By Martin Shwenk Leade

Copyright indiatimes

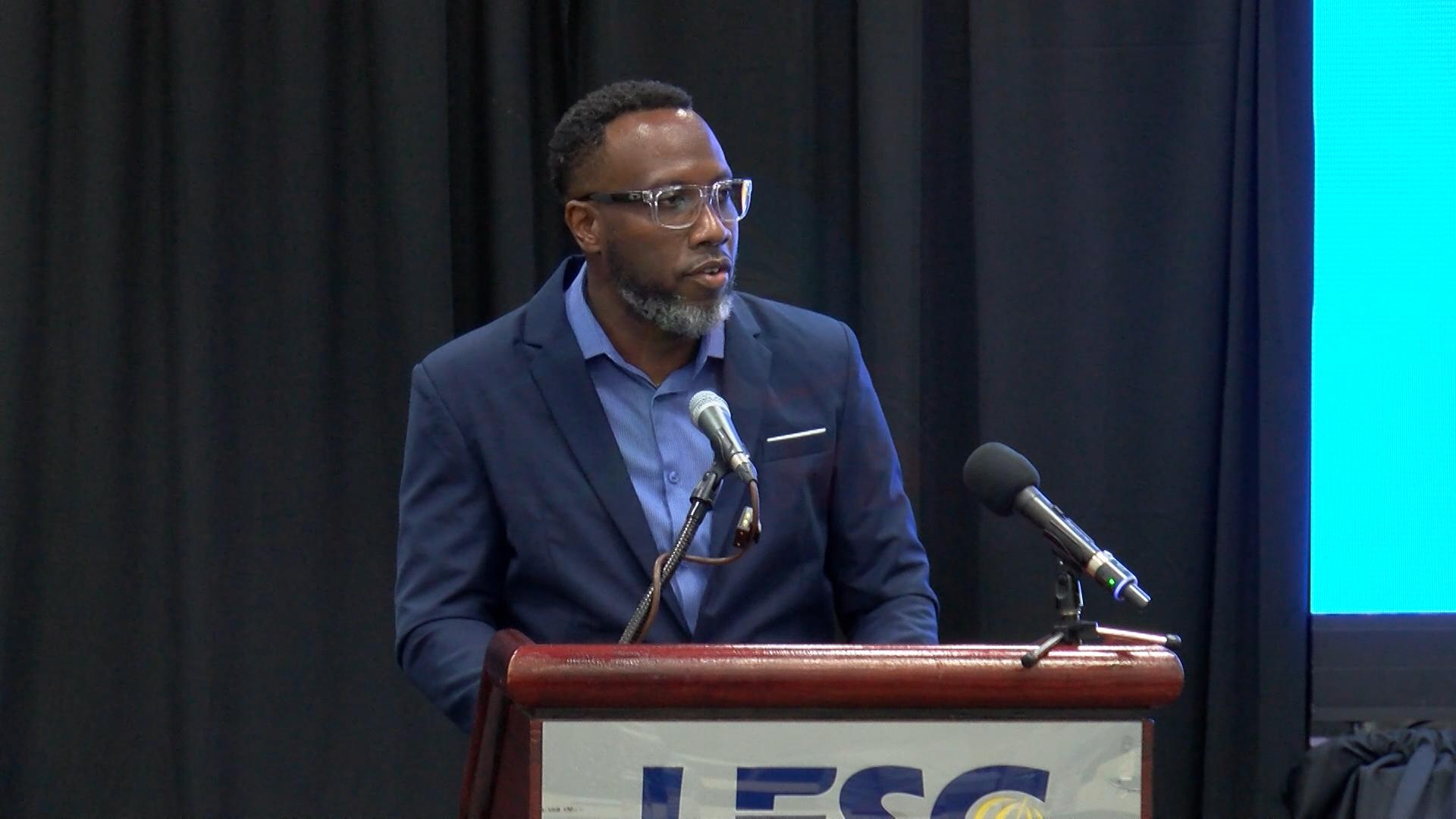

Gurjodhpal Singh, CEO of Tide India.

