Sanctions and tariffs have not only united China and Russia, but also the world against dollar dominance.

Our Biggest Miscalculation

Eurointelligence has an interesting article on Our Biggest Miscalculation. Let’s tune in.

The biggest geopolitical error of our decade has been the west’s attempt to isolate Russia and China at the same time, or to rephrase an old joke about Europe – to keep Russia out, and China down. The result of this error is that the China-Russia relationship is on course to become globally the most consequential alliance between any two powers – at a time when the western alliance is weakening.

The deepening China-Russia relationship does not show up with a bang, but it came in small steps: China delivering dual-use goods to Russia; China allowing grey market transactions in critical raw materials; the Brics payments system; last week’s summit at the Shanghai Cooperation Council, in which President Xi Jinping went out of his way to demonstrate China’s strategic alliance with Russia and North Korea. Joe Biden’s high-performance semiconductor ban has led to a burgeoning chip industry in China. China’s Cross-Border Interbank Payment System is nowadays used by 54% by Chinese companies, now outnumbering those that use the dollar-based Swift system, which is based on telegram communication, which is slower and carries much higher transaction charges.

The FT has a story that China is now opening its bond market to Russian energy companies that will now have access to so-called panda-bonds. US and European sanctions closed off Russia’s access to global capital markets in 2022. Initially, Chinese banks pulled rank, fearing secondary sanctions. But this has changed now, as China is well on the way to extricate itself from its dependency on US-dollar markets.

We have been warning about the side-effects of an overuse of financial sanctions, a mechanism we don’t think is fully understood by those who use them. US foreign policy makers discovered the use of dollar-based sanctions mechanisms, and turned them into a primary foreign policy tool. But they underestimated other country’s ability to create alternative infrastructures over time. We read a lot of comments from foreign policy experts, trying to belittle those efforts.

The dollar-based global infrastructure has allowed the US to wield exorbitant degrees of power, but this was critically dependent on these instruments staying in the background, rather than being actively deployed. There are some parallels with nuclear weapons – they are also not meant to be used as a primary defense instrument.

China’s Cross-Border Interbank Payment System

The Canadian government website notes Beijing creates its own global financial architecture as a tool for strategic rivalry

Note: This was published in May of 2018, updated in July of 2025.

China has created the Cross-Border Interbank Payment System (CIPS) to facilitate the use of the renminbi as an international trading currency. China thus makes its own trading and financial relationships more streamlined, reduces illicit transfers, and provides a level of protection from sanctions. The number of direct and indirect clearing banks enrolled in CIPS has climbed substantially within a short time. China hopes that as the system develops and increases the volume of renminbi transactions, the global dominance of the US dollar will decrease.

A financial backbone emerges

On 8 October 2015, China launched a new payments system—the Cross-Border Interbank Payment System (CIPS)—that uses China’s currency, the renminbi (RMB), for international transactions. Beijing also announced the creation of the China International Payment Service Corporation (CIPS Corp.) Limited to operate CIPS, CIPS Corp. is under the supervision of the central bank.

Statecraft and strategy

By facilitating and encouraging the increased international use of RMB, Beijing also lessens the supremacy of the US dollar, seeking de facto de-dollarization. In 2014 and 2015, the PRC also successfully lobbied International Monetary Fund (IMF) members to add the RMB to the basket of currencies that make up the IMF’s reserve management tool, the Special Drawing Rights (SDR). In October 2016, the RMB joined the SDR reserve basket along with the US dollar, the euro, the Japanese yen and the British pound. CIPS is Beijing’s effort to create new technologies and systems that support greater international use of RMB as well as the global rise and acceptance of the RMB through an improved international payments system.

Beijing is also concerned by the rising tide of US international financial sanctions. The PRC has observed how Russia, Iran, North Korea, Sudan and other states have been affected by these sanctions. It also remembers the US imposing trade embargos and financial sanctions on China during the Cold War. It is aware that certain governments pressure SWIFT to cooperate on the application of sanctions, and call upon it to block certain states from being able to use SWIFT to make payments. China is aware that Moscow, Tehran and other governments are keenly interested in creating or strengthening alternative international payment systems that can lessen the threat of US sanctions.

A fully operational CIPS, which reduces the PRC’s reliance on SWIFT, has a number of other advantages. Beijing is mindful of the fact that US and European banks dominate SWIFT’s governance and that their systems and networks are geared towards handling US dollars (SWIFT is perceived as playing an important role in maintaining the global dominance of the dollar). It is also concerned by the fact that US security and intelligence agencies looking to track international payments are allegedly able to access the system.

Let’s now discuss CIPS. Here are some AI generated snips.

China’s Cross-Border Interbank Payment System (CIPS) is a financial infrastructure launched in 2015 to clear and settle cross-border renminbi (RMB) transactions, facilitating the internationalization of the yuan. It connects banks worldwide for efficient, real-time yuan payments, offering an alternative to SWIFT for RMB transactions and aiming to reduce reliance on the US dollar. While CIPS is growing with more international participants, a significant portion of its transactions still rely on the SWIFT messaging system.

