Copyright euroweeklynews

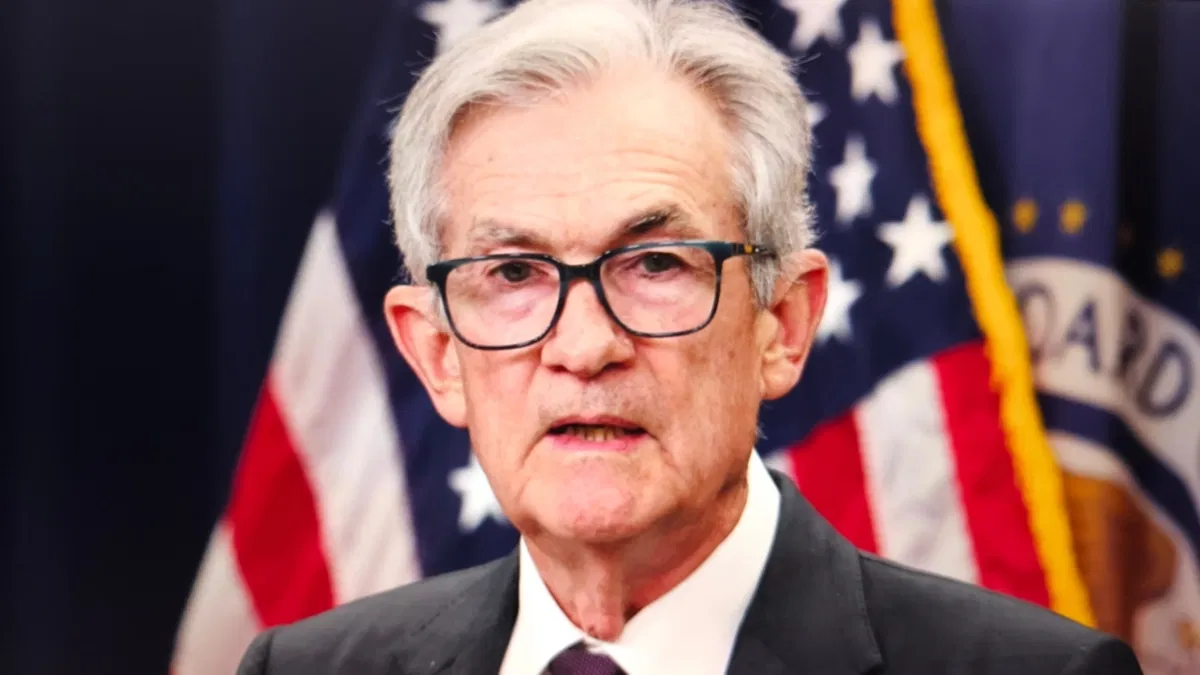

The US Federal Reserve has lowered its benchmark interest rate by 0.25 points to 3.75–4 per cent and said it will end balance-sheet runoff on December 1, according to the official Federal Reserve statement. Chair Jerome Powell said a further cut in December is “far from guaranteed”, cited by Reuters, a remark that tempered market hopes of rapid easing. What the Fed changed – and why it matters for Europe The Fed’s decision lowered the federal funds target range and set a halt to quantitative tightening (QT) from December 1, citing the need to keep bank reserves “ample”, reported by Reuters. Markets initially pulled back, and the US dollar strengthened as Powell downplayed the odds of another cut in December, cited by Reuters markets coverage. For UK expats in Spain, the direct link to borrowing costs comes through the euro area, not the US. Most variable-rate Spanish mortgages follow the 12-month Euribor, which closely mirrors European Central Bank (ECB) policy and euro-money-market conditions. You can find more information on this via the Bank of Spain. Mortgages, credit, and savings in Spain Spanish mortgages (Euribor-linked): The Fed cut does not automatically lower Euribor. Any sustained easing in your mortgage rate depends on ECB decisions and euro-money-market moves. You can find more information on this via the Bank of Spain. Cards, personal loans and business credit: In the US, Fed moves influence the prime rate quickly; in Spain, pricing responds more to Euribor and bank funding costs. The Fed’s halt to QT may help global liquidity, but the effect on European lending rates is indirect, cited by Reuters. Savings rates: Spanish savings yields remain tied to competition for deposits within the euro area and ECB policy, rather than the US Fed. Current official rates are listed by the European Central Bank. Sterling, euro, and the dollar Powell’s remarks prompted a stronger US dollar immediately after the meeting. When the dollar rises, the euro often weakens, and that shift can spill over to GBP/EUR exchange rates – important for expats transferring UK income or pensions to Spain, cited by Reuters global markets wrap. A firmer dollar can weaken the euro, which may improve GBP/EUR transfer rates in the short term. View all finance news. View all USA news.