By Mandy Zuo,Ralph Jennings

Copyright scmp

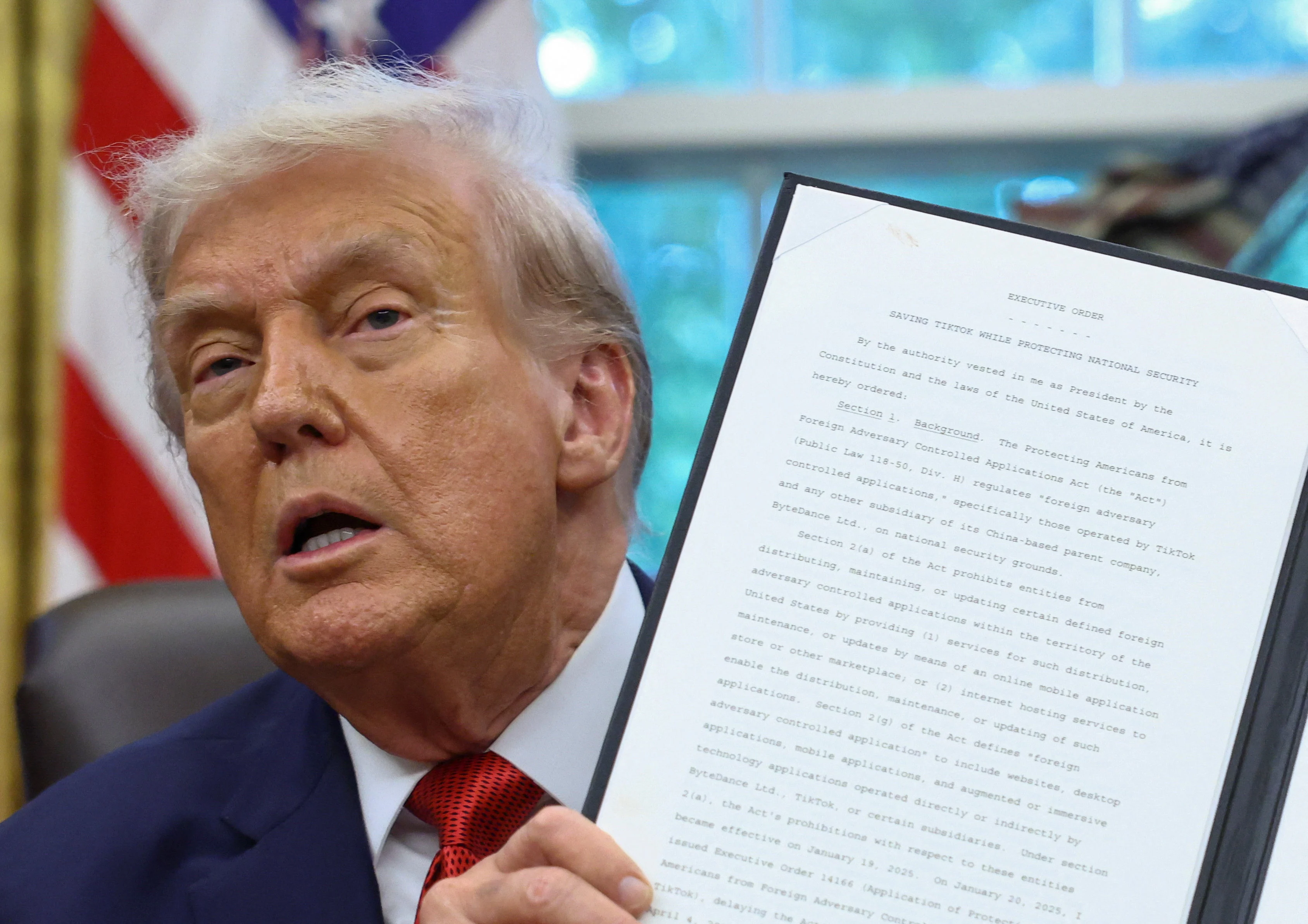

As US President Donald Trump signed an executive order on Thursday to bring the widely watched TikTok dispute closer to a resolution, the move fuelled expectations of broader US-China trade deals when their leaders are expected to meet next month.