Complementary to SWIFT:While CIPS is designed to be a direct competitor in the long term, it currently utilizes the SWIFT network for messaging and some settlement processes, particularly for indirect participants.

Geopolitical Significance:CIPS is seen as part of China’s strategy to build its own global financial architecture, reduce its vulnerability to US financial sanctions, and lessen the dollar’s global dominance.

Growing Adoption in Asia and Africa:The system is seeing increased use in Asia and is expanding to other regions, such as Africa, as trade between China and these areas grows.

I have pooh-poohed a BRICS currency for decades. And I still do.

At the same time, however, I cautioned the key idea behind BRICS is not a trading currency, but a way to avoid sanctions.

That has come to fruition, not through BRICS, but rather through CIPS. It’s not yet complete because it still uses SWIFT for some functions.

Importantly, CIPS is used by 54 percent by Chinese companies, now outnumbering those that use the dollar-based Swift system.

Trump Punishes India with 50 Percent Tariffs for Buying Russian Oil

On August 27, I noted Trump Punishes India with 50 Percent Tariffs for Buying Russian Oil

Trump’s 50 percent tariffs on India start today.

On August 28, 2015, I commented Hoot of the Day: Trump Administration Accuses India of Arrogance

The most arrogant administration in history accuses India of arrogance over Russian oil imports.

Bullies Pick on the Weak

“It’s real easy, that India can get 25% off tomorrow if it stops buying Russian oil and helping to feed (Russia’s) war machine,” Navarro told Bloomberg Television.

What’s troubling to me is assh*les telling other nations who they can or cannot conduct business with, then accuse them of arrogance when they don’t obey arrogant commands.

China and the EU keep buying Russian oil, especially the former.

And Trump promised on numerous occasions that Russia would have “severe consequences” if it did not agree to a deal.

Instead, this is now “Modi’s war” in the administration’s biggest shift of irresponsible denial and lies regarding Russia.

Trump Admits Rift With India

Please note Trump Admits 50% Tariff on India Over Russian Oil “Caused a Rift” Between Nations

US President Donald Trump admitted that imposing a 50 per cent tariff on India for purchasing Russian oil has “caused a rift” between the two countries, acknowledging that such a decision was “not an easy thing to do.” Trump justified the measure as necessary to curb Russia’s finances, while Indian officials reiterated that their energy procurement follows national interests and market dynamics.

Tariffs, Tensions, and Official Statements

During an interview with Fox and Friends on Friday, Trump explained, “India was their biggest customer. I put a 50 per cent tariff on India because they’re buying oil from Russia. That’s not an easy thing to do. That’s a big deal, and it causes a rift with India.” He further noted that the issue impacts global relations, stating, “This is a Europe problem much more than our problem.”

Strategic Interests and Diplomatic Moves

India has roundly rejected claims that the tariffs are justified, labelling them “unfair, unjustified, and unreasonable.” Indian officials have underscored that decisions about energy imports are guided by sovereignty and the imperative to maintain affordable supplies for its population.

The tariff standoff comes as part of a broader set of US measures urging allies to restrict Russian oil trade, while India continues to prioritize its economic and energy security.

The Logical Indian’s Perspective

This latest round of tariffs highlights how trade policies and foreign relations intersect, often putting immediate political objectives ahead of long-term cooperation. Confrontation over energy choices risks undermining collaboration, prosperity, and mutual trust, especially when global stability is at stake.

The Logical Indian calls for leaders to prioritise respectful negotiations, inclusive dialogue, and solutions that safeguard the interests of all stakeholders.

India’s Agriculture

About 46 percent of India’s workforce works in agriculture.

This figure comes from the Economic Survey 2024-25 and reflects a slight increase from previous years, indicating a continued dependence on agriculture for employment.

Trump wants India to remove its agriculture tariffs. On this score, Trump is correct.

India’s average Most Favored Nation (MFN) tariff on agricultural goods was 39% as of March 2025, one of the highest among WTO members.

High duties protect the livelihoods of millions of small-scale Indian farmers from competition from cheaper, heavily subsidized foreign imports.

Two Political Realities of India Policy

Narendra Modi, Prime Minister of India, would not stay in office if he upset half the nation.

This is unfortunate because it is in India’s best interest to have more competition and lower the price of goods.

India Ironies

Trump is correct that India would be better off with no tariffs. But note the irony of “Tariff Man” putting tariffs on the whole world.

Trump has driven India closer to Russia and China, another huge miscalculation by Trump.

Trump’s tariffs and sanctions are systemically driving countries towards the two nations he wants to isolate.

Finally, Trump is shooting American taxpayers in the foot.

India’s tariffs raise costs on India’s consumers. Trump’s economically illiterate response to strike back with tariffs that will raise costs for US consumers and businesses.

Weaponization of Swift

Please consider the March 2022 post Richmond Fed article What Is SWIFT, and Could Sanctions Impact the U.S. Dollar’s Dominance?

