Copyright Reuters

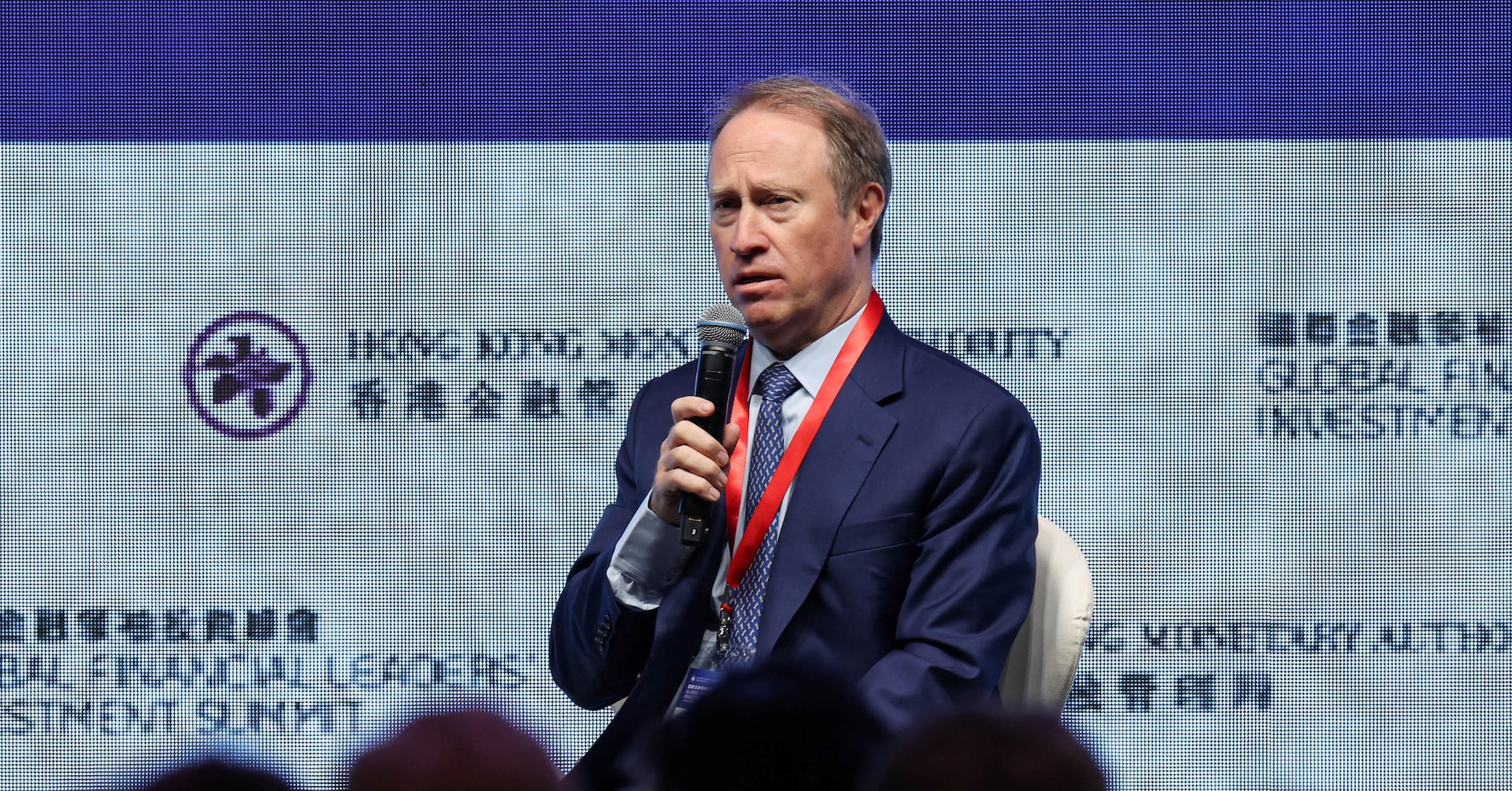

HONG KONG, Nov 5 (Reuters Breakingviews) - A sense of relief permeated Hong Kong’s annual gathering of Global Financial Leaders, opens new tab this week as a truce in the Sino-American trade war and a rebound in Chinese equities set a relaxed tone for discussions. An impressive roster of executives, including Carlyle (CG.O), opens new tab CEO Harvey Schwartz and Macquarie (MQG.AX), opens new tab CEO Shemara Wikramanayake, convened at the Rosewood hotel - recently crowned the world's best - to discuss global trade, private markets and energy. At a dinner the night before, delegates watched a robot demonstrate boxing and were introduced to the city's most extreme trail runners. Yet even as the mood in Hong Kong brightens, the opportunity for global firms is shifting. Four years ago when the city’s de-facto central bank hosted its inaugural summit, the goal was to signal Hong Kong was back open for business. At the time, the COVID pandemic had isolated the territory and local protests sowed doubt over its future as a global financial centre. Many even doubted Beijing’s own support for Hong Kong. The threat of the U.S. turning financial weapons it had aimed at Russia on China also led to questions about the feasibility of Wall Street maintaining its presence in the People’s Republic. Sign up here. Now that the prospect of full financial decoupling has receded a bit, visiting executives did not need to tiptoe around the topic of China. Brookfield (BN.TO), opens new tab CEO Bruce Flatt and Blackstone (BX.N), opens new tab COO Jon Gray even struck an optimistic tone on pockets of Hong Kong’s depressed real estate. And a line-up of Chinese officials re-iterated the motherland's determination to strengthen the financial centre, including through measures to boost offshore yuan liquidity in Hong Kong. Eddie Yue, CEO of the Hong Kong Monetary Authority, also had plenty to tout to international investors who have pulled out funds: so far this year, China’s CSI 300 Index (.CSI300), opens new tab is up by a nearly a fifth, while Hong Kong’s Hang Seng Index (.HSI), opens new tab is one of the world's top performers with a 28% gain. Not that leaders like Morgan Stanley (MS.N), opens new tab CEO Ted Pick, his counterpart at Goldman Sachs (GS.N), opens new tab David Solomon and UBS (UBSG.S), opens new tab Chair Colm Kelleher needed extra reasons to convene. For banks and fund managers, the HKMA is a heavyweight client distributing lucrative mandates as custodian of Hong Kong’s HK$4.3 trillion ($554 billion) Exchange Fund. The question is no longer whether U.S. financial firms can maintain their presence in China, but how much business they can continue to capture. Despite the geopolitical tensions, Wall Street has not retreated: cross-border claims on Chinese residents by American banks are close to an all-time high, according to data, opens new tab from the Bank for International Settlements. This captures loans by U.S. banks to Chinese borrowers -- and to their own Chinese subsidiaries. Ultimately, the fortunes of Hong Kong - a gateway between global investors and mainland markets – remain deeply tied to those of China, whose economy is grappling with deflationary pressures, its own prolonged property crisis and sluggish consumption. The International Monetary Fund expects, opens new tab China’s GDP growth will slow to 4.2% next year, down from 4.8% this year. This is a problem. Offshore investment banking revenue from Chinese clients, though rebounding, remains below levels in the first seven years of the past decade, according to Dealogic. Rising global protectionism has curbed the ability of Chinese companies to acquire overseas assets. U.S. banks' share of that reduced offshore revenue