The lithium fields outside Reno, Nevada, look like lunar plains with white crusts, shallow pans, and ribbon roads between drilling rigs. For most visitors, the site is a story about extraction and the promise of electric mobility. For two engineers, Bilen Aküzüm and Lukas Hackl, it was an accidental, stubborn question that refused to go away.

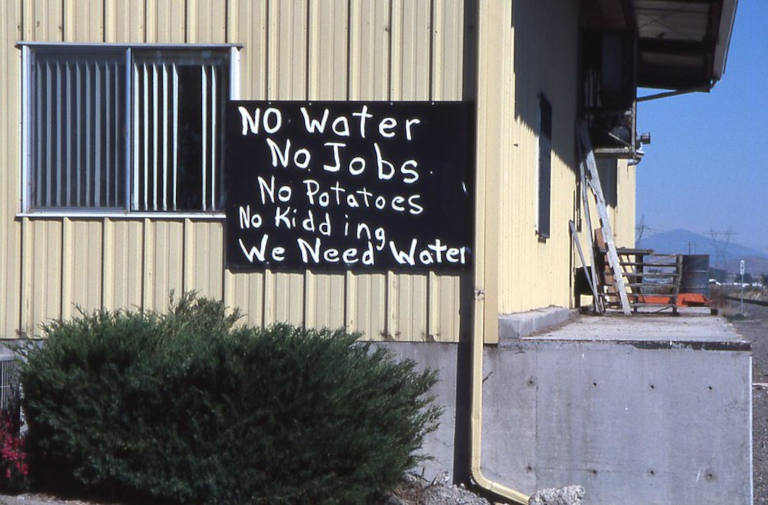

On road trips from California to Canada, the pair kept hearing the same thing from miners and processors: chemical waste. Plants were piling up sodium sulfate while importing caustic soda and other reagents by the tanker.

“We were looking to gain better insights into the critical mineral space and the battery supply chains,” Aküzüm, the co-founder and CTO of Aepnus Technology, told Interesting Engineering in an interview.

“But everybody kept talking about this chemical waste stream that was coming out of their operations due to using many reagent chemicals.” The paradox was obvious because the facilities stockpiled sodium-sulfate waste while importing caustic soda (sodium hydroxide) and other reagents by tanker load.

“I kept thinking, why are these facilities shipping one molecule out and shipping another in?” Hackl, the co-founder and CEO of Aepnus, said. That simple question drove the two engineers to design a system that could turn waste salts back into the acids and bases industry depends on — a way to rewire industrial chemistry so byproducts became feedstocks again.

It’s more than a prototype. It exposes a quiet choke point in the clean-energy transition: not just critical minerals, but the chemicals that process them.

The trip that changed the brief

The two engineers did not set out to found a company. In 2019, colleagues and friends from Berkeley Lab, they began a road trip to understand the battery supply chain.

“We actually went through a long road trip across California, Nevada, and even parts of Canada,” Aküzüm recalled. “We visited a lot of lithium mines, battery recycling facilities… Our initial idea was critical minerals. But everybody kept moving us away from the minerals because they were discussing this chemical waste stream.”

The problem recurred everywhere. Plants relied on sulfuric acid and caustic soda to leach and separate. Acid plus base produced sodium sulfate salt, which piled up as waste.

“These facilities currently have a very linear operation. They’re constantly purchasing chemicals, which costs a lot of money… and results in waste on the other side,” Aküzüm said. Reagent chemicals can be a substantial fraction of operating expenses; he estimated costs of reagent chemicals could be up to “30–40% of their opex.”

The arithmetic was brutal and obvious: buy chemicals from far away, use them once, produce salt waste, and pay to dispose of it. “That’s two problems,” Aküzüm said. “A huge cost and an environmental burden.”

Rather than chase another mineral-extraction scheme, the pair decided to tackle the reagent side of the chain: could they turn salt back into usable acid and base?

From salt to reagent: The idea and the patent problem

Electrochemistry offered a conceptual answer. Electricity can split salt into its components. The idea wasn’t new — patents from the 1970s and 1980s explored salt-splitting electrolysis — but those efforts collapsed under the cost of exotic catalysts like iridium, seven times more expensive than platinum. The chemistry worked, but the economics didn’t.

Aepnus’s breakthrough came from combining advances in materials science and electrochemistry with careful cell engineering. The team developed new electrode formulations and a modular electrolyzer architecture that avoided rare catalysts and enabled reactions on cheaper, robust surfaces.

In practice, that meant fewer exotic materials, lower capital costs, higher product purity, and less energy per unit produced.