The recent removal of Russian banks from the SWIFT messaging system has highlighted the importance of payments in supporting economies. But the weaponization of SWIFT has also left some commentators worrying about the loss of the U.S. dollar’s dominance, as it might drive banks and firms to other substitutes. This Economic Brief discusses the economics of SWIFT and explains why emigrating from the U.S. dollar may be more difficult than we thought.

The Richmond’s Fed’s assessment is self-serving. Yet, it appears accurate. Importantly the Fed even admits weaponization, the emphasis was mine.

Lessons of the Day

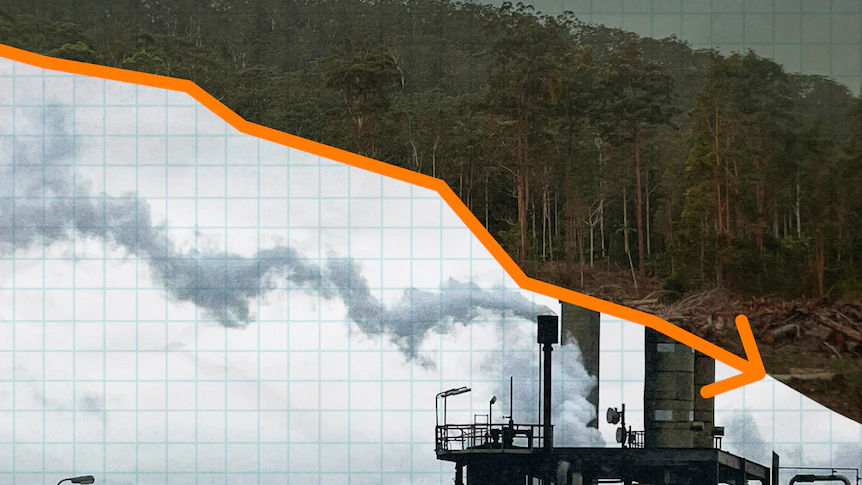

The more you depend on sanctions, the less they work.

That’s the real risk to the dollar.

I have discussed those lessons many times previously.

September 26, 2024: To Those Hard of Learning, Here’s a Repeat Lesson on Why Sanctions Fail

Let’s discuss a claim that sanction failures are due to a lack of political will.

September 19, 2023: Lesson of the Day: Sanctions Don’t Work Because They Create New Markets

A person who touted a buyer’s cartel sanction success, now complains the buyers cartel leaks like a sieve.

February 18, 2024: How China Gets Around US Sanctions on Semiconductors

US sanctions backfire again. China is stronger as a result.

Flashback Hoot

On April 13, 2022 I commented Janet Yellen Warns China on Russia and Creating a Bipolar Global Financial System

In a question and answer session, Yellen said that the United States needed to work hard with China to avoid a bipolar global financial system that pits democracies against autocratic countries.

What Does China Do With a Dollar That’s No Longer Risk Free?

In light of Fed actions against Russia, I pinged Michael Pettis at China Financial Markets some questions on China’s reserves on March 18, 2022.

Please consider my Pettis Q&A post What Does China Do With a Dollar That’s No Longer Risk Free? Buy Gold?

Q&A With Michael Pettis

Mish: Will China now hold more commodities and fewer dollars despite the pro-cyclical nature of it? More Euros or Yen over dollars? More gold?

Michael Pettis (emphasis mine):

1: “Given that so much of China’s “reserves” are now indirect and held by state-owned banks (all the increase since 2017) it’s hard to say what the currency composition of China’s reserves are.

2: “Officially the US dollar is still by far the biggest component, but it is slowly declining.

3: “I expect that this will continue as far as the official reserves go but, as you know, the hard part of reducing the US dollar component of your reserves is figuring out what the alternative should be, and with such high and growing reserves (once you include the indirect reserves at the state-owned banks) that is a very difficult question to resolve.”

Not Now Does Not Mean Never

The demise of the current US-dollar financial system with SWIFT at the heart of it is underway. I just cannot tell you when the system crumbles, nor can anyone else.

Although the dollar avoidance the BRICs seek is much easier said than done, not now doesn’t mean never. The recognition phase has started.

Most do not realize the EU is involved even though it wants no part of the BRIC structure. Importantly, the EU’s annoyance at SWIFT is far more significant than any yapping by Brazil.

So, don’t be surprised if something truly significant starts with the EU, not the BRICs. That’s an idea I have not seen anyone else suggest.

Trump has threatened BRICS nations with 100 percent tariffs if they create a competing currency.

A true BRICS currency still seems unlikely to me for reasons discussed many times.

For example, please consider More Gold Backed BRIC Currency Silliness on Dethroning the Dollar

However, SWIFT-avoidance is well underway and that will soon enough be a major success.

Even the EU is sick of US sanctions and may develop its own system.

Gold Has a Message

Meanwhile, gold has a strong message about sanctions, the dollar, tariffs, and other misguided policies of Trump.

For discussion, please see my September 2, 2025 post Gold Surges Above $3,600 to New Record High Despite a Rising Dollar

Gold does not believe the Fed is under control, Congress is under control, budget deficits are under control, and Trump is under control.

And neither do I.

This post originated on MishTalk.Com

Thanks for Tuning In!