The proposed divestiture, meanwhile, has also raised questions about the fate of Chinese and American companies investing and operating in each other’s markets.

In the latest development in the saga involving the short-video app, Trump wrote in the Thursday order that divestiture of the influential platform under Chinese firm ByteDance would allow American users to continue using it, while also protecting national security.

That followed a framework deal reached in Madrid earlier this month, and a “go-ahead” from President Xi Jinping in their call last week, Trump said. Under the proposed terms of the deal, TikTok would operate under US ownership, led by investors such as Oracle, with ByteDance retaining a 20 per cent stake.

At a news conference on Friday, China’s foreign ministry urged Washington to provide a level playing field for Chinese investors following the TikTok deal.

“The Chinese government respects the wishes of enterprises and welcomes them to conduct business negotiations based on market rules, reaching solutions that comply with Chinese laws and balance interests,” spokesman Guo Jiakun said when asked to comment on the deal.

“We hope the US will provide an open, fair and non-discriminatory business environment for Chinese companies investing in the US,” he said, without disclosing further details of the deal.

Dexter Roberts, a US-based senior fellow at the Atlantic Council think tank’s Global China Hub, said that, following the TikTok deal, Trump and his team would love to see more Chinese companies localising.

However, China would expect something significant in return, according to Roberts.

“China has already made it pretty clear that they want to strike a tough TikTok deal,” he said, pointing to previous Beijing statements saying the US should treat Chinese firms fairly and without discrimination.

And China might not mind if its companies concede ground in the US if it gets a deal in return, including on geopolitical issues, he said, adding: “I would imagine that whatever they’re getting is more valuable.”

Some China analysts expressed concern that the TikTok deal may set a precedent complicating Chinese investments abroad, as Beijing actively encourages its companies to expand overseas.

“Large companies naturally attract scrutiny, often negative, and must manage social and governmental relations in the countries where they operate,” said Tang Dajie, a researcher with the China Enterprise Institute think tank in Beijing.

The protracted situation involving the fate of the popular app – a critical cultural and economic platform for both China and the US – reflects the urgency for growing Chinese companies to improve their handling of local relationships, he added.

This is particularly true with a platform company like TikTok, Tang explained, because when excessive basic data and influence is gained in a country, it could be linked to political motives, which is “a common conspiracy theory in Europe and the US, though often without solid evidence”.

“From the perspective of businesses, what they need to do is enhance their global awareness and improve understanding of local laws,” he said.

If the deal [is] unfair and unreasonable to Chinese companies, we can expect Beijing will take issue with this and respond in kind

James Zimmerman, lawyer

It could also prompt reciprocal treatment for American companies operating in China, which have repeatedly voiced concerns in recent years about data use, compliance requirements and uneven enforcement, especially when bilateral relations sour.

“If the deal terms are viewed as unfair and unreasonable to Chinese companies, we can expect Beijing will take issue with this and respond in kind,” said James Zimmerman, a Beijing-based lawyer and former chairman of the American Chamber of Commerce in China.

Beijing and Washington remain entangled in prolonged trade negotiations, and reportedly high on the agenda are US export controls on hi-tech products, as well as China’s purchases of Boeing planes and US soybeans.

On Thursday, Premier Li Qiang met in New York with US business representatives, academics and civic leaders, urging them to use their influence to help improve troubled relations between the two economic giants.

Addressing representatives from the National Committee on US-China Relations and the US-China Business Council, he called them “very important organisations that serve as a bond between the two countries”.

Mark Natkin, managing director of Hong Kong-based market research firm Marbridge Consulting, agreed that China was eyeing a big return if it agrees to concede the TikTok algorithm, which he called “the crown jewel of the business”.

China would look at what it can get in terms of AI, chips and advanced manufacturing, he said.