Copyright ZeroHedge

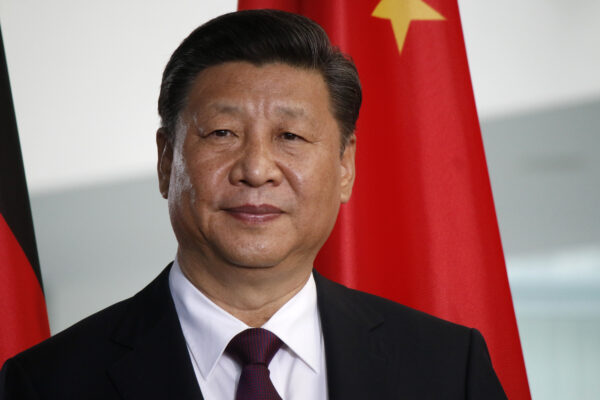

SNAPSHOT: Equities up, Treasuries down, Crude down, Dollar flat, Gold up. REAR VIEW: ISM Services comes in hot; ADP tops expectations; Treasury begin preliminary considerations of increases to future auction sizes; China reportedly bans foreign AI chips from state-funded data centres; Larger-than-expected EIA crude stock build; Oral arguments on validity of Trump's IEEPA tariffs begin; Riksbank holds rates as expected; GOOGL Gemini to help run AAPL's Siri features. COMING UP: Data: Australian Exports/Imports, German Industrial Production, EZ Retail Sales, Canadian Leading Index, US Chicago Fed Labour Market Indicators, US Challenger Layoffs. Events: BoE, Banxico & Norges Bank Policy Announcements. Speakers: Fed’s Williams, Barr, Hammack, Waller, Paulson, Musalem; ECB’s Lane, Nagel, Schnabel & de Guindos; BoE’s Bailey; BoC's Macklem, Rogers, Kozicki. Supply: Australia, Spain, France. Earnings: Continental, Commerzbank; AstraZeneca, Sainsbury’s; Airbnb, ConocoPhillips, Warner Bros More Newsquawk in 2 steps: 1. Subscribe to the free premarket movers reports 2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days MARKET WRAP US indices ended the day with notable gains after a downbeat start as initial AMD weakness post-earnings weighed with investors touting lofty valuations, but this soon pared. Sectors were mainly green with Communication Services and Consumer Discretionary sitting atop of the pile, with Consumer Staples, Tech, and Real Estate sitting in the red, albeit marginally. US data came via ADP and ISM Services, both of which came in hotter than anticipated, with both garnering a Dollar bid and pressuring on USTs. ADP, which is receiving more attention due to the US government shutdown and lack of data, rose to 42k from -29k, and above the expected 28k. ISM Services rose to 52.4 (exp. 50.8, prev. 50.0), and above the top end of the analyst forecast range, while prices paid saw an unwelcome rise to a three-year high. Following the hotter-than-expected data, DXY rose to session highs, while both US indices and Treasuries sold off. In FX, after the aforementioned peak, the Dollar sold to be more-or-less flat at pixel time, and paused its recent rally to the benefit of high beta FX amid the broader risk environment. JPY was the clear laggard. Oil swung from gains to losses in a choppy day of trade amid a lack of much oil-specific newsflow. Overall, T-Notes were sold after ADP and Services ISM beat, while the Treasury began preliminary discussions on boosting future auction sizes, which was disclosed at QRA (more details below). Precious metals strengthened, albeit with spot gold not giving a real test to USD 4k/oz, and Bitcoin lifted back above USD 100k. US ISM Services PMI: The headline rose to 52.5, above the expected 50.8 and the highest estimate of 52.3, after being 50.0 in September. Business activity moved into expansion, 54.3 from 49.9. Employment contracted at a lesser rate (48.2 from 47.2), New Orders accelerated to 56.2 from 50.4, and Prices Paid hit 70.0 from 69.4, the highest reading in three years. Respondents cited tariffs behind the move higher in Prices Paid, while there was no indication of widespread layoffs or reductions in force, but the government shutdown was mentioned several times as impacting business activity and generating concerns for future layoffs. Eleven industries reported growth in October, one more than in September, while the number reporting contraction decreased from seven to six. On prices paid, Oxford Economics says the move higher doesn't alter their assumption that the tariff-related hit to activity and inflation is close to peaking for the year, but "is a reminder of the upside risks to inflation and another reason for the Fed to be more cautious lowering interest rates from here". ADP: National Employment for October rose to 42k from -29k, above the expected 28k. Median change in job stayers was unchanged at 4.5%, with job changers rising to 6.7% from 6.6%. Given the US Government is on shutdown, which means a halt to the majority of data, the private ADP report