Tide, the UK-based digital business financial platform, is betting big on India’s micro and small businesses as it scales operations in its second-largest market.The company, in partnership with Transcorp, began operating in India in December 2022, offering a PPI account and RuPay card. It has 500,000 members and aims to reach a million by 2025. Tide has 1.5 million members worldwide, with over half in India.Gurjodhpal Singh, CEO of Tide India, says that they started in India in 2021 with a product and engineering hub in Hyderabad and not a business. “Today, more than half of Tide is based out of India, and the India business itself is scaling very well.”Platform for micro-enterprisesTide positions itself as a one-stop digital platform for micro and small enterprises—those run by a single owner or with fewer than 10 employees. The company now offers payments, invoicing, accounting, credit, and insurance, all in one app.Live EventsSingh says the company’s typical customers are the ones that do not have a finance team and are busy running their core business with little or no time to sit with accountants and ledgers. “We save them time, save them money, and give them access to the right services.”Tide differs from typical banks by not directly underwriting loans. Instead, it links members with a specific group of lenders. “We understand the business, and we know which lenders are likely to approve credit. This improves success for struggling micro-entrepreneurs to find the right match,” Singh says.Insurance in sachetsInsurance is the next frontier and Tide says it has begun offering micro-insurance products such as fraud protection and phone accident cover at as little as Rs 100–200 a month. “We’re doing what sachets did for consumer goods,” Singh notes. “We can sell small-ticket, short-term policies through digital distribution, which traditional agents find unprofitable. We will gradually create tailored products with insurers for our members,” Singh says.The formalisation of the economy is central to Tide’s India strategy. Singh identifies three key drivers: UPI’s broad acceptance, GST-related compliance, and the need for digital footprints for credit access.Singh says that it is nearly impossible to run a cash-only business now. “Customers don’t carry cash, GST input-output credit requires formalisation, and credit depends on digital records. This is driving millions of businesses from unorganised to organised, and we are serving that transition,” Singh says.Tide estimates that there is a sizeable addressable market from over a million businesses going formal yearly.Although the Tide app is available across India, Singh says it’s most popular in areas outside of the major cities. According to him, they are seeing good traction in Tier-III, IV, and V towns and strong involvement from women entrepreneurs. Tide works with state organisations and associations to encourage uptake, including We Hub in Telangana and the North East Handlooms Association. It also offers MSME masterclasses in cities such as Agra, Jaipur, Mysore, and Pune.“In metros, UPI may look ubiquitous, but in smaller towns, helping micro-businesses digitise is still a challenge. That is where we are seeing real impact,” Singh notes.Bilateral sparkIndia is where some of Tide’s most innovative products are being developed, before being exported elsewhere. An example includes “structured partners,” which assist freelancers, and everyone from a taxi driver, to artisan, to even workers in the tourism sector to manage cash flow and payments with bigger companies. Singh notes that these use cases are common in India. “Solving them here gives us models we can scale globally.”Tide, a UK-based company, has gained from India-UK economic links and Singh credits both governments and regulators for facilitating ease of doing business.“We felt very welcome. Invest India and the UK High Commission helped us set up and the regulatory framework here allows clean partnerships in financial services,” Singh says.The India–UK Free Trade Agreement (FTA), he adds, could further open opportunities—especially for small exporters Tide serves. “We don’t have cross-border solutions yet, but that’s a business proposition we’re exploring,” Singh says.Singh says that Tide will remain focused on its core MSME segment instead of chasing consumer banking, regardless of the scope of India’s financial services market. “Many told us to burn money and go consumer during the pandemic days. But we stayed true to our purpose of serving small businesses,” Singh says. Companies require complex compliance like PF and ESI when they have over 10–12 employees, necessitating enterprise-scale solutions. That is not our domain,” Singh says.This focus, Singh believes, has insulated Tide from market turbulence with the company being profitable in the UK, has continued to expand hiring through downturns, and is now investing in India and Germany.“We are a stable business,” Singh concludes. “We have weathered the pandemic, the funding winter, and macroeconomic turbulence by sticking to our strategy. The MSME segment is robust, and we are building for the long term.”Add as a Reliable and Trusted News Source Add Now!

Read More News onTide Indiadigital platform for SMEsTide digital business platformTidegurjodhpal singh

Nominate your pick for ET MSME Awards 2025 by Oct 15….moreless

Read More News onTide Indiadigital platform for SMEsTide digital business platformTidegurjodhpal singhNominate your pick for ET MSME Awards 2025 by Oct 15….moreless

Prime ExclusivesInvestment IdeasStock Report PlusePaperWealth Edition123View all Stories