology. The companies that build stronger links between story and sale will shape what—and how—the world buys next. Editorial StandardsReprints & Permissions