garners more attention and comes under greater focus as the FOMC committee looks to gain a clear picture of the economy. In wake of the metrics there was a marginal hawkish shift in pricing, but nothing dramatic. ADP chief economist Nela Richardson noted that private employers added jobs in October for the first time since July, but hiring was modest relative to what was reported earlier this year. Meanwhile, Richardson adds, pay growth has been largely flat for more than a year, indicating that shifts in supply and demand are balanced. FIXED INCOME T-NOTE FUTURES (Z5) SETTLED 14+ TICKS LOWER AT 112-10 T-notes sold after ADP and Services ISM beat, while Treasury begins preliminary discussions on boosting auction sizes. At settlement, 2-year +4.5bps at 3.630%, 3-year +5.4bps at 3.645%, 5-year +6.3bps at 3.764%, 7-year +6.6bps at 3.950%, 10-year +6.6bps at 4.157%, 20-year +7.1bps at 4.718%, 30-year +6.9bps at 4.740%. INFLATION BREAKEVENS: 1-year BEI -5.4bps at 2.827%, 3-year BEI +0.2bps at 2.539%, 5-year BEI +0.5bps at 2.342%, 10-year BEI +1.3bps at 2.297%, 30-year BEI +2.1bps at 2.240%. THE DAY: T-notes were lower across the curve on Wednesday, with the curve steepening. Downside was seen in the aftermath of the US ADP report, which saw 42k jobs added to the US economy, improving from the prior -29k while also surpassing the +28k analyst consensus. Further pressure was seen in the wake of the Quarterly Refunding announcement, which largely was as expected, and it maintained that it expects to keep auction sizes maintained for at least the next several quarters. However, the Treasury made an additional comment to its guidance that, looking ahead, the Treasury has begun to preliminarily consider future increases to nominal coupon and FRN auction sizes. This remark led to further pressure across the curve but contributed to the steepening. Further pressure was seen into settlement with the ISM Services PMI beat, and a return to expansionary territory. Employment and prices paid also picked up - painting an overall hot picture of the services side of the economy. The Prices Paid index hit a 3-year high, which likely won't be taken too well by the FOMC, with those concerned about the recent uptick in services inflation, given that it is not directly impacted by tariffs. On trade, the focus was on the Supreme Court hearing regarding the legality of Trump's tariffs. However, reports have suggested that judges on both sides of the political landscape were sceptical of Trump's claim that a 1997 emergency economic law grants the President power to impose tariffs. QUARTERLY REFUNDING: The main development was the addition to its guidance. It maintained that it expects to keep coupon and FRN auction sizes steady for at least the next several quarters; however, it added, "Looking ahead, Treasury has begun to preliminarily consider future increases to nominal coupon and FRN auction size". Indicative of a boost to auction sizes at some point in the future, but perhaps not until H2 '26 or 2027, given the current "at least the next several quarters" guidance. Ahead of QRA, Morgan Stanley did not expect a move until February 2027. For a full summary, please click here. SUPPLY Bills US sells 17-wk bills at high rate 3.770%, B/C 3.36x US Treasury to sell USD 110bln in 4-week bills and USD 95bln in 8-week bills on November 6th; to settle November 12th STIRS/OPERATIONS Market Implied Fed Rate Cut Pricing: Dec 16bps (prev. 17bps), January 23bps (prev. 26bps), March 32bps (prev. 35bps). NY Fed RRP op demand at USD 12.7bln (prev. 16.98bln) across 12 counterparties (prev. 13) NY Fed Repo Op demand at USD 0.102bln across two operations today (prev. 4.8bln across two ops. on November 4th; well down from the USD 50bln peak October 31st (month-end)) EFFR at 3.87% (prev. 3.87%), volumes at USD 94bln (prev. 98bln) on November 4th. SOFR at 4.00% (prev. 4.13%), volumes at USD 3.147tln (prev. 3.237tln) on November 4th. Matches top end of target for Fed funds rate. CRUDE WTI (Z5) SETTLED USD 0.96 LOWER AT USD 59.60/BBL; BRENT (Z5) SETTLED USD 0.92 LOWER AT USD 63.52/BBL Oil swung from gains to losses in a