The Goldman Sachs Group Forecasts Strong Price Appreciation for Dell Technologies (NYSE:DELL) Stock

Dell Technologies (NYSE:DELL – Get Free Report) had its target price boosted by analysts at The Goldman Sachs Group from $150.00 to $155.00 in a research report issued on Tuesday,MarketScreener reports. The firm currently has a “buy” rating on the technology company’s stock. The Goldman Sachs Group’s target price points to a potential upside of 3.70% from the company’s current price.

A number of other analysts also recently issued reports on the stock. JPMorgan Chase & Co. increased their price target on shares of Dell Technologies from $125.00 to $145.00 and gave the stock an “overweight” rating in a report on Thursday, July 17th. TD Cowen increased their price target on shares of Dell Technologies from $125.00 to $130.00 and gave the stock a “hold” rating in a report on Friday, August 29th. Wall Street Zen upgraded shares of Dell Technologies from a “hold” rating to a “buy” rating in a research report on Saturday, September 13th. Susquehanna restated a “neutral” rating and set a $125.00 price objective on shares of Dell Technologies in a research report on Wednesday, August 13th. Finally, Fox Advisors cut shares of Dell Technologies from an “overweight” rating to an “equal weight” rating in a research report on Friday, August 29th. Sixteen equities research analysts have rated the stock with a Buy rating and six have given a Hold rating to the company’s stock. Based on data from MarketBeat, Dell Technologies has an average rating of “Moderate Buy” and a consensus target price of $148.67.

Get Dell Technologies alerts:

View Our Latest Stock Analysis on DELL

Dell Technologies Price Performance

DELL stock opened at $149.46 on Tuesday. The firm’s fifty day simple moving average is $131.27 and its 200-day simple moving average is $114.29. The company has a market capitalization of $100.49 billion, a P/E ratio of 21.98, a price-to-earnings-growth ratio of 0.97 and a beta of 1.04. Dell Technologies has a 12 month low of $66.25 and a 12 month high of $149.68.

Dell Technologies (NYSE:DELL – Get Free Report) last released its quarterly earnings data on Thursday, August 28th. The technology company reported $2.32 EPS for the quarter, beating the consensus estimate of $2.29 by $0.03. Dell Technologies had a net margin of 4.73% and a negative return on equity of 236.21%. The business had revenue of $29.78 billion for the quarter, compared to the consensus estimate of $29.14 billion. During the same period in the prior year, the firm earned $1.89 EPS. The business’s revenue for the quarter was up 19.0% on a year-over-year basis. Dell Technologies has set its Q3 2026 guidance at 2.450-2.450 EPS. FY 2026 guidance at 9.550-9.550 EPS. As a group, sell-side analysts forecast that Dell Technologies will post 6.93 earnings per share for the current year.