“We don’t use any expensive catalysts like iridium, for example,” Aküzüm said. “Once we switched to these cheaper electrodes and facilitated reactions to happen on the surface of our electrolyzers, we were able to reduce the operating costs… less energy required, higher concentration, and higher purity products.”

The other challenge, variable, impure feedstocks, was solved by borrowing from the chlor-alkali industry’s established impurity removal playbook. Pretreatment systems ensured real industrial brines could run through the electrolyzers without fouling.

“The chloralkali industry has established rigorous processes for impurity removal in a very cost-effective manner,” Aküzüm noted. “We’re learning from that playbook and using similar off-the-shelf technologies.”

Two simple design principles guided the work: avoid exotic solutions, and borrow proven ones. The result was a system that could run for weeks or months without constant intervention.

Pilots in the field

Proof-of-concept in heavy industry requires more than lab runs. The technology must survive messy feedstocks, contaminant spikes, and long campaigns.

Aepnus built a containerized pilot in Bécancour, Quebec, a 20-foot system sized to be the minimum viable product their partners wanted to see. “This was the scale that our customers and project partners in Quebec wanted to see at the smallest scale our system works for at least a thousand hours,” Aküzüm said.

That pilot did more than run; it logged 2,000 hours of continuous operation. It processed real sodium-sulfate byproduct from real facilities and delivered membrane-grade caustic soda suitable for industrial reuse. The two signal events for industry partners were decisive as the system ran long, and the output met the purity and concentration standards needed to feed back into a plant’s process.

“The important milestone for this pilot project was to prove… that our technology can be operated for at least 1,000 hours, which is a six-week continuous campaign, day and night, never stopping,” Aküzüm said. “That bolstered our customers’ confidence that the innovations we’re doing on the electrode and material science and cell architecture front are innovations that can last really long.”

The pilot processed roughly four tons of sodium sulfate per year, which is minuscule compared with the tens of thousands of tons generated by many facilities. Still, the point was demonstration, not capacity. Aepnus lets customers run their tests and validate product quality by operating close to industrial partners.

Importantly, the pilot was run by a 12-person team at the National Center for Environmental Technology and Electrochemistry (CNETE), trained by Aepnus, “without direct intervention by Aepnus,” the company later explained in a press release, proof that the technology can be transferred.