choppy day of trade in a lack of much oil-specific newsflow. WTI and Brent printed highs of USD 61.09/bbl and 64.53/bbl in the European morning, before selling off through the duration of the US session to settle at lows, albeit with no clear headline driver behind the move. On the supply footing, oil output at Kazakhstan's Tengiz oilfield dropped 25% in October to 725k BPD due to maintenance, while Libya’s NOC Chairman noted the main goal is to raise oil and gas production. In the latest weekly EIA data, crude saw a greater build than anticipated, in fitting with the private metrics last night. Distillates had a shallower draw than forecasted, while Gasoline saw a much greater draw than expected. Overall, crude production rose 7k W/W to 13.651mln from 13.644mln. Note, ADNOC set December Murban crude OSP at USD 65.79/bbl (prev. 70.22/bbl). EQUITIES CLOSES: SPX +0.37% at 6,796, NDX +0.72% at 25,620, DJI +0.48% at 47,311, RUT +1.54% at 2,465 SECTORS: Consumer Staples -0.25%, Real Estate -0.06%, Technology -0.08%, Utilities +0.03%, Energy +0.18%, Financials +0.29%, Industrials +0.40%, Health +0.44%, Materials +0.54%, Consumer Discretionary +1.12%, Communication Services +1.63%. EUROPEAN CLOSES: European Closes: Euro Stoxx 50 -0.15% at 5,697, Dax 40 +0.06% at 24,139, FTSE 100 +0.04% at 9,760, CAC 40 -0.53% at 8,157, FTSE MIB -0.09% at 43,202, IBEX 35 -0.72% at 16,034, PSI +0.73% at 8,446, SMI -0.10% at 12,301, AEX +0.64% at 982. STOCK SPECIFICS: AMD (AMD): Investors took profits following a strong rally amid lofty valuations, despite EPS and revenue topping, with a solid outlook. Amgen (AMGN): Stellar report; major metrics beat & raised guidance. Arista Networks (ANET): Weaker than expected guidance signalling a sharp sequential slowdown in rev. growth & slightly lower margins. Axon Enterprise (AXON): Profit way short of expected. Bank of America (BAC) announced new 3-5yrs targets; ROTCE 16-18%, EPS 12%+, CET1 ratio 10.5% NII improvement 5-7% CAGR over 2026-2030. Johnson Controls International (JCI): EPS & revenue beat with strong next quarter & FY outlook. Lumentum Holdings (LITE): Top & bottom-line surpassed exp. w/ strong outlook. Pinterest (PINS): Profit missed alongside a weaker-than-expected top line view. Rivian Automotive (RIVN): Rev. beat & shallower loss per. shr than anticipated. Super Micro Computer (SMCI): EPS & revenue light with weak next quarter profit view. UPS (UPS) cargo plane crashed shortly after take-off near Louisville Muhammad Ali International Airport. Upstart Holdings (UPST): Disappointing earnings report. FX The Dollar Index chopped on Wednesday amid likely profit-taking after a five-day rally capped upside spikes on the hot US data. ADP in October (42k) printed above the expected +28k, marking the first positive reading since July. Thereafter, ISM Services printed hot, with the headline above expectation and Prices Paid hitting a three-year high as respondents continue to cite tariff impacts. Over the foreseeable future, the Supreme Court ruling on the legality of Trump's IEEPA tariffs will loom in the background as oral arguments from both sides began today. DXY settled flat around 100.17. G10 FX performance was split. JPY lagged, trimming its haven bid on Tuesday, while CAD & CHF also saw weakness but to a lesser degree. CAD weakness was mitigated by S&P Global Services PMI moving into expansion for the first time since November 2024 (50.5 from 46.3). NZD, AUD, and GBP saw a bid as risk sentiment generally improved regarding global equities. Fleeting modest JPY appreciation was seen in early European trade after Japanese Top Currency Diplomat Mimura noted that recent JPY moves are deviating from fundamentals and that excessive FX volatility, not levels, is the main concern. USD/JPY sits around 154.01 from earlier 152.97 lows. The Riksbank maintained its rate at 1.75% as expected, reiterating that the policy rate is expected to remain at this level for some time to come. On labour, the central bank says it's showing weak development, although there are now some signs that a turnaround is on its way. EUR/SEK was muted towards the expected decision.