Copyright researchsnipers

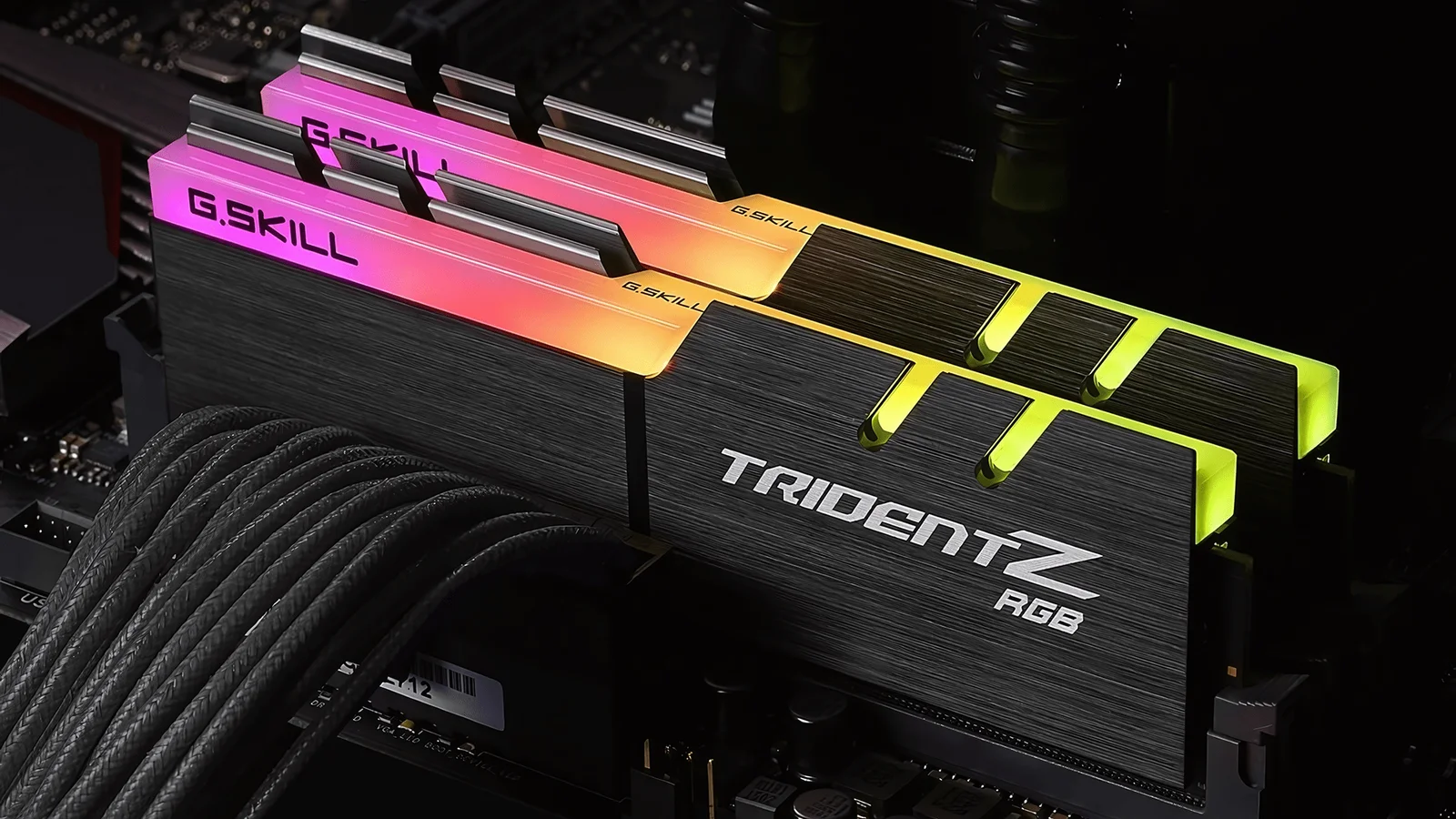

The world’s largest memory manufacturer SK Hynix has sold its entire production capacity for the coming year – including RAM and NAND memory. The Korean company is benefiting from the “storage supercycle” that is currently driving up prices. SK Hynix reports record numbers In the course of the Announcement of its latest business figures SK Hynix has announced that it is not only recording new record profits, but also that all production capacities for all storage capacities produced by the company are already fully booked. For end customers, this is another sign of a massive increase in prices due to demand from the AI industry. According to SK Hynix, existing stocks of RAM (DRAM) are currently barely available. For next year, all capacities for DRAM, NAND flash and high-bandwidth memory (HBM) for AI applications have already been completely sold. Even with conventional storage, customers would already be booking capacity for 2026 on a large scale. DRAM & Flash production is stagnating, demand is enormous SK Hynix had recently not expanded its capacities for the production of flash chips and DDR5 memory because all investments were fully focused on the HBM market and the AI providers operating with billions of dollars. SK Hynix completely stopped producing DDR4 RAM last year in favor of new HBM capacities. The demand for DDR5 RAM for servers is currently driving prices up, it said. SK Hynix is currently the leading HBM supplier with market shares beyond the 50 percent mark and wants to continue to invest extremely aggressively in expanding its capacities for the extremely profitable AI storage. The background is contracts with companies like OpenAI, which primarily involve building gigantic data centers to carry out AI calculations. OpenAI alone wants to use “Stargate” to build a network of data centers for around $500 billion, for which SK Hynix will supply the storage. The storage types for use in PCs, smartphones, tablets and various other devices from the classic IT and consumer electronics sectors are being completely undermined in the wake of the AI boom. Market observers only reported at the beginning of August that Samsung and SK Hynix had begun to raise prices by 30 to 40 percent each due to the continued high demand for DRAM and NAND memories with massively reduced capacities. In the coming months and years it is only likely to continue to rise.