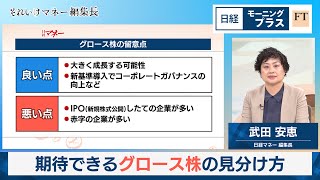

Growth stocks generally refer to companies with strong profit expansion, often newly listed firms or those with relatively small market capitalizations still in the early stages of growth. Currently, about 600 companies are listed on the Growth Market. While the section emphasizes growth potential and offers more relaxed maintenance standards compared to other markets, nearly half of the listed firms are trading below their initial public offering (IPO) valuation, highlighting a persistent challenge.

For the market to become more attractive to investors, it must overcome the tendency for IPO prices to represent a company’s peak valuation. In recent years, the market had been sluggish under conditions favoring large-cap stocks. However, since April, sentiment has shifted. As large, globally exposed firms were sold off following global uncertainty, funds began flowing into growth stocks. In addition, the exchange announced it would tighten listing maintenance requirements, raising the standard from a market capitalization of 4 billion yen over ten years to 10 billion yen over five years, spurring expectations of structural reforms. This momentum is expected to continue beyond September as the exchange urges listed firms to pursue higher growth-oriented management.

Observers see this as a continuation of reform efforts, following the exchange’s 2023 initiative urging companies to address low price-to-book ratios. That campaign triggered rallies in many value stocks, and investors now anticipate a similar impact for growth shares.

In this context, the methods of investors skilled in growth-stock investing are attracting interest. One such investor, known as Spo, achieved a tenfold increase in assets over five years by focusing on relatively undervalued growth companies. Spo selects stocks based on criteria such as whether operating profit can double within five years, whether the business model supports sustained revenue growth, and whether the price-to-earnings ratio hovers around 20 times.

However, Spo notes that even companies with strong business models can see their shares fall once optimism is priced in after earnings announcements. To avoid this pitfall, he increasingly focuses on whether a stock remains resilient following earnings reports. A successful example came in 2024 with Classico, a retailer of apparel and household goods. Despite concerns that advertising campaigns might mark a peak, steady user growth confirmed the company’s trajectory. Spo bought ahead of earnings, which later surpassed expectations, and the share price rose 1.5 times.

Such cases illustrate how experienced investors’ methods can provide valuable guidance. Yet, for many, simply being selective in choosing which growth stocks to buy can also be a prudent strategy.

Source: テレ東BIZ