WASHINGTON (Gray DC) – A group of Democratic lawmakers is taking on the ultra-wealthy, proposing a bill that would require them to pay what they owe.

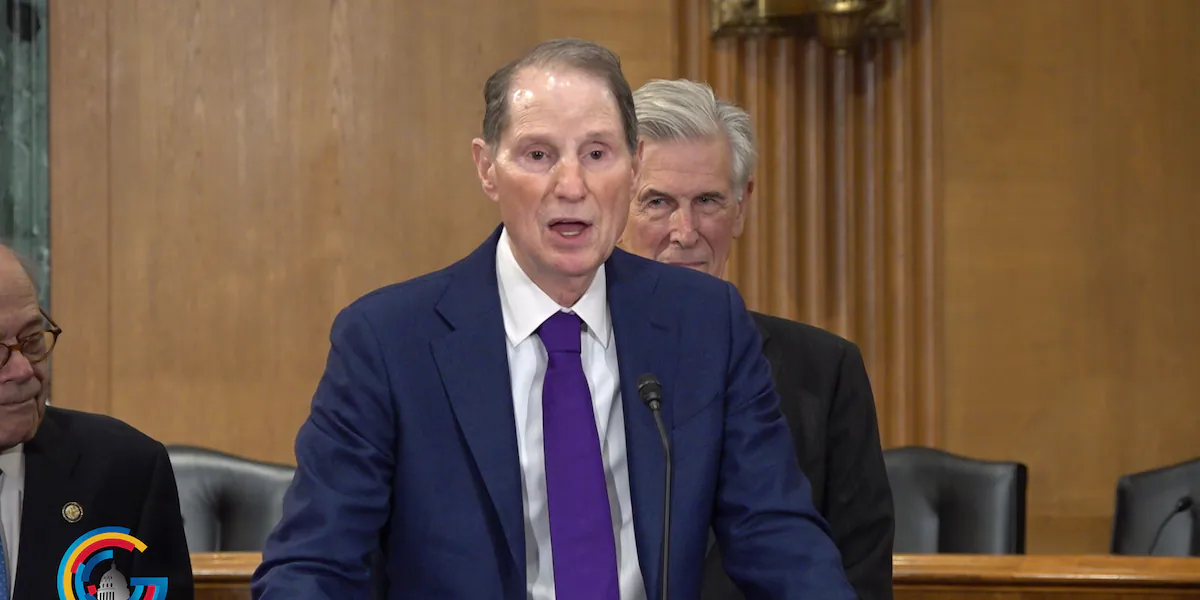

Senate Finance Committee Ranking Member Sen. Ron Wyden (D-OR) and a team of Democrats from both chambers introduced on Wednesday the Billionaires Income Tax Act, the first bicameral legislation of its kind.

The bill eliminates loopholes that allow billionaires to defer tax indefinitely, guaranteeing they pay annually just like every other hardworking American. It’s a change Wyden says would affect fewer than 1,000 taxpayers: only those with more than $100 million in annual income or more than $1 billion in assets for three consecutive years.

“Here’s the issue at hand: America today has a rigged tax code,” Sen. Wyden explained. “There is a thicket of little-known accounting rules and tricks that lets billionaires opt out of paying a fair share.”

“American billionaires now hold $7.6 trillion in worth,” added Rep. Steve Cohen (D, TN-9), “Meanwhile, everyday Americans keep paying more and more and inflation hurts them more and more.”

Wyden says it’s not just about being fair; amid funding concerns for key programs, the revenue generated could make all the difference.

“You could do something about Medicare and education and the big economic challenges. I think people are going to say, ‘this is common sense and we should have done it a long time ago’,” said Wyden.

Similar legislation was introduced in the 118th Congress, but never made it out of committee.

Meanwhile, the Trump Administration is still working to sell the One Big Beautiful Bill Act to Americans – which provides tax cuts for top earners – as a way to grow the economy.