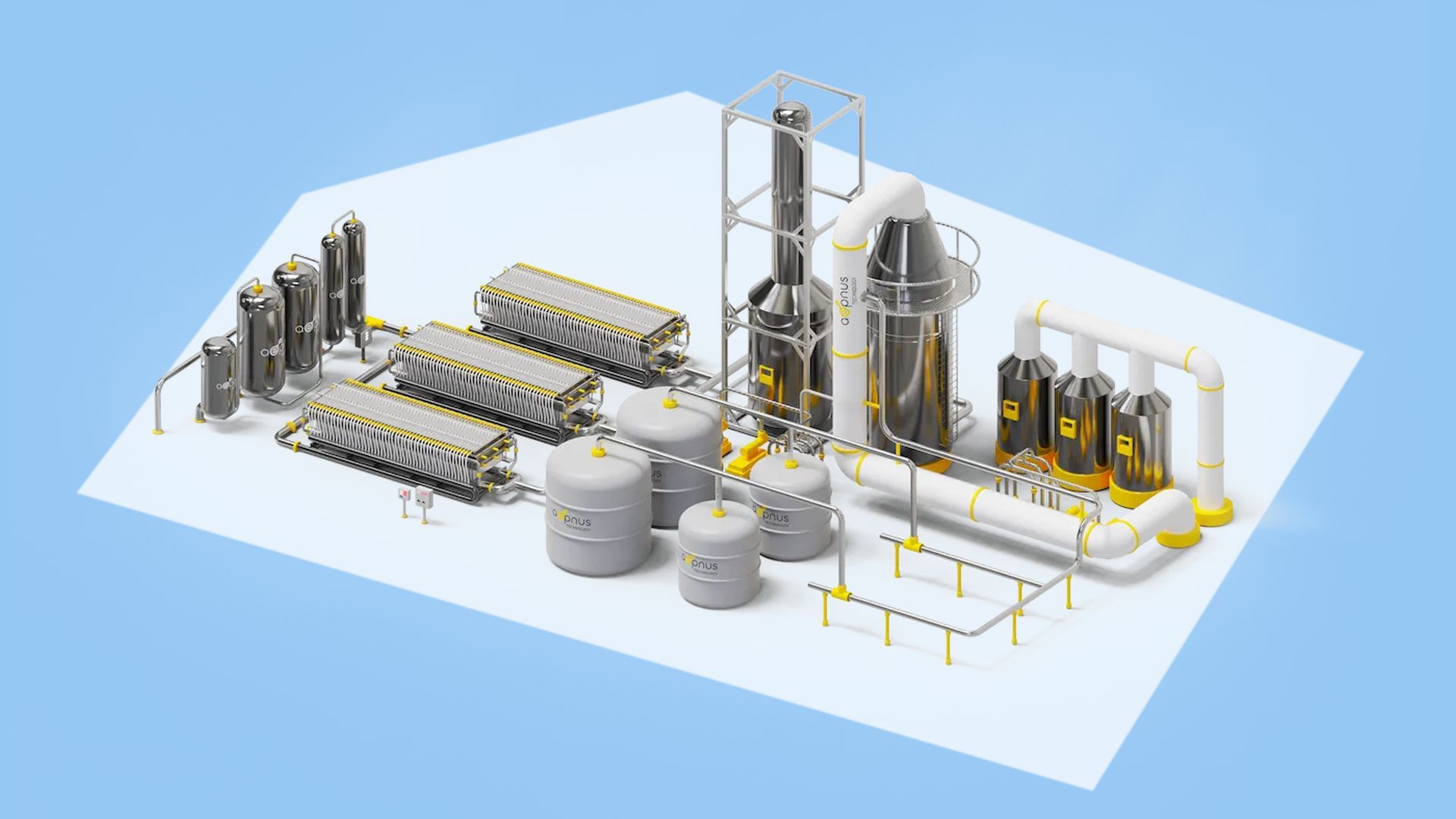

Aepnus didn’t stop at a successful container. They scaled up to a next-generation 40-ton system in Oakland, California, ten times larger, showing that the cell architecture could be brought to commercial scale and that the primary remaining challenge was not the reactor itself but building an end-to-end process train: pretreatment, electrolyzer operation at industrial throughput, and post-processing to meet customer specs.

How the process actually works

The simplest way to explain Aepnus’s system is to start from the feedstock, sodium sulfate, the salt created when acid and base neutralize in industrial operations. Rather than treating it as waste, Aepnus feeds it into a modular electrolyzer that, when powered, drives electrochemical reactions to split and rearrange the ions into the original reagents – caustic soda and sulfuric acid.

Aepnus has three technical pillars that make this feasible in an industrial setting. The first is utilizing the surface-active electrodes and cheap catalysts. Instead of relying on scarce precious metals, Aepnus uses advanced electrode formulations that facilitate reactions at the electrode surface. The key is engineering the electrode’s microstructure and chemistry so the salt can be converted efficiently without exotic materials.

The second is a robust cell architecture. The electrolyzer’s design addresses fouling, current distribution, and thermal management, which are common failure points for electrochemical systems receiving heterogeneous feedstocks. The modular architecture lets operators scale capacity by stacking more cells rather than building a single gargantuan reactor.

Pretreatment and standard industry membranes are the third technical pillar. Aepnus didn’t invent a new, fragile membrane. It borrowed the chlor-alkali industry’s impurity removal techniques: sedimentation, filtration, targeted chemical removal, and membrane choices that tolerate industrial contaminants. That upstream work means reliable, long runs downstream.

The upshot system produces membrane-grade caustic soda, has fewer unwanted co-products, and demands roughly 40 percent less energy than legacy processes, according to Aküzüm. “The biggest metric we’re tracking is the kilowatt hours per ton of chemical produced,” he said. “What we’re able to achieve is we can produce these chemicals like caustic soda and sulfuric acid 40% less energy than the current processes of making these chemicals.”

That energy advantage is crucial. Electrochemical processes succeed only if the electricity is cheap and clean enough or uses dramatically less energy than alternative supply chains, including the embodied energy of shipping and disposal. Quebec’s hydropower and many mining regions’ access to renewables make the approach compelling; so does the avoidance of freight and disposal.

Corrosion, materials, and the ugly bits of scaling

You don’t win industrial chemistry on clever lab tricks alone. You win it on materials of construction, piping choices, seals, and the thousands of small decisions that keep a plant from corroding itself into oblivion.

“Because we’re creating these acid-based chemicals, they are quite corrosive,” Aküzüm said. “The biggest challenge… has not been on the core technology, the electrolyzer itself, because the construction materials are very robust.”

“But as a company, lacking experience in dealing with large quantities of corrosive chemicals, we had a fast learning curve to choose what type of piping material to use, tank materials, and sealing materials. Everything was corroding and leaking at first, and then very quickly we reached a place where these are the right material choices for us to endure these very corrosive environments,” he added.

