Copyright thewrap

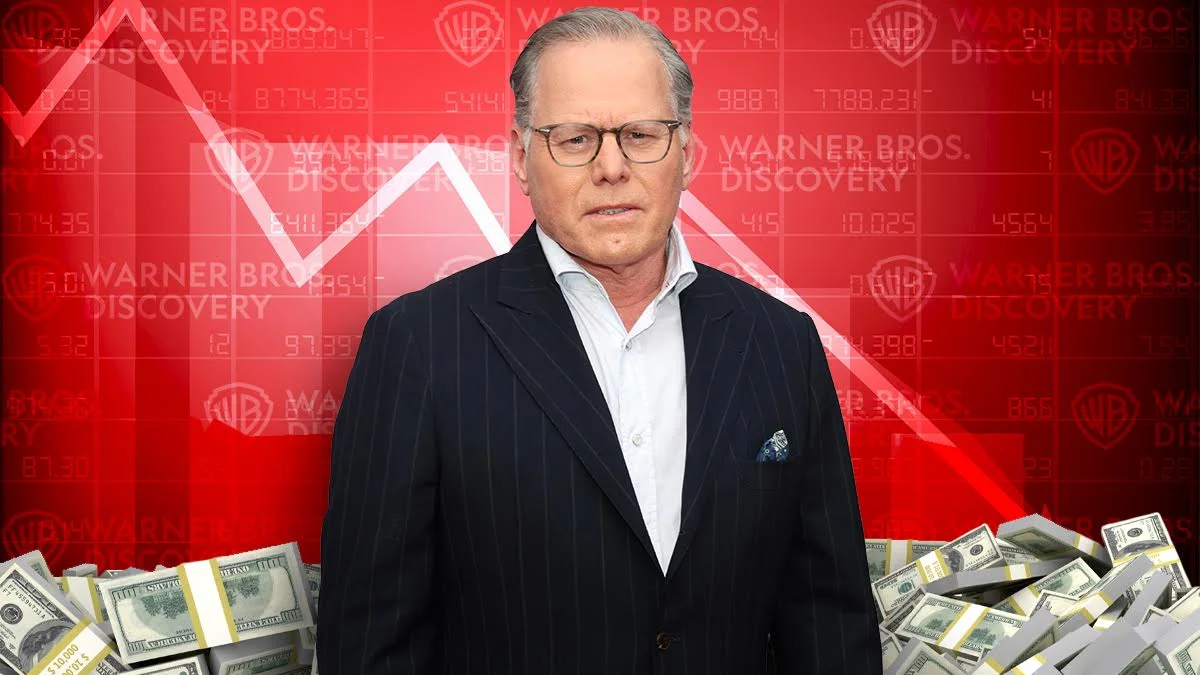

Warner Bros. Discovery announced it was undergoing a “strategic review” on Tuesday after the company said it is fielding “unsolicited interest” from “multiple parties” for all or part of its business. Its stock popped 11% on the news. But mergers have generally not been kind to the company that started out as Warner Brothers in 1923, including what history will record as one of the worst mergers ever with AOL Time Warner, whose shareholders lost $2oo billion in the aftermath of that dot-com bubble marriage in the early aughts. That didn’t stop the Ellisons’ billions, which have actually made what would have otherwise been a ho-hum year for M&A in media and entertainment pretty interesting. Through their own new acquisition, Paramount, they set off a new steeplechase for Warner Bros. Discovery — either as a whole entertainment conglomerate, or as two separated units in Warner Bros. and Discovery Global. That now begs the question of whether the Ellisons would take another crack at buying WBD, or maybe just the Warner Bros. studio and HBO, on a hot streak right now. Or do we see some new deep-pocketed buyers emerge? Paramount reportedly made a $20 a share bid for WBD that was spurned, leading to CEO David Zaslav‘s announcement: “After receiving interest from multiple parties, we have initiated a comprehensive review of strategic alternatives to identify the best path forward to unlock the full value of our assets.” But the constituency we aren’t reading too much about here is the WBD shareholders who are sitting on a stock at Tuesday’s close that is still 17% lower than when WBD first started trading on April 11, 2022, after Zaslav engineered his Discovery’s takeover of Warner. That is 17% lower, notably, even with the takeover talk bump to WBD stock from when Paramount’s interest first broke and then the 11% rise on Tuesday. For shareholders, that’s three-plus years of watching your stock go in the opposite direction of where it’s supposed to go. Big shareholders include Vanguard Group and BlackRock on the institutional side, and Condé Nast owners the Newhouse family and cable mogul John Malone on the individual side. (Malone inherited the Warner stock, a big bonus over the downward course where Discovery was headed.) The Ellisons seem suited to shake things up. It feels like their parachuting into Hollywood was all about that, with the bags of cash to make it happen. But now that the “For Sale” sign is officially up at WBD, you’d have to consider Netflix, Amazon, Apple, Comcast or maybe even a consortium of private equity or Saudi backers as potentially interested suitors. On Tuesday, Ted Sarandos left the door open to considering Warner, saying on the earnings call: “We focus on profitable growth and reinvesting in our business, both organically and through selective M&A,” Sarandos said, with an emphasis on selective M&A for effect. Zaslav brought in the big-gun investment bankers to assist with his review, Allen & Co., J.P. Morgan and Evercore. Let’s pause for a minute to consider the math: $12.54 — This was WBD’s closing price on Sept. 10, the day before Bloomberg broke the news that Paramount was preparing a bid. $16.17 — This was WBD’s closing price the next day, showing a 29% bump on a so-called takeover premium. Takeover offers in the media space have been attracting a 20% to 25% premium. If Paramount did indeed offer $20 per share offer, that represents a 59% premium from the $12.54 where WBD was languishing before the takeover news broke. But clearly Zaslav and team are thinking that WBD see the upside of bringing in other potential buyers to boost a premium for the company. Circling back to those downtrodden WBD shareholders. Bank of America Securities on Tuesday placed a value of $30 per share on WBD ($26 for the Warner Bros. studio, which includes HBO, and $4 for the cable networks side, which includes CNN). So what if a buyer would come in with a $30 a share offer for the whole company? That would be a 48% premium to the current price, and 140% premium to the Sept. 10 closing price. Pretty enticing for a shareholder who’s held on for three years in a downward slide. Zaslav was schooled under the legendary General Electric CEO Jack Welch when he was starting out at NBC, so don’t underestimate his deal savvy, even though WBD shareholders are feeling like they got stuck with a dud. Editors Note: The Reset is a newsletter we send out every Sunday to enterprise subscribers to WrapPRO. We are sharing this edition on the heels of Warner Bros. Discovery becoming officially up for sale. If you think your company or organization would be interested in signing up for an enterprise plan, please