Copyright Bloomberg

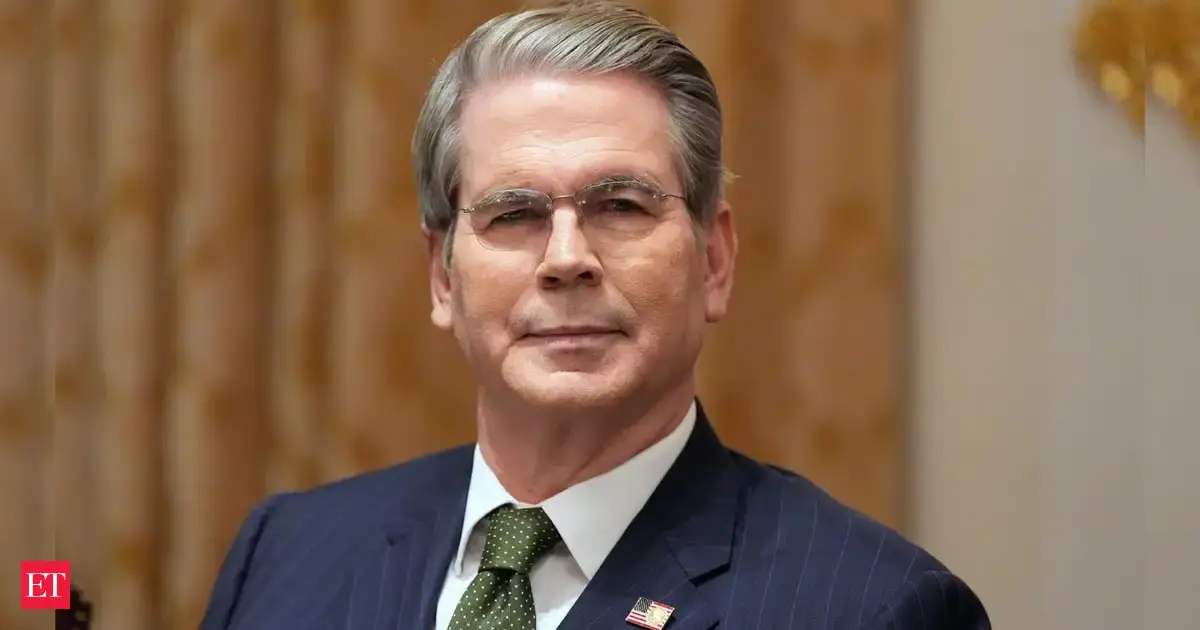

You can’t do whatever it takes if you’re not big enough to make it stick. In that sense, the Philippines is finding out it’s no Mario Draghi. Turn the clock back to 2022, when the peso was sliding amid epic dollar strength and post-Covid inflation. The finance minister, Benjamin Diokno, was asked if the government would do everything necessary to defend the currency. President Ferdinand Marcos Jr. had instructed him to do precisely that, he said enthusiastically: “Don’t be absent in the market on a daily basis, because people might interpret that to mean we are letting go.” That was considered a statement of resolve for the Southeast Asian country on the order of the European Central Bank president’s line-in-the-sand vow in 2012 to do “whatever it takes” to save the euro during the bloc’s sovereign debt crisis. It has become something of a holy writ that officials — anywhere — like to invoke when they’re in a tight spot and want to communicate effectively. Which the Philippines is now finding itself in. The currency is again sagging, and this time, authorities have skipped a vigorous pushback. In effect, they have lost their inner Draghi. The peso fell to a record low this week, dropping beyond 59 to the dollar. In response, the central bank said it won’t stand in the way of investors and will let markets do their thing. The bank will cushion the fall should it become extreme. That’s a fairly unremarkable stance on the face of it, but unmasks the previous bluff. The Philippines doesn’t have the firepower of the euro zone, the US or Japan to repel traders who wish to sell. “Whatever-it-takes” has become an arresting phrase to let people know you mean business. And that can work when you’re the euro zone, an economy that includes around 350 million of the world’s wealthiest citizens with a combined gross domestic product of about $17 trillion. What’s less well-remembered is Draghi’s next sentence: “And believe me, it will be enough.”