Insider Buying and Selling at Dell Technologies

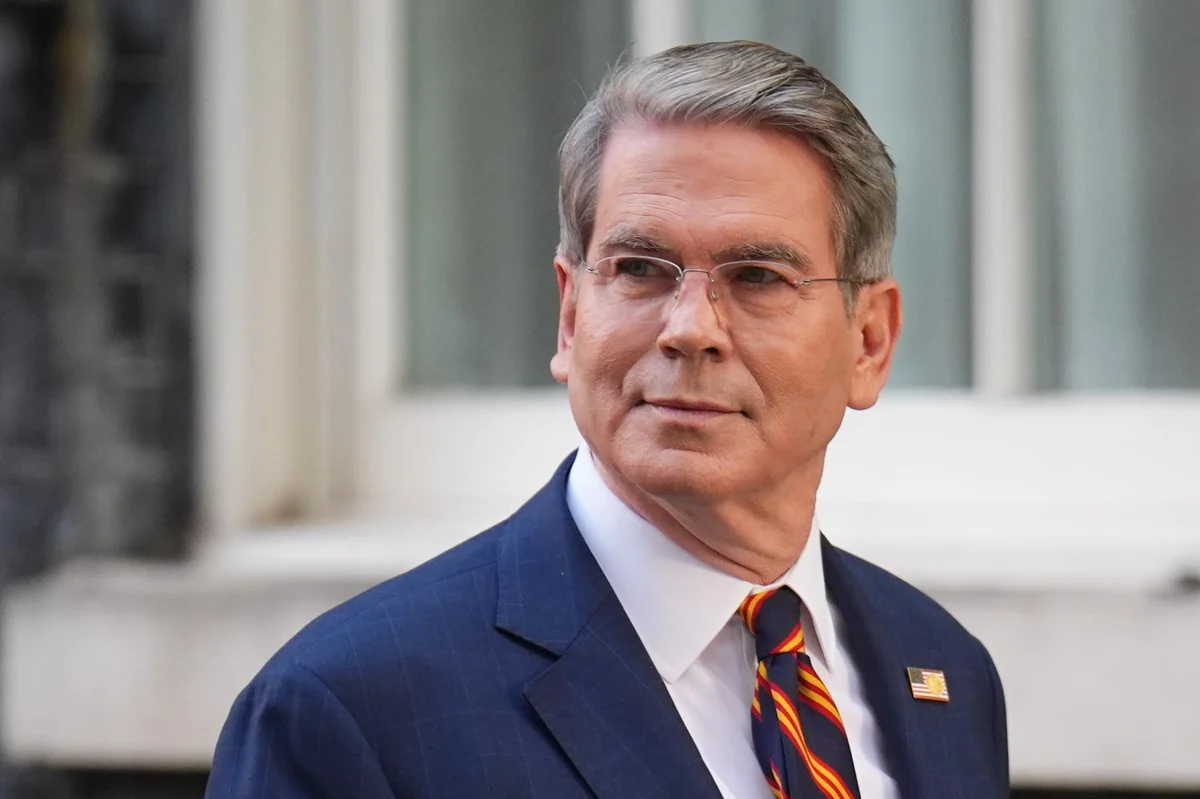

In other news, Director William D. Green sold 50,000 shares of the stock in a transaction dated Monday, August 11th. The shares were sold at an average price of $140.00, for a total value of $7,000,000.00. Following the completion of the sale, the director directly owned 45,045 shares in the company, valued at $6,306,300. This represents a 52.61% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Lynn Vojvodich Radakovich sold 725 shares of the stock in a transaction dated Monday, September 15th. The shares were sold at an average price of $126.39, for a total transaction of $91,632.75. Following the completion of the sale, the director owned 23,680 shares of the company’s stock, valued at $2,992,915.20. This trade represents a 2.97% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 3,204,462 shares of company stock valued at $420,370,484 over the last ninety days. 42.00% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Dell Technologies

Several hedge funds and other institutional investors have recently bought and sold shares of DELL. Smallwood Wealth Investment Management LLC acquired a new stake in Dell Technologies during the first quarter worth about $25,000. Winnow Wealth LLC acquired a new stake in shares of Dell Technologies during the second quarter valued at about $25,000. N.E.W. Advisory Services LLC acquired a new stake in shares of Dell Technologies during the first quarter valued at about $26,000. Cheviot Value Management LLC acquired a new stake in shares of Dell Technologies during the first quarter valued at about $27,000. Finally, Flaharty Asset Management LLC acquired a new stake in shares of Dell Technologies during the first quarter valued at about $27,000. 76.37% of the stock is currently owned by institutional investors and hedge funds.

Dell Technologies Company Profile

(Get Free Report)

Dell Technologies Inc designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally. The company operates through two segments, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

Featured Stories

Five stocks we like better than Dell Technologies

How to Plot Fibonacci Price Inflection Levels

Datavault AI: The New AI Contender Backed by Big Funding

What Do S&P 500 Stocks Tell Investors About the Market?

CoreWeave: Why the New King of AI Infrastructure Has Room to Run

3 Grocery Stocks That Are Proving They Are Still Essential

Top 3 Dividend Achievers for October: High Yields, Growth Ahead