has also shrunk to 39%, down from 45% in 2020, as Chinese banks gain in key businesses. However, overall Chinese investment banking fees are trending back up to 2021 levels, LSEG data shows. Equity capital markets have emerged as a bright spot, with BYD (002594.SZ), opens new tab, Xiaomi (1810.HK), opens new tab and Contemporary Amperex Technology (300750.SZ), opens new tab delivering three of the world’s five largest deals in the first half of the year. Total issuance is on track to approach $100 billion in 2025, approaching levels last seen in 2020 and 2021, according to Dealogic. Western banks — led this year by Morgan Stanley and Goldman Sachs, with UBS close behind—continue to dominate the league tables. Yet here too there is change. While Hong Kong is holding the global crown for new listings, the debuts are dominated by Chinese firms whose shares already trade on New York or mainland bourses. Secondary listings – which typically generate lower fees and favour domestic advisers – now account for the majority. CITIC Securities (600030.SS), opens new tab has sponsored 29% of new listings so far this year, up from 8% in 2021 and just 5% a decade ago. And even if Hong Kong makes progress in attracting non-Chinese issuers, Western banks may be sidelined there too. Take Dubai-headquartered Softcare (2698.HK), opens new tab, which sells diapers across Africa, Latin America and Central Asia: its planned $300 million offering is backed exclusively by Chinese sponsors -- CITIC, CICC and GF Capital – leaving little room for international players. Despite this shift of power, Zhang Hui, vice chair and president of Bank of China (601988.SS), opens new tab, was the only prominent executive from the domestic competition on the programme of the first full day of the summit. Of course, China still matters greatly to global banks. It accounts for 63% of Asia Pacific ex-Japan investment banking fees, according to LSEG data, and such rankings only capture part of the business opportunity. U.S. heavyweights like Citigroup (C.N), opens new tab and JPMorgan (JPM.N), opens new tab provide global companies operating in China with hedging, corporate banking, cash management and trade finance services. Banks also still rely heavily on people in Hong Kong to service their operations in other parts of Asia. Meanwhile, wealth management will continue to grow in importance with Hong Kong expecting to become the world's largest centre in the coming years. If Hong Kong can broaden its appeal beyond China -- and if Chinese firms can win more global acceptance -- Western financial firms could enjoy a proper resurgence. For now, Hong Kong is settling into a new normal that may offer them fewer, less lucrative opportunities. Follow Una Galani on Linkedin, opens new tab and X, opens new tab. Context News For more insights like these, click here, opens new tab to try Breakingviews for free. Editing by Antony Currie; Production by Aditya Srivastav Breakingviews Reuters Breakingviews is the world's leading source of agenda-setting financial insight. As the Reuters brand for financial commentary, we dissect the big business and economic stories as they break around the world every day. A global team of about 30 correspondents in New York, London, Hong Kong and other major cities provides expert analysis in real time. Sign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com. All opinions expressed are those of the authors. Una Galani is Asia Editor of Reuters Breakingviews, based in Hong Kong, overseeing a team of columnists across the region. She was previously in London, Dubai and Mumbai. Breakingviews is the global financial commentary brand of Reuters delivering agenda-setting insight in real time on the most important events impacting global markets and companies.