Timing-chip maker SiTime (SITM) this week expanded its product offerings to include resonators. The news drove SiTime stock to a nearly four-year high.

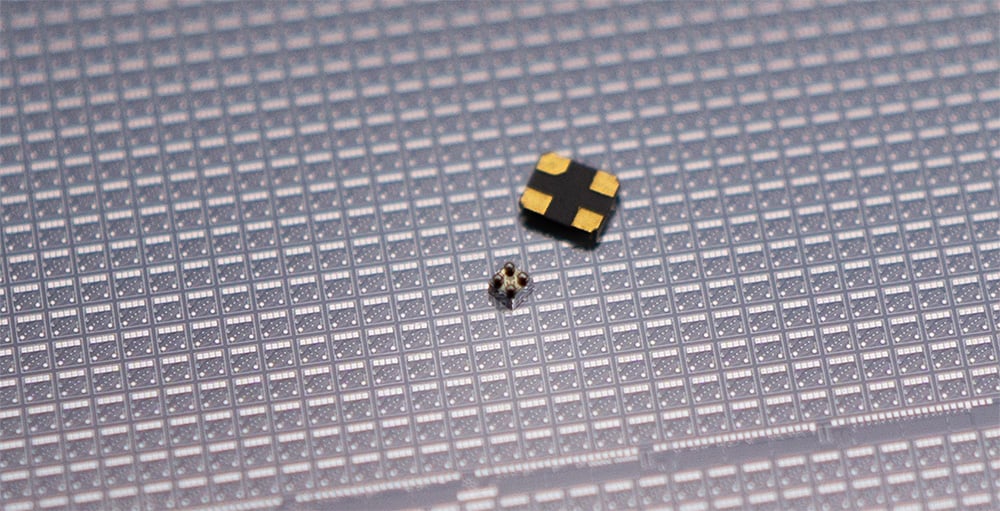

The Santa Clara, Calif.-based company introduced its Titan Platform family of semiconductor MEMS resonators on Wednesday. MEMS are micro-electro-mechanical systems. SiTime’s MEMS resonators are at least four times smaller than the smallest legacy quartz alternatives.

The launch marks SiTime’s entry into the $4 billion resonator market and rounds out its product offerings in the precision timing market.

On Thursday, Stifel analyst Tore Svanberg reiterated his buy rating on SiTime stock and raised his price target to 320 from 240.

In afternoon trades on the stock market today, SiTime rose more than 2% to 312.15. That’s its highest level since December 2021.

SiTime’s resonator launch establishes the company as “the industry’s sole provider of the full suite of precision timing solutions,” Svanberg said in a client note. It also further disrupts the legacy $10 billion-plus quartz-based timing market, he said.

SiTime Stock Is On Two IBD Lists

SiTime’s Titan resonators will enable further miniaturization of electronics for wearables and medical devices, along with smart home and industrial gear.

“Titan fulfills our vision of being the only provider of complete timing components — oscillators, clocks and now, resonators,” SiTime Chief Executive Rajesh Vashist said in a news release. “Titan is the result of over a decade of innovation in MEMS design, materials science and semiconductor process engineering.”

SiTime stock is on two IBD lists: IBD 50 and Tech Leaders.

Follow Patrick Seitz on X at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Timing Is Everything For This Niche Chipmaker

Apple Stock Rises As iPhone 17 Officially Goes On Sale

Newly Public AI Infrastructure Firm Surges After Quarterly Report

Find Winning Stocks With MarketSurge Pattern Recognition & Custom Screens