Copyright Fast Company

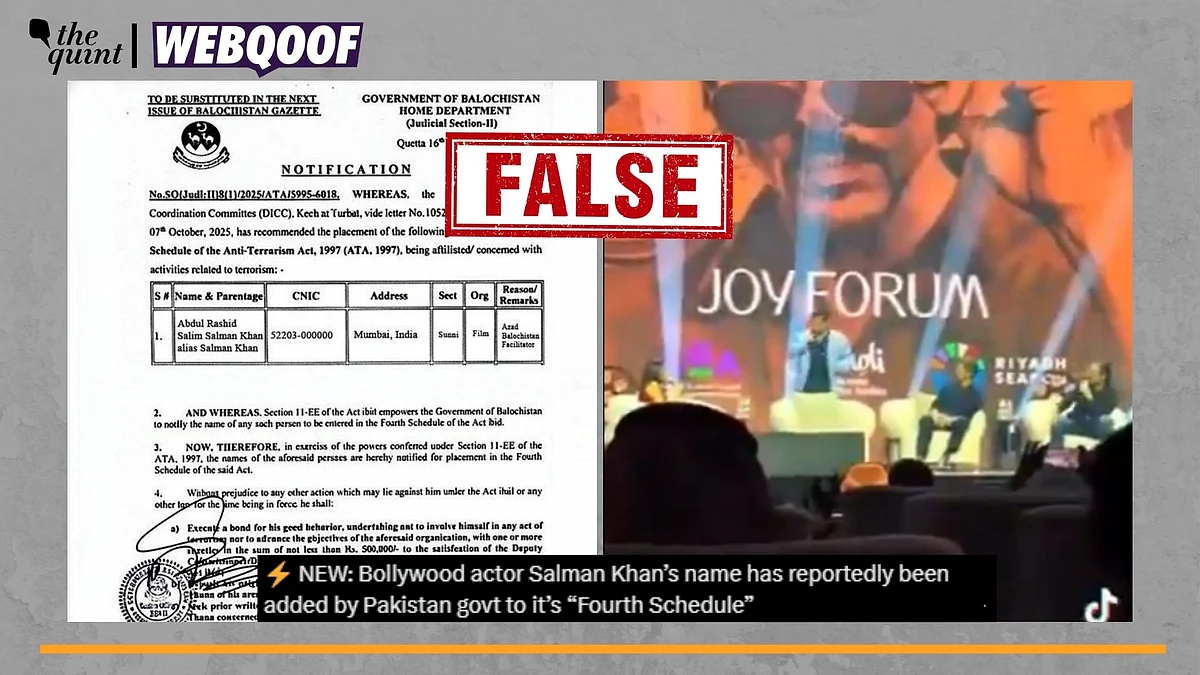

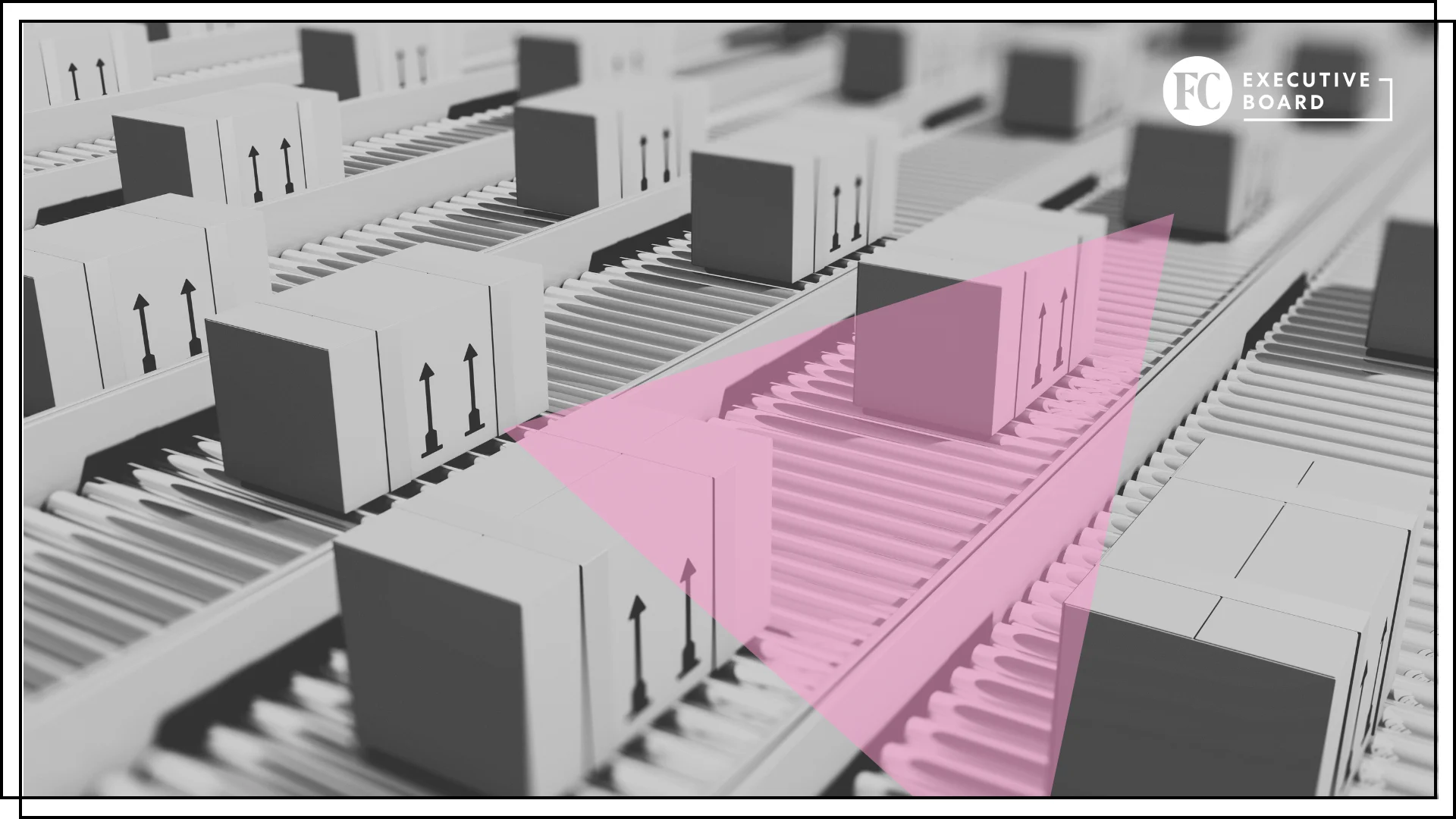

Uncertainty is the trending business buzzword. Shifting supply chains, trade wars, and heightened geopolitical risk are making many business leaders scratch their heads (or beat them against the wall). “Freezing” is a common human reaction to fear of the unknown. Do nothing; hold steady; wait and see what happens next. It’s not very strategic, but for many, it feels safe. Reacting late may seem less risky than backtracking, but it often means falling behind. THE RISK OF WAITING IT OUT Indecision during volatile times can lead to stagnation. Addressing operational inefficiencies can feel less urgent than reacting to immediate pressures, such as tariffs or rising costs, yet ignoring this vital aspect could mean missing critical opportunities. Ultimately, there will be competitors who use this time to their advantage. Subscribe to the Daily newsletter.Fast Company's trending stories delivered to you every day Privacy Policy | Fast Company Newsletters There is rarely a downside of optimizing one’s operations, exploring alternatives, and building resilience even when there is a lack of predictability in external focus. When leaders focus on what they can control, they can equip their organizations to weather the next big wave—or to seize the chance to soar through the squall. THE ROLE OF INTERNAL EXCELLENCE Greater uncertainty requires greater precision. Improved data integrity and data utility can support operational efficiency, positioning organizations for competitive agility. Poor data can lead to flawed decisions, such as misallocating inventory. A company that uses outdated sales forecasts, for example, might overstock low-demand products while underordering high-demand items, leading to lost revenue and higher carrying costs. Outdated margin analyses by product or region can create costly expenses. For example, if a region, location, or product has a gap in margin, the gap may indicate inefficiencies ripe for resolution. Businesses must also revisit their forecasting methods, which may now face greater challenges in a turbulent environment. Bottom line: Despite external uncertainty, improving internal operations must be a priority for long-term success. THE ROLE OF SKU RATIONALIZATION AND FINANCIAL BUFFERS SKU rationalization, or streamlining product offerings, can serve as a first line of defense against sudden shifts in supply or demand, or the kind of margin compression that results from tariff increases. By streamlining product offerings, companies can focus on producing higher-margin goods and better position themselves to accommodate shifts in domestic versus international production. Concurrently creating financial buffers can help leaders manage cash flow when price elasticity on demand or delayed consumer purchasing behavior adds financial pressure. Cash reserves or flexible credit lines can act as a safety net, allowing businesses to absorb unexpected shocks, such as sudden tariff increases or supplier disruptions. These