Those hard lessons are the reason many startups built in labs never scale. Aepnus learned and designed the plant so that material choices and straightforward maintenance mitigate the key failure modes. The containers were meant to be serviceable in the field, not museum pieces in a controlled lab.

One of the most practical decisions, often ignored by technologists focused on reaction rates, is where the equipment physically lives. Aepnus’s customers want both options, depending on geography and co-location of facilities.

“If several customers with the same problem are co-locating already,” Aküzüm said, “it makes sense for us to co-locate with them, build a plant, a common facility to take in all this waste from different facilities into one plant that we own, and then hand them back the chemicals. The economics make a lot more sense that way.” In Quebec, where battery clusters are emerging, a regional processing hub can aggregate waste streams and produce economies of scale.

By contrast, mines in remote locations benefit from on-site, containerized deployment. Aepnus’s plug-and-play model allows small facilities to run a few units in parallel. “If they are located in remote areas, it makes more sense to do on-site chemical generation and do a delocalized operation,” Aküzüm said.

The flexibility matters because the problem is not a single factory; it’s an ecosystem. A hub model can achieve scale and cost efficiency, while distributed units minimize transport and capture value for individual producers.

Who benefits and who doesn’t

Aepnus’s solution isn’t limited to lithium or battery recycling. The acid-base chemistry pattern repeats across heavy industry. Aküzüm listed early customers in pulp and paper, textiles, pigments, and consumer products such as shampoos and detergents.

He also believes semiconductors may present a compelling future market: chip fabrication uses acid reagents extensively, and a circular model could reduce waste and exposure in sensitive, high-value supply chains.

“We actually have customers across pulp and paper, textile industry, pigment manufacturing, consumer products… future applications include the semiconductor industry,” Aküzüm said. “The platform starts with sodium sulfate chemistry, but we know we can also attack other salt waste products, nitrate salts, phosphate salts, and borate salts.”

That breadth is both a strength and a reality check. Aepnus does not, and has never claimed to, produce metals directly. They are not extracting lithium or cobalt. “I would like to be very clear again,” Aküzüm highlighted, “we do not extract any critical minerals from these streams. We’re taking chemical waste and recycling it back into useful chemicals. Not critical minerals. Useful chemicals.”

The company’s message to partners is concrete: to reduce operating costs, avoid disposal fines, localize supply, and, in many cases, reduce life-cycle carbon if electricity is clean. “If you use it with renewable electricity, it would reduce the carbon footprint of this chemical significantly,” Aküzüm said. The benefit stems not just from lower energy per kilogram but from avoided shipping and the avoidance of fossil-derived co-products used to produce sulfuric acid in traditional supply chains.

The economics: Energy, OPEX, and the “30–40 percent” line

Aepnus has an economic hook. According to Aküzüm, reagent chemicals can be “up to 30–40 percent of their opex” in some refining operations. That’s a big number; reduce it, and the plant economics change materially. The pilot’s finding that the electrolytic process can save 40 percent of the energy needed versus legacy routes translates directly into cost savings.

However, any real commercialization will demand deeper techno-economic models: CAPEX of full plants; lifetime of electrodes; membrane replacement schedules; and the price differential between locally produced caustic soda and market imports. Aepnus’s strategy is to sell pilot systems, prove uptime, and then support either local manufacturing or build-operate models, aiming to de-risk that transition.

Partners like GM, the Ultium CAM joint venture, Nemaska Lithium, and Vale Base Metals aren’t casual backers. Their involvement signals that large industrial actors see an opportunity to reduce cost and compliance risk at scale.

If the environmental and economic arguments are persuasive, there’s also a strategic angle. Aküzüm said, “The cost of these reagent chemicals accounts for almost 30 to 40 percent of the operating costs in the critical mineral space”.

“By using our technology, you can reduce the cost of these chemicals. First, by doing so, we’re improving the competitiveness of the North American markets… and number two, we get to do this in a much more sustainable and environmentally friendly way than elsewhere.”

Countries that ramp up domestic refining and battery production still rely on global flows of caustic soda and other reagents. Closing that loop on location reduces dependence on long supply chains and the kinds of shocks ripple through commodity markets when geopolitics or shipping bottlenecks bite.

This is a quieter form of strategic industrial policy than submarines or tariffs. Build a domestic chemical backbone that makes your mining, refining, and battery industries more insulated from global shocks. For nations eager to keep battery value chains local, that matters.

IP, regulations, and the third knob

Aepnus has been building more than reactors. They’re assembling a protective stack of patents, “we have a white patent portfolio,” Aküzüm said, plus regulatory relationships to operate complex chemical equipment near industrial sites.

The press release noted full coordination with Canadian regulatory authorities was part of the pilot approach; future deployments will require deeper permits and environmental approvals.

The immediate engineering challenge is not the electrolyzer design, as Aepnus insists it is de-risked. It is designing the full process train, the pretreatment for variability, stacked electrolyzer cells for throughput, and post-processing to deliver product to customer specifications. That’s what their California 40-ton system and the Bécancour pilot were built to demonstrate.

The company’s next big milestone will be a demonstration plant of commercial scale, integrating pretreatment modules, scaled electrolyzer stacks, and product finishing, all in one integrated flow. That step is where CAPEX, financing, and industrial offtakes, rather than lab results, become the story.

If Aepnus succeeds at scale, the effects reach beyond sodium sulfate. Aküzüm’s vision is both modest and ambitious. For a century, chemical engineers had two knobs, temperature and pressure. He wants to make voltage the third.

“Our vision is to add a third knob to the toolbox of a chemical engineer. That third knob is the knob of voltage,” he told me. “By adjusting the electricity and the voltage that we apply in these reactors, can we make different materials, different chemicals… and electrify the production of various chemicals?”

That’s a radical reframing thought, less as waste management and more as a retooling of how the chemical industry makes stuff. Combined with AI for process control and, eventually, materials discovery, the approach could accelerate substituting fossil-intensive routes for electricity-driven chemistry.

Aküzüm sees machine learning and quantum computational tools as possible accelerants: “The more that we can use AI and quantum computing to make predictions on the types of material combinations that allow us to catalyze specific reactions, the more it is only going to unlock the application of the types of reactors that we’re building.”

The moonshot is a distributed fabric of electrified chemical factories and small, stackable reactors run by renewable electricity that produce chemicals on location from locally generated salts and wastes. That vision reframes supply chains: rather than shipping reagents around the globe, industries multiply localized, electrified production nodes.

Risks, limits, and honest tradeoffs

No feature on industrial innovation is complete without a frank account of what may not work. Aepnus’s process doesn’t replace virgin mining. “Not for virgin mining of minerals,” Aküzüm said. “We don’t do critical mineral refining… but it can decouple many of these industries from purchasing chemicals.”

There are material, regulatory, and economic risks: electrodes will need lifetimes consistent with industry expectations; sites must be located near reliable electricity; operators require training to handle corrosive chemicals and high-voltage electrochemical equipment; and regulatory permitting for chemical plants can take years in some jurisdictions.

Then there is scale-up risk. A containerized pilot that handles four tons a year is a valuable demonstration, but many industrial sites generate tens of thousands of tons of salt annually. The hard step is to build demonstration plants that aggregate feedstock, demonstrate continuous uptime, and sign off on product specs.

“We’ve de-risked the electrolyzer cell and architecture to the point that we feel confident that we can actually deploy the system,” Aküzüm said. “But now we need to put this entire process train together in a demonstration plant at full commercial scale so our customers gain confidence to make commercial agreements.”

Finally, any major industrial shift invites incumbents and compound market effects. Chlor-alkali incumbents may adapt; some will resist. But industrial history is littered with old giants that adapted and with industries that became, quietly, more efficient as a new tool spread.

Why two engineers, not a giant, found it first

The story of Aepnus also teaches engineers about where innovation still happens. Big companies invest in big changes but are often slow to notice the mundane, systemic inefficiencies a curious outsider can quickly map. “We were true scientists, trying to understand the real problem,” Aküzüm said. “By talking to people across the industry, we realized the problem wasn’t the resource but the reagents.”

Hackl and Aküzüm combined complementary skills. Deep lab understanding of electrochemistry with the pragmatic systems engineering required to get field‐reliant hardware working in remote, corrosive environments. They built a company aimed at the messy, unglamorous domain where venture capital is thin and industrial customers are cautious, but the economic value is real.

“What we did was look at the whole supply chain,” Hackl said. “Not just the sexy bits that make headlines. We asked what it actually takes to turn these materials into products. The answer wasn’t just metals. The chemicals process them, and that’s what we solved for.”

Three thousand miles and two thousand hours after that Nevada road trip, the argument that Aepnus is making is straightforward, as industrial chemistry is the invisible architecture of the energy transition. If that architecture is leaky, expensive, and brittle, the more visible parts of the transition, batteries, windmills, and solar farms, are harder to deploy at scale.

Aepnus’s model is not a silver bullet. It is a practical, industrially minded answer to a set of inefficiencies that add up, costs, carbon, and geopolitical exposure. It works because it is deliberately unglamorous: the company focused on electrodes, seals, piping, and operating procedures in corrosive environments, not just on flashy performance numbers.