Copyright The New York Times

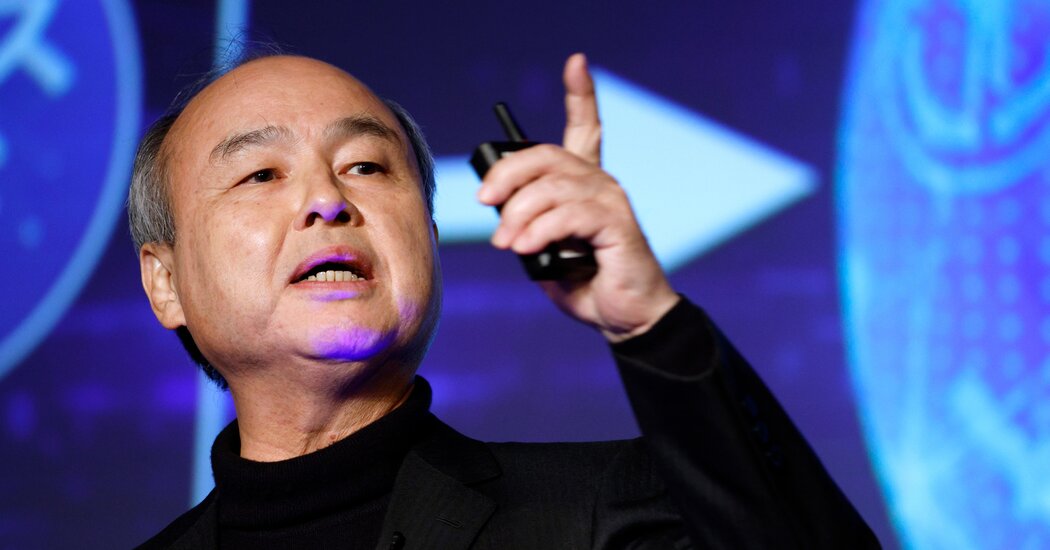

SoftBank, the Japanese technology giant, has staked its future on artificial intelligence. But to help pay for those expensive investments, the company last month sold its entire $5.8 billion holdings in Nvidia, the chipmaker behind the A.I. boom, SoftBank said in its quarterly earnings report on Tuesday. SoftBank’s enormous spending plans, including some $30 billion alone on OpenAI, come amid a flood of planned investments in artificial intelligence across the technology industry — including circular deals among the same companies. (Nvidia, for example, is committed to investing up to $100 billion in OpenAI, which in turn plans to buy an enormous slug of the chipmaker’s processors.) News that SoftBank, an influential technology investor, was getting out of one of the biggest names in artificial intelligence stoked concern among some investors that the rally in A.I. stocks was overdone. A new skeptic of the boom appeared on Monday: Michael Burry, the hedge fund manager made famous by the book and the movie “The Big Short,” questioned on social media the accounting for tech giants’ huge purchases of computer chips. But SoftBank’s reason for the sale was purely pragmatic, according to its chief financial officer, Yoshimitsu Goto. “We do need to divest our existing portfolio so that, that can be utilized for our financing,” he told analysts. “It’s nothing to do with Nvidia itself.” Late last month, OpenAI completed a corporate reorganization to become a for-profit company. As part of that move, SoftBank agreed to make its full $30 billion investment in the ChatGPT maker. The move underscored the steep financial requirements of SoftBank’s continuing focus on artificial intelligence. “I want SoftBank to lead the A.I. revolution,” Masayoshi Son, the company’s founder and chief executive, said in 2023. That has meant making big pledges, including the OpenAI investment, and joining a venture called Stargate, with OpenAI and Oracle, that intends to build an array of data centers. More broadly, SoftBank has announced that it plans to invest $100 billion in projects in the United States. Doing so has forced the company to find the money for its pledges, including by selling off existing investments and borrowing heavily. In some cases, however, those investments have paid off already. Despite the price tag of the OpenAI commitment, the start-up’s soaring valuation — on paper, at least — helped SoftBank more than double its profit in the most recent quarter, to 2.5 trillion yen, or $16.2 billion. But SoftBank’s sale of its Nvidia stake resurrected memories of its last investment in the chipmaker, which it sold off in 2019. That was a few years before its stock began to climb on the back of demand for A.I. services like ChatGPT.