reach out to our head of enterprise sales, Kimberly Donnan, at kimberly.donnan@thewrap.com. 1. Tech Companies Pushing Off Those Exits: Research firm CB Insights reported some interesting data last week as part of its State of Venture Q3’25 Report that shows that tech companies are in less of a rush to strike an exit. “The ability to raise at decacorn ($10 billion and above) valuations while staying private removes the pressure to go public for capital. Companies can now scale to a massive size, hire top talent through liquid secondary markets, and maintain founder control — all without the quarterly earnings pressure or regulatory burdens associated with going public,” CB Insights explains. Average time for tech startups to stay private rose from 12.2 years in 2015 to 15.9 years in 2025. See below. 2. AI Killing Jobs? Not if You Look at This Data: It seems like companies are increasingly bringing people on board who help embed AI into daily operations, but new data dispells the widespread notion that the technology is a job killer. The Economist cites work by Seyed Hosseini and Guy Lichtinger, both doctoral students at Harvard University who have been tracking companies that hired “generative-AI integrators.” The students used AI itself to go through 200 million job postings and found 130,000 such vacancies at 10,600 firms that they called “AI adopters.” See below for the upward trend. When you hear Libby Bush talk about her motivating drive over the years, one that has been rewarded with a senior executive role for partnerships at CAA, it’s hard not to think it came from her days on the soccer pitches and lacrosse fields of her youth outside Philadelphia. She ended up playing Division I lacrosse for the University of Richmond Spiders, a sport she’s still involved with near her home in Pacific Palisades. “I certainly didn’t get promoted because I waited for somebody to recognize my worth. It takes fighting for yourself, asking for things even though you might not feel qualified or you might not feel like you’ve hit the mark completely to deserve it. The worst people can say is no. “It’s a little bit of the fake it til you make it. I never worked for an agency. How did I have the right to start one? But I believed enough in myself, I was willing to take the risk and I was willing to hear the word no as many times as I needed to until I heard the word yes. Holding myself back and not doing it because I didn’t have the qualifications was just never a part of the trajectory for me.” Sure feels like the spark of a competitive athlete is still in there somewhere. Bush, 43, spoke to our TV business reporter Lucas Manfredi for last week’s installment of our Office With a View executive Q&A series about the importance of brands becoming an essential tool for creators to both finance and market their projects across platforms. Bush has been responsible for leading the CAA team behind collaborations between hit series like Netflix’s “Bridgerton” and Flonase and Apple TV+’s “Severance” and State Farm. She’s also worked closely on connecting brands directly with CAA clients through projects like Ariana Grande’s Swarovski ad campaign, the NBC competition series “On Brand With Jimmy Fallon” and Kerry Washington’s YouTube series “Street You Grew Up On.” Bush, whose career has taken her to the NBA, WNBA, Disney and to her own startup agency Tandem Entertainment that CAA later purchased, is aware how important it was to hone her own story if she was going to help creators and brands do the same. “One size does not fit all in this business. There’s a lot of options on how to financially get deals done and creatively tell great stories in entertainment and culture.” Ad Age this year put her on its list of Leading Women, an honor for which some commenters on LinkedIn called her a “badass.” Our favorite part of her interview with Lucas was this career advice: “I would also say I learned a lot about mentorship and mentoring. When you work in really big corporations and you start out young in your career in these big organizations, you realize really quickly that people will continue to grow in their careers and they may end up anywhere. “So to me, it was always about treating everybody — whether they were next to you, below you or above you — the same, and how important it is to collect relationships and nurture them. Your network becomes everything to you in your career. Understanding how to use it and protect it and nurture it is a really big lesson for me throughout those companies.” The PR Guy Who Says The AI Boom Is a Bust, Channels with Peter Kafka podcast What’s Your AI-dentity? Bloomberg Opinion (survey) How a mogul picked his latest sports investment, The Athletic MoneyCall