Copyright businessday

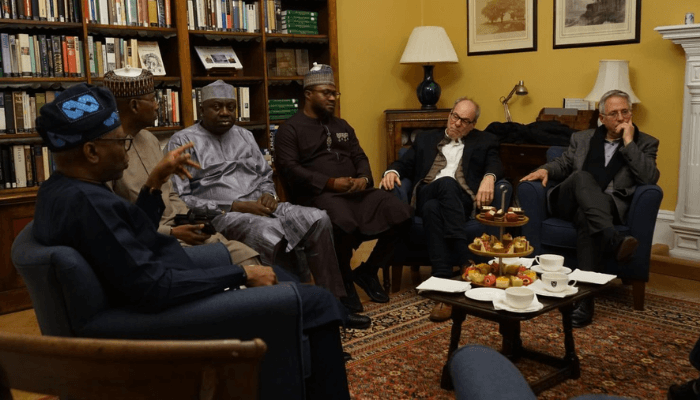

Nigeria’s push to restore investor confidence and accelerate reform in Africa’s largest oil-producing country took centre stage at the Oxford Investment Forum this week, where Senator Mohammed Sani Musa, chairman of Nigeria’s Senate Committee on Finance, positioned security and coherent policy reform as the foundation for sustainable capital flows into the continent. Speaking at a high-level dialogue at the University of Oxford titled “Finance, Sovereignty, and Structural Reform: Rethinking Capital for Africa’s Future,” Musa presented what he described as Nigeria’s “reform moment,” arguing that Africa can no longer remain at the margins of global finance discussions. The Senator delivered a message that blended fiscal realism with assertive advocacy, calling for investment frameworks that acknowledge Africa’s development priorities and its right to industrialise. Musa’s remarks came at a time of cautious optimism about Nigeria’s policy direction under President Bola Ahmed Tinubu, whose administration has embarked on politically sensitive economic reforms, including currency liberalisation and the partial removal of fuel subsidies. Investors and analysts have repeatedly signalled that the success of these measures will depend not only on regulatory stability but also on how Nigeria addresses its chronic security and infrastructure gaps. Musa leaned into those concerns, arguing that national security is not merely a domestic issue but an economic lever. Read also: NUPRC expects increase in oil production as Emem FPSO set for final voyage to Nigeria “Investors don’t just track interest rates and policy statements,” he said. “They track security risks, supply chain resilience, and the predictability of the regulatory environment.” He cited ongoing efforts to improve counter-terrorism operations and strengthen regional security collaboration, including initiatives along transport corridors critical to trade. He highlighted a new National Cybersecurity Centre designed to secure digital infrastructure and increase confidence in Nigeria’s financial systems at a time of rising cyber-risk exposure globally. The senator’s intervention grew more pointed during an exchange with the European Union Ambassador, where Musa pressed for what he described as “climate equity.” He argued that Africa, responsible for less than four percent of global emissions, is being asked to shoulder disproportionate economic sacrifice in the name of the global energy transition. “Africans cannot be penalised for seeking the same industrial development trajectory that built wealthy nations,” he said, noting that energy poverty remains a limiting factor for manufacturing and technology sectors across the continent. Musa urged development partners to move beyond grant-based climate funding and toward blended finance models capable of mobilising private capital at scale. The central theme of the senator’s appearance was that trust, both political and market-focused, is the currency Nigeria must earn back. According to Musa, investor trust depends on clear policy direction, governance reforms that reduce the cost of doing business, a transparent investment pipeline, and credible legislative backing for reform. He argued that the Tinubu administration has begun to deliver on these conditions, pointing to ongoing tax reforms and renewed engagement with multilateral lenders and private equity funds. Musa also emphasised that legislative backing is essential to sustaining reform momentum. He credited Senate President Godswill Akpabio with driving an oversight agenda that prioritises fiscal discipline and investment-friendly legislation. “Nigeria cannot afford reform fatigue or halfway measures,” Musa said. “The National Assembly is not a spectator in this process. We are shaping the regulatory architecture that investors rely on.” Forum participants, including fund managers, diplomats, and development finance experts, viewed Musa’s presentation as signalling Nigeria’s intent to compete more aggressively for global capital. Rising geopolitical competition, particularly between Western nations and China, has placed resource-rich African economies in a strategic position. Musa suggested that Nigeria intends to leverage that positioning, not through dependency, but by presenting itself as a reform-driven partner. His appearance at Oxford underscores a broader effort by Abuja to re-engage investors after years of policy inconsistency and slowing growth. The Nigerian delegation’s message was clear: reforms are underway, security is improving, and the country wants capital, not charity. For Musa, the forum served as an opportunity to frame Nigeria not just as a recipient of investment but as a participant shaping the continent’s economic future. In a global environment defined by capital scarcity and geopolitical risk, the senator argued that sustainable finance hinges on one thing: confidence that reforms will endure. “Stability and security create growth,” he said. “Growth unlocks investment. Investment creates sovereignty. That is the sequence that will define Africa’s future.”