resources can position companies to meet obligations and avoid reactive cost-cutting measures. RETHINK SUPPLY CHAINS Geopolitical shifts and trade policies are driving many companies to rethink their supply chains. Some organizations are getting creative. They are assembling products in one country while sourcing parts from another. This may reduce tariff exposure while circumventing the need for additional infrastructure development. But navigating the current complexities requires more than creative sourcing. It requires strong relationships. advertisement Uncertainty and disruption often call for clever solutions and flexible planning. Strategic optionality is the ability to develop multiple, adaptable, scenario-based options that businesses can use to handle a wide range of potential challenges without significant disruption. For example, collaborating with competitors (also known as “co-opetition”) may be an effective strategy during supply chain disruptions. One recent example of this involved competing manufacturing companies who each had their primary supplier in different countries. They reached a unique agreement to balance resources across borders – reducing transportation costs while bypassing tariffs and infrastructure obstacles. This type of collaborative effort shows how innovation can arise when companies think beyond their usual practices. THE BALANCING ACT Improving operational resilience may also mean streamlining processes using lean principles with risk-tolerant strategies. While stockpiling may seem counterintuitive to those accustomed to lean manufacturing principles, there are cases where calculated inventory buffers can be a lifesaver. For example, if you run a paper mill, preemptively ordering a custom part to have on hand could mean the difference between meeting or missing revenue projections if a machine fails. If the spare never gets used, it may look like a sunk cost. But if it prevents significant downtime, it becomes a brilliant investment. This balancing act between lean principles and calculated risk underscores the importance of assessing risk tolerance. CONTROL WHAT YOU CAN INFLUENCE In Stoic philosophy, the ‘dichotomy of control’ principle highlights the distinction between what we can influence and what is beyond our reach. Stephen Covey, author of The 7 Habits of Highly Effective People, referred to this as the ‘Circle of Influence’ and the ‘Circle of Concern.’ The former, according to Covey, includes what we can directly affect, while the latter involves factors outside our control. Whether viewed through a philosophical lens or a practical one, focusing on areas where you can make a difference is more impactful than wasting resources on things you can’t change. Strong business leaders rarely sit idly and wait out a storm, probably because they know there will always be another one coming. Those who prioritize what is withing their control—internal improvements—have an opportunity to set themselves apart at a time when many others remain distracted. Daniel Lee is the president of Carpedia International.