One of the world’s main number crunchers released its latest economic report on Tuesday. But the middling forecast from the International Monetary Fund doesn’t begin to capture the helter-skelter ride the global economy is on.

Even as the I.M.F. was preparing its report, a flurry of developments were already altering the picture. New U.S. tariffs on imported wood, furniture and kitchen cabinets that are expected to drive up the cost of home building took effect on Tuesday. So did the opening round of higher port entry fees that China and the United States will impose on each other’s vessels.

Tuesday’s turn of the trade wheel was just one click in a series of repercussions set in motion by President Trump’s vow to smash the world’s economic order. More will follow.

Last week, Beijing decided to sharply step up curbs on its export of rare earth metals, materials that are essential for the manufacturing of semiconductors, cellphones, wind turbines and nearly every other modern gadget. New restrictions on equipment needed to produce batteries for electric cars are also scheduled to take effect next month.

“The U.S.-China relationship is highly volatile,” said Richard Portes, a professor at the London Business School. “One doesn’t really know what to expect from one day to the next, and that is typical of the current administration.”

The souped up tension between the two economic superpowers is catching other countries — that is, almost every country — in the crossfire. China’s restrictions on metals and magnets, for instance, would affect European automakers who use those materials and ship them across borders within Europe. And the levies on ships made in China apply even to non-Chinese shipping companies stopping at American ports.

On Tuesday, the Chinese government ratcheted up the retaliation by adding five American subsidiaries of the South Korean shipping company Hanwha to its sanctions list, accusing the subsidiaries of “supporting and assisting” the United States in its moves in the shipbuilding industry.

Beijing and Washington are also essentially pressuring nations around the globe to take sides. Mexico, one of the world’s biggest buyers of Chinese cars, proposed a 50 percent tariff last month on those vehicles after heavy lobbying from the Trump administration.

India, meanwhile, has moved closer to China since the White House, piqued by New Delhi’s continued purchase of Russian oil, imposed tariffs up to 50 percent on Indian goods. In August, Prime Minister Narendra Modi visited China for the first time in seven years to attend a security and economic conference — a public display by India’s leader that his country has plenty of allies should the Trump administration continue to single it out for punishment.

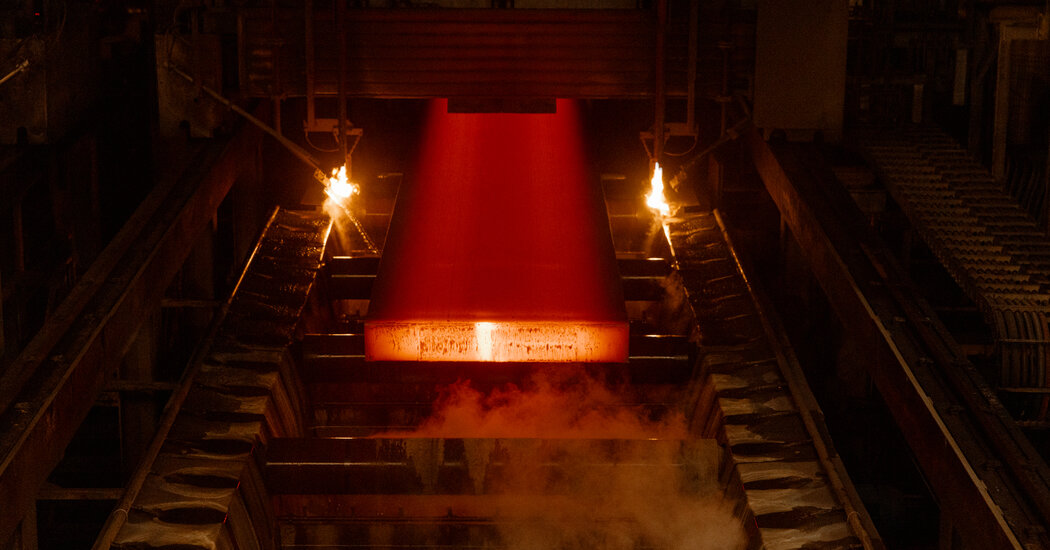

But the mood in Britain darkened considerably last week when the European Union announced its own set of punishing tariffs on steel imported into its 27-nation bloc. The policy delivered a gut punch to Britain’s steel industry, which sends nearly 80 percent of its exports to the European Union.

Britain, though, wasn’t the target of the policy — just a bystander to moves aimed at Beijing and Washington.

The 50 percent E.U. tariff was directed at China, which has been accused of dumping underpriced steel on the global market. The tax was also designed with an eye to putting the European Union in a better negotiating position with the United States.

“The Union is ready to work with like-minded countries with a view to ring-fencing their economies from global overcapacity,” the European Union’s executive arm said last week. “We will continue exploring ways of working together with the U.S.”

Despite the frequent swerves in trade policy, though, the global economy will remain highly integrated, said Lucrezia Reichlin, a professor at the London Business School, even as the center of gravity shifts toward Asia and away from the West.

For now, growth is slowing in both the United States and China, while a pervasive unpredictability characterizes the short- and long-term outlooks.

Mr. Portes at the London Business School summed up the dynamic between the world’s two largest economies: “China has stable, clear and determined objectives. The Trump administration changes from day to day, in its views and its policies.”

“The degree of uncertainty is huge,” he added, “and that has consequences for the global economy.”

Jeanna Smialek contributed